Jerome "St. Nick" Powell and Employment data highlight Wild Week

For those investing in 2022 US markets, and for that matter all global markets, it may feel as if the Grinch stole the entire year and not just Christmas. Equities have been on a downward spiral for almost all of 2022 after the S&P 500 hit its last all time high on just the second trading day of the year. Fueled by raging inflation and a rising interest rate environment, bears have been feasting on weak bulls, with every attempted recovery met with a stronger downturn.

This current rally has been powered by a September Year over Year Consumer Price Index (CPI) print of +8.2% and a Month over Month figure of +0.4%, both numbers that came in hotter than expectations, but a combination of record-setting put volumes and major cash reserves on the sidelines ignited a squeeze off the $3500 level on the S&P 500, which brings us to the present day.

ECONOMIC DATA

Week Ending December 2, 2022

This week was headlined by employment data and Fed commentary.

Monday was highlighted by comments from St. Louis Fed president James Bullard. Bullard reiterated his hawkish stance in a speech Monday afternoon where he emphasized that interest rates will need to be higher for a longer period of time through 2023 and 2024 in order to bring inflation down to the Fed's 2% mandate. Markets, discouraged by his comments, fell over 1.5% in late trading on Monday.

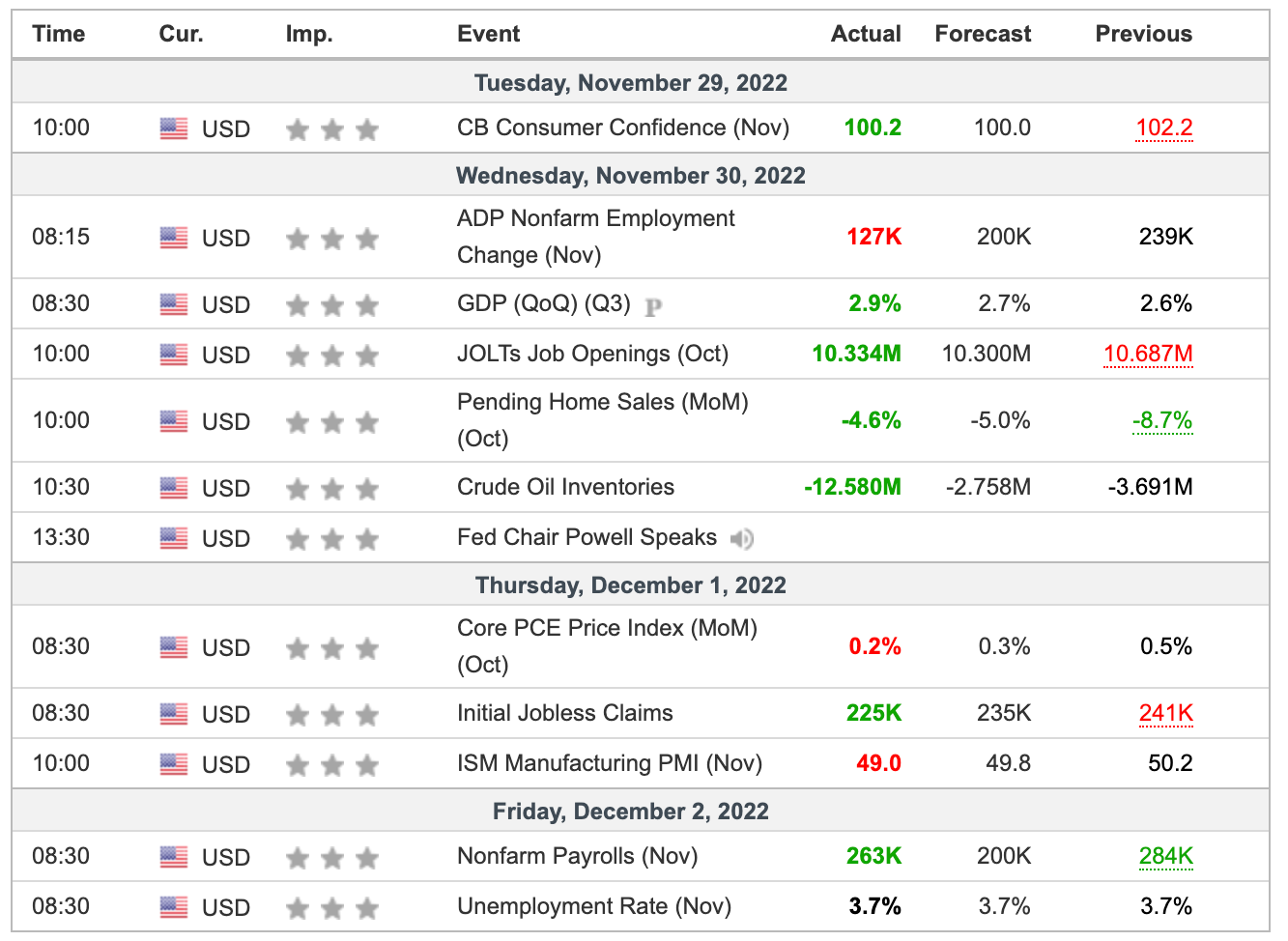

Tuesday was the quietest day of the week with muted economic activity. Consumer confidence came roughly in line with expectations. Asides from equities, oil markets were taken for a ride as a few member states of OPEC+ announced a potential move to further cut output.

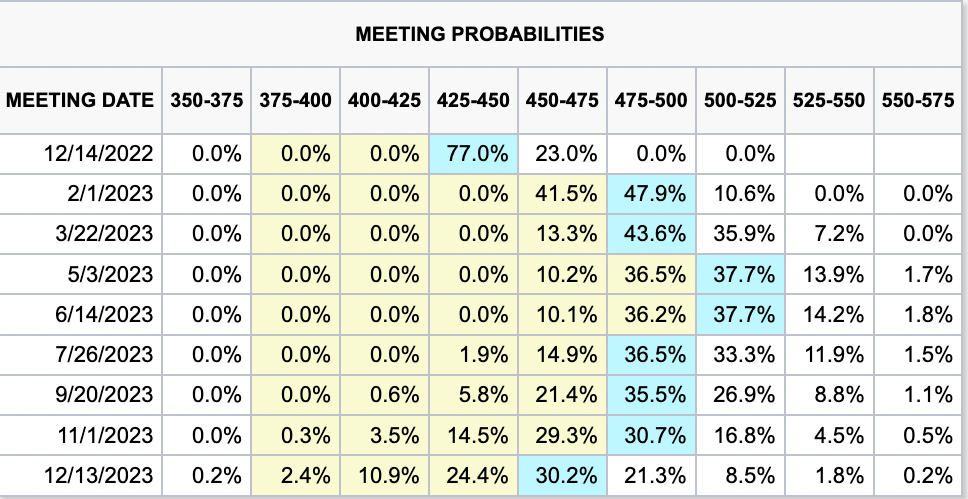

Then came Wednesday. Data kicked off with a weak ADP report (recall that slower jobs growth is seen as a positive in this environment as the fed will likely tilt dovish) and an in-line revised Q3 GDP. It was no secret that all eyes were going to be on Fed chair Jerome Powell's 1:30pm speech from Jackson Hole, as speech that would effectively set the stage for the next FOMC and rate hike decision in two weeks time. Powell took the podium and pumped markets saying "Fed Could Slow Pace of Rate Rises as Soon as December FOMC Meeting." Equities rocketed on this statement, with an initial move of over 1% on his remarks. What followed was another squeeze of epic proportions. Net inflows on the three major US indicies almost quadrupled as traders piled in on Powell's comments, with the Nasdaq Composite closing up over 4.5% on the day. Fed funds futures swaps indicated a market wide drop in rate expectations, with the new anticipated terminal rate being under 5% in 2023. Odds for a 50 basis point hike in the December meeting also jumped to over 75%, up from around 60% before the speech. Softer rate hikes give investors a glimmer of hope and markets may be able to see the light at the end of the tunnel, however it goes without saying that in order for any further advancements to take place in equities, there must be significant reductions in inflation, which we will be able to see best when the November CPI report is released in ten days.

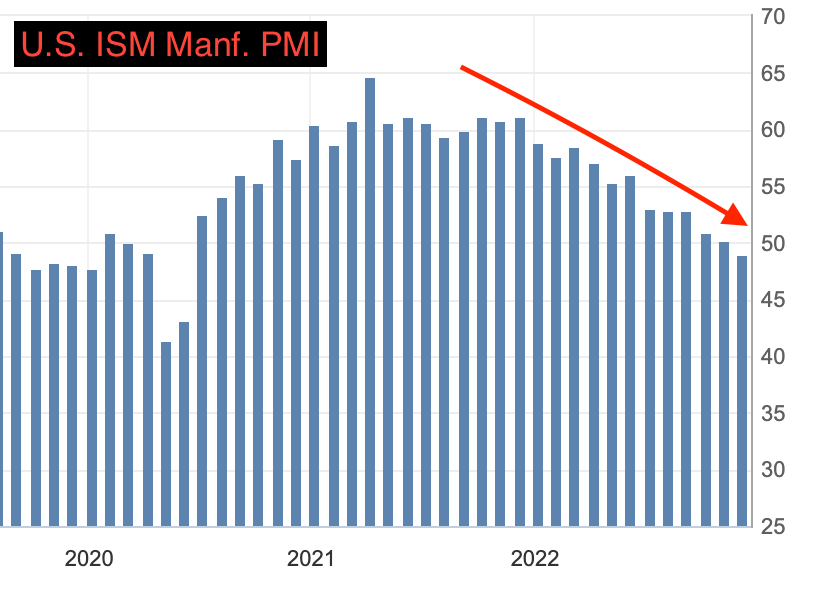

Thursday was another important day as PCE inflation data, often dubbed as "Powell's Favorite" was set to be released. Month over Month PCE inflation tempered and came in at +0.2% vs a consensus estimate of +0.3% and down from +0.5% in October. Markets embraced these numbers and rallied to start the day, with the S&P 500 setting fresh three month highs, reaching the key $4,100 level right out of the gates. However, ISM manufacturing PMI, a measure of industrial sentiment and activity, rained on the bulls party as it came in weaker than expected, further fueling fears that the US was heading into a recession. Slower manufacturing and industrial activity has been a theme of 2022, and is one of the biggest red flags for the U.S. economy at the moment.

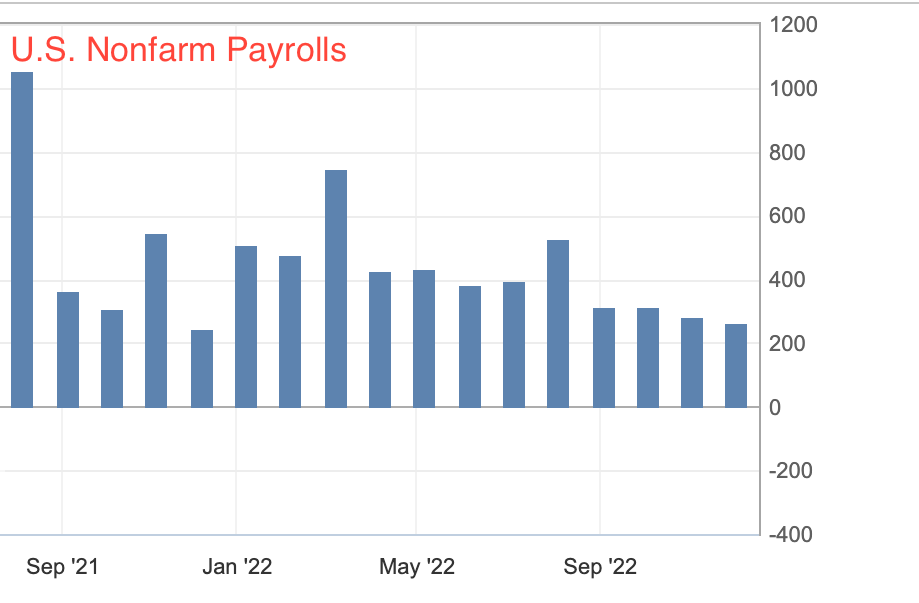

Friday brought the most anticipated data release of the week with November nonfarm payrolls and updated unemployment rate. Bulls came in with an expectation of a weaker job market, which would help back the case for a more dovish fed. However, this expectation was shattered when nonfarm payrolls came in at a staggering +263,000, soundly beating the 250,000 estimate and nowhere near the bullish estimates of 150,000-175,000. Wages also grew at a blistering rate of +0.6% from the prior month, further complicating the Feds vision of perfect price stability. The unemployment rate remained unchanged at 3.7%, another blow to equities, where investors were expecting a figure in the 4%+ range following treasury secretary Yellen's remarks earlier in the week calling for an expectation for higher unemployment. The labor market was still strong and tight, which did no favors for bulls as the expectations for lower inflation and smaller rate hikes were tempered. Markets instantly dropped off this news, with the Nasdaq Composite slumping as much as 2.5% in pre-market trading. However, markets would reverse these losses by midday, with the Nasdaq Composite only trading down 0.40% by lunch.

Analysis

Recession or not?

Compiling and analyzing all the data for this week leads to a rather open-ended conclusion, subject to bearish or bullish bias of the observer. Even from an objective standpoint it is hard to decipher the differing views of the fed speakers of the week, with hawks calling for higher rates for longer, while Powell indicates it may be time to slow hikes. Overall the impression given from the fedspeak of the week seems to be a dovish tilt, while there is still room for caution as more data comes out ahead of the December FOMC meeting.

Moving onto the economic data of the week, it does not get any easier to draw clear conclusions. Sentiment and PMI indicate a slowing economy, with the latter threatening recession territories. However, while a weaker economy is good for equities at the present time due to the prospects of lower overall rates, employment offers a differing perspective on the economy. Employment data for the month of November remained strong and indicated that the robust labor market of the 2020s is still chugging right along. The fed has always tried to maintain full employment while keeping price stability, but it would be naive to think Powell is excited with November's employment figures. While there is a silver-lining in that wages grew at a strong pace, benefiting the consumer, they still lag the monstrous inflation of 2022 and also serve as further reason for the Fed to take more action to restore price stability. If employment does not slow meaningfully over the next two to four months it will become increasingly difficult to subdue inflation and force the Fed's hand in raising rates higher than currently anticipated by markets.

While employment remains strong, it is hard to ignore the slowdowns in business activities and the fact that we are still not at the end of the current rate hike cycle when thinking in terms of recession probabilities. This weeks data still indicates that a mild recession is likely in the works for 2023, which will be enhanced if inflation data in the coming weeks come in hotter than expected and forces the Fed to hike higher and stay higher for longer.

Our Positioning and Conclusions

We interpret this week's data and Fed messages as an overall positive for equities that will allow for this current rally to maintain its momentum in the short term. As a result, we maintain a slight overweight rating on U.S. equities, with an emphasis on risk-on buying in small caps following Powell's statements. We anticipate the S&P 500 to face heavy resistance at its yearly down trendline, however a break over this trend may allow a push to the key $4,200 level.

We now look forward to next weeks data, which includes Non-manufacturing PMI and important inflation data with the PPI report. It is also important to recall that we are now entering the Fed's blackout period, minimizing information we receive from officials until the FOMC meeting on the 14th.

Full analysis and projections for next weeks data will be discussed on our usual Sunday evening installment of Andy's Angle.

Comments ()