A Look To The Week Ahead: 2022 Comes to a Close

A Sleepy week ends extraordinary year

We hope everyone had a great christmas and to those that do not celebrate we hope you took advantage of the days off to spend time with family. Personally, despite the frigid temps here in the Northeast, the christmas spirit felt alive and well with New York's Rockefeller Center bustling with visitors to see the marquee christmas lights dance across the city streets. Across the country as noted by our all our writers, we observed exceptional spending and travel, despite both adverse weather and economic conditions.

These positive signs of a continually resilient economy gives us more insight into our 2023 outlook and trade plan, which will be made available to members later this week.

In terms of the trading week ahead and our trading plans, it is relatively light, as there isn't much in terms of economic data or earnings to build a full trading plan off of. However, there are a few macroeconomic details as well as some regular end of year trends that are worth watching.

So let's get right into it.

Economic Data

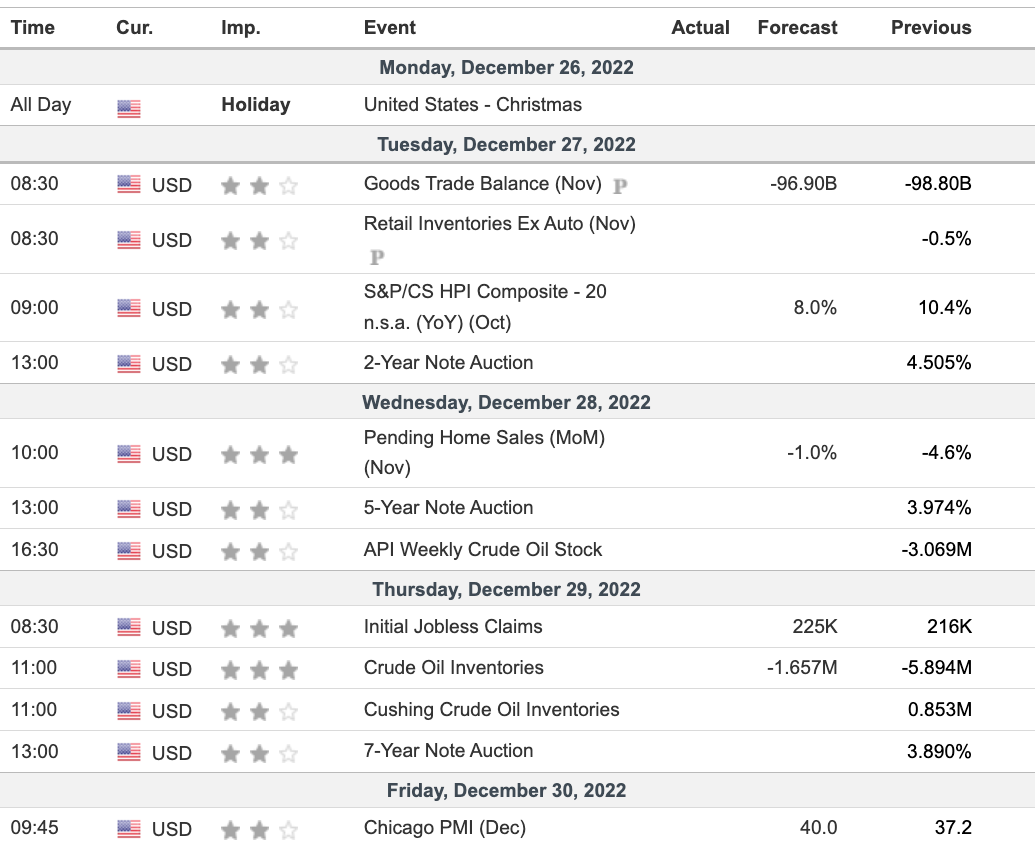

Week ending December 30, 2022

The week starts today, well it was supposed to, but both U.S equity markets and debt markets are closed Monday in observance of Christmas. Most global markets are closed today as well, making it a peaceful day worldwide.

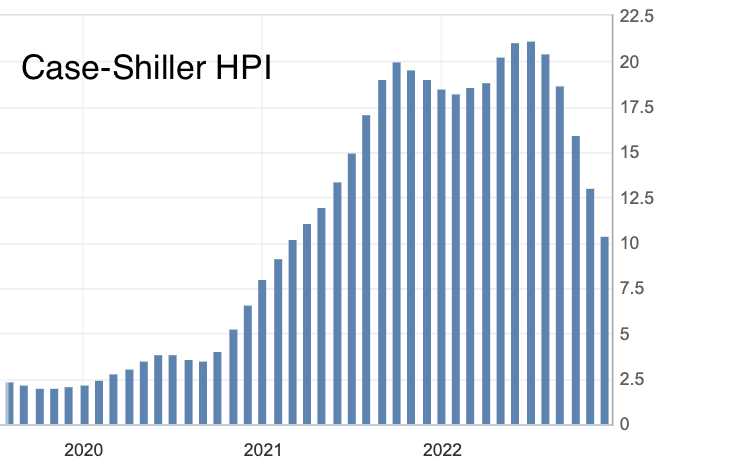

Tuesday also doesn't carry much importance in terms of data. Of the data points set to be released we will most closely be watching the S&P/Case-Shiller Home Price Index. The index measures the change in the selling price of single-family homes in 20 metropolitan areas, and is another key data point to watch when monitoring the housing market.

Home prices have begun to collapse as a result of higher interest rates, however they are still trending much higher on a year/year basis than under normal market conditions. Expect home prices to continue to rise at a slower rate, which will be seen as a positive for markets as home prices and rent prices are major components for benchmark inflation indexes such as the CPI.

Moving onto Wednesday we stay on the housing train with what will probably be the biggest data point of the week in the form of November pending home sales. While this really isn't a massive data point in the grand scheme of the economy, it is as eventful as this week gets. Pending home sales in November are expected to decline, continuing what has been a largely negative trend for the better part of 36 months now.

The importance of weak housing data lies in its ties with the dollar. A weaker housing market will have a negative impact on USD, which will help bring inflation lower, as well as curtailing rising yields which have been pressuring equities all year long. Housing is a major factor of the U.S. economy and as a result has an outsized effect on USD, keeping it relevant, especially in a volatile environment such as the current market.

Thursday brings an emphasis on oil, with crude oil inventories as well as jobs data in the form of initial jobless claims. Oil should be highly volatile this week as futures contracts for 2022 expire and roll into 2023. Paired with the expectation that there will be yet another inventory draw on both crude and gasoline, expect continued fluctuations in the price of crude, which as retreated significantly from its June highs. Jobs data is important as the main driver behind the Fed's policy forecast for 2023 is higher unemployment, so expect markets to embrace "bad" news at it will play into the Fed's hand.

Friday closes out the year with nothing much. Chicago PMI, which monitors the manufacturing health of the Chicago region economy, is the only data point of note to be released. While it can give a small insight into the manufacturing economy, its regional limitation makes it a non-event for broader markets.

And that's a year's worth of economic data done.

Things to Watch

Week ending December 30, 2022

While the data front is weak for this week, there will still be ample volatility.

While a santa rally has failed to materialize in 2022, unless you consider last week's 0.1% drop in the S&P 500 as a rally (Given the nature of 2022 markets you could feasibly argue that), there is still some hope for a new year's rally.

As the year comes to a close there will be many large funds that will need to either close out losing positions or begin rotating into positions for 2023. On top of this, there will be trillions in expiring options and bonds both publicly and privately held, that will help contribute to volatility. While it may be nice to get a quiet week for once in 2022, it seems unlikely it will be this week.

On the global front there are numerous things to watch.

First off, peace talks between Russia and Ukraine seem to be resurfacing as President Zelenskiy has appointed the current G20 president nation, India, to push for Ukraine's 20-point peace plan. While this is a positive sign, true peace talks are still a ways off, as India itself has many national security incentives to maintain positive relations with Russia, especially in terms of the oil trade.

Moving on, the next major global situation to monitor is none other than China. The headlines out of China over the last 72 hours have been grim to say the least. With overflowing hospitals and crematoriums at full capacity, the covid has finally captured the nation by its throat. However, the economy seems to be doing fine, as the CCP seems to have given up on their "zero-covid" policy, allowing the virus to run its course throughout the nation. As Jiang, a Beijing-based white-collar worker put it, "It feels so good to see so many people, and I want to embrace them," showing positive signs surrounding China's reopening economy. Meanwhile in Shanghai, ports were reported to be functioning near peak volumes, further solidifying the fact that while covid is running rampant in the country, the economy is roaring back to life, which helps the entire global economy as the ailing manufacturing giant finally comes back online

Finally, the last thing to watch is the weekly chart on the S&P 500.

Last week's action ended with a nice dragonfly doji on the weekly chart, indicating a potential reversal, which would be the first real higher low of this bear market, making it a potential turning point for markets. It will be important to watch this week's action as we believe more positive signs of bottoming around the 3,800 level may give a bullish trade to 4,000+ into early January.

Closing Remarks

We enter this week with a reiteration of our mild-bullish standpoint on U.S. equities. We revised this from slightly bearish last week as we saw signs of bottoming and now expect mild repositioning that will help buoy equities into the new year. We expect heightened volatility as markets wrap up the year, but do expect milder moves in relations to economic data. In terms of global events it is prudent to monitor the situation in China, while it seems relatively under control for now it is a rapidly evolving situation and is worth keeping track of due to its implications across global markets.

Finally, we look forward to our 2022 recap and highlights as well as our full 2023 projections, stats and highlights to be published later this week. If any readers have specific requests for either the 2022 recap or 2023 outlook please leave comments below and we will try our best to fit it into our expansive reports.

Comments ()