A Look to the Week Ahead: Earnings Season Ramps Up

All is quiet...

At Andy's Angle we strive to provide our readers not only the most useful content as a tool for their investing, but we also aim to both provide education and most importantly an opinion on financial markets.

Helpful insights from our perspective so to speak.

To enhance this experience we will be creating more flowy content, going against our usual rigid article structure, ensuring our voice is seen through are writing rather than just a monotone display of facts.

With that being said...

Markets have continued to be stubbornly bullish, and well, it isn't without good reason.

Last week's inflation data was surprisingly good, with CPI falling to 5%.

In addition to this, earnings season started off stronger than expected, with JP Morgan reporting record profits and regional bank PNC reporting solid earnings, easing fears over the extent of the damage caused by the recent banking crisis.

Despite all this...

The S&P 500 failed to reclaim its uptrend from the October lows and it seems as if we now have yet another well-defined weekly pattern. Even though markets have had five straight green weeks (we'll count the first week of April which was -0.05% for the sake of simplicity), the dominant trendline has held as resistance for much of the last month, capping gains.

Furthermore,

Another bearish indication is seen in a clear Head and Shoulders formation on the weekly chart, coinciding with levels within the 410-430 channel that have seen heavy rejections four prior times.

This volume shelf has been key for a year now and has been the end of numerous bear market rallies. Now shifting your attention to the volume indicator at the bottom of the chart you notice it has completely vanished.

In fact, April is on pace to be the lowest volume month since November 2021. This low liquidity, which we've discussed in prior articles, tends to lead to more sensitive markets, overreacting to even the smallest data points.

But this isn't the case here, last week's CPI, PPI and earnings yielded no day with an over 1.5% change from the previous close. This has led to the VIX cratering down to a 16-handle, indicating the lowest volatility and fear in markets since the Jan 2022 all time highs.

So what gives?

Markets seem to be in a state of equilibrium right now, and there really hasn't been much to throw off this balance for the last few weeks.

No surprise inflation readings, no bank collapses, no geopolitical threats.

It's been quiet... too quiet.

Earnings should begin breaking this silence with bigger names set to report this week, but volatility will likely be hard to come by given the lack of economic data and just a weak news cycle at the moment.

A few earnings surprises here and there may add some uncertainty but this week's slate isn't too enticing.

Moreover,

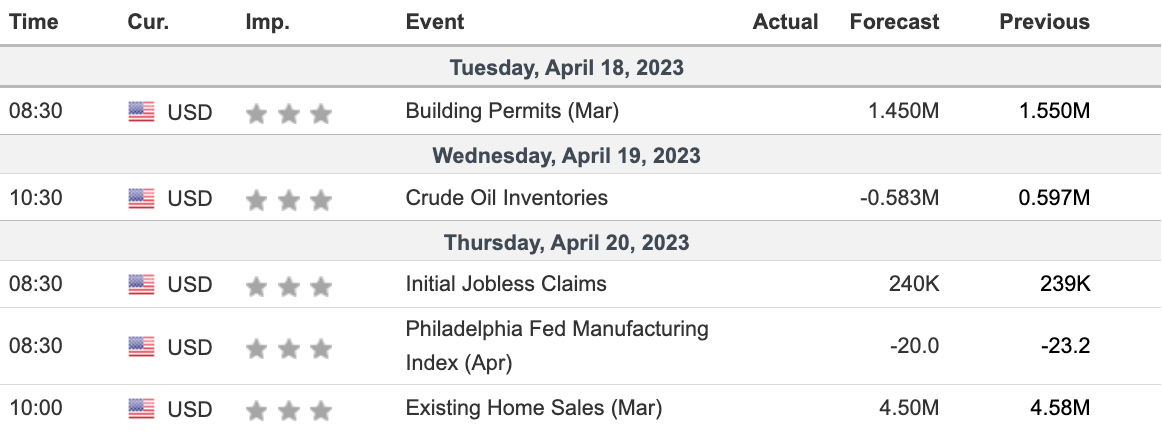

There is nothing of note in terms of economic data, and we would go so far as to saying this week is the slowest in terms of data that we've seen since the shortened holiday weeks back in December and January.

We do have a pretty consistent stream of speeches from Fed officials throughout the week so that should keep markets on their toes, but given softer inflation data we don't foresee too much hawk talk.

Earnings

Week ending April 21, 2023

A lot of earnings this week, with banks closing out their reports and broader sectors including tech beginning their reporting.

With hundreds of companies set to report this week there are guaranteed to be a few headline beats and blockbuster misses.

Let's go through what we are watching everyday and a couple of spotlight names that must be monitored by investors.

Monday: Charles Schwab ($SCWB), M&T Bank ($MTB)

Banks, banks, banks.

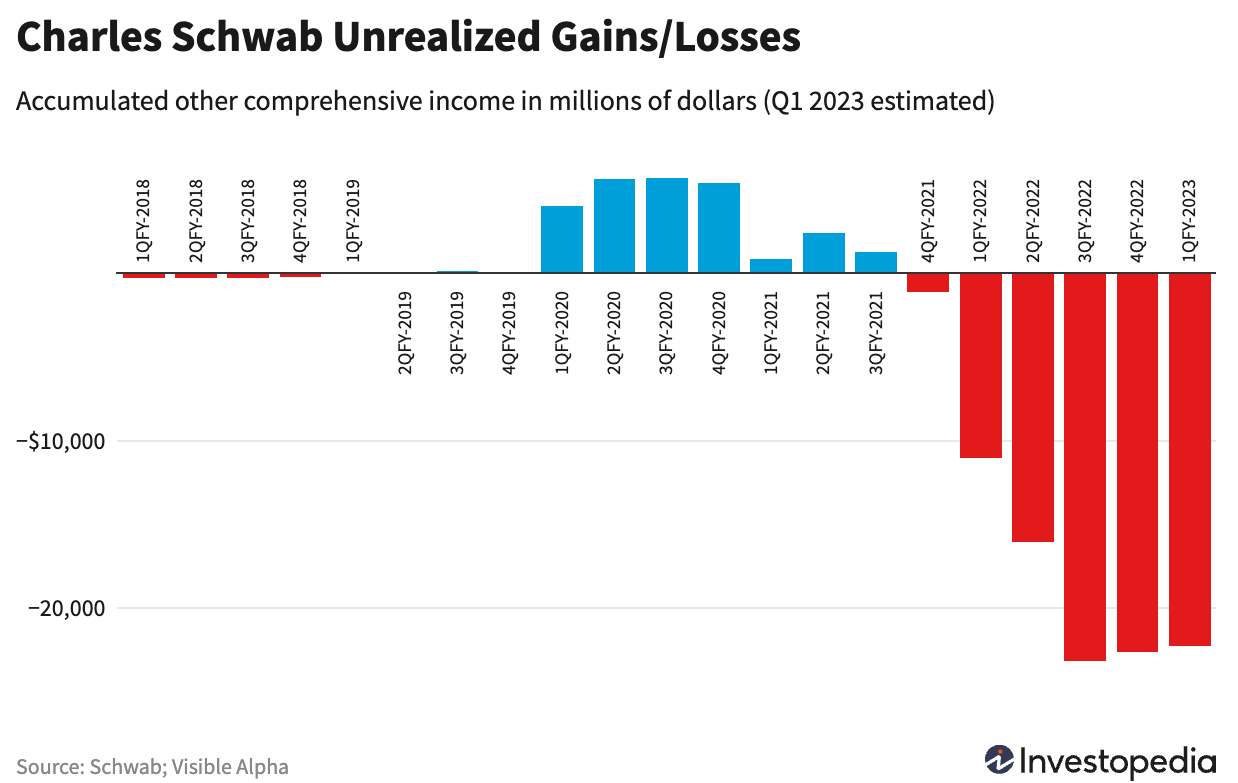

Charles Schwab was one of the heavily beaten down names in the bank rout and for good reason...

Just like the failed SVB and Signature Bank, Schwab's mismanaged balance sheet has led to tremendous unrealized losses, pressuring the bank.

So far it has managed to survive the initial crisis, but their earnings report will give a glimpse into just how bad their balance sheet looks now.

Tuesday: Netflix ($NFLX), Bank of America ($BAC), United Airlines ($UAL), Goldman Sachs ($GS), Johnson and Johnson ($JNJ)

Here we are mainly watching Netflix as it is the first of the big tech to report.

The banks on Tuesday, including BofA and GS are expected to beat and we don't expect many issues given JP Morgan's report last week.

Big banks are thriving off the carcasses of the smaller ones.

Netflix has had its woes and we expect them to continue as consumers pull back spending, and the same goes for United, although travel seems to be doing great. Paired with lower costs associated with fuel due to lower overall energy prices, we may see a beat there.

Wednesday: Tesla ($TSLA), ASML ($ASML), Morgan Stanley ($MS)

Tesla.

That's the one to watch here.

Everyone will be interested to look at how their margins were affected after six straight price cuts to start the year, in an effort to rekindle demand for their electric vehicles.

Tesla did miss on their vehicle deliveries for the first quarter, albeit by a narrow enough margin to be considered negligible in context of this report.

It will be important to see how much damage both rising input costs and lower selling prices for their cars did to their bottom line and how their cash flows were affected.

ASML is an interesting semiconductor name to watch as that sector has been rather frothy for a few months. They supply the machinery that makes the chips, and as a result can be an early indicator of which direction the semiconductor industry is trending in.

Thursday: American Express ($AXP), AT&T ($T)

American Express is yet another financial services name that took a hit in March's worries, however we like this name given their strong margins and simplified business model in credit services.

Thursday is a deep, but spotty slate of earnings, with no big names reporting, but many important niche earnings, like American Express and AT&T.

Friday: None of Note

Friday is quiet.

The week ends with nothing of note other than Proctor and Gamble ($PNG).

Earnings can be tough to read into and for that we encourage readers to read and even take notes on our new investing education series following earnings analysis, the first edition can be found here.

Our second edition is slated to be released on Wednesday and will continue to provide readers with the easiest guide to reading earnings as earnings season really starts to ramp up.

Closing Remarks

It really is a quiet week, but earnings should keep things fun.

We are maintaining a bearish outlook on U.S. equities and will be very closely monitoring the battle between the S&P 500 and its rising trendline.

While we are bearish, we do not really see a major downside move this week per say, with a lot of it hanging on earnings, mainly Tesla as well as various different notes from Fed speakers.

As a result we are maintaining large cash holdings, and will have both and update to our investing portfolio and our latest value stock pick out to subscribers this weekend.

For now, we see limited short term volatility, but anticipate a larger move, to the downside, to begin to form once earnings from big FAANG names come out later this month, but for now it is best to manage risk accordingly and understand that markets haven't been this calm since the peak of the bull market.

Take that how you will...

-Andy's Angle Writing Team-

Comments ()