A Look to the Week Ahead: Aggressively Unchanged

Markets just don't want to move do they?

We knew this range on SPX would be a tough one, with numerous sticking points in the 4050-4200 range throughout the current bear market... but this is getting excessively monotonous.

This range has seen many rejections, and three complete distribution periods as well, highlighted in the chart above.

The current, and longest one, has been dragging on for nearly two months, with no signs of wanting to break either way.

There is somewhat of a head and shoulders on the daily chart, but hoping for that to follow through is futile, especially given current market volumes.

Last week saw three of the top five lowest full-day volumes since late 2021, highlighting how thin markets have gotten over the last seven weeks.

Despite better than expected CPI, markets refused to make a move out of its range, keeping bulls and bears on the edge of their seats as impatience grew...

So what?

What makes this pattern give way, and which way will it be?

Well, there's no easy answer to this.

Trading volumes have dropped off a cliff as many investors, human investors, are weary of U.S. equities. This has given rise to algo-led markets and more importantly, record volumes of short dated options trading.

Those two factors are what have characterized what little moves the market has made in the last couple of months, and this pattern will continue until true volatility is brought back into markets.

But that shouldn't be much longer.

The debt-ceiling saga is crescendoing and may begin sending real jitters throughout markets starting this week, as the deadline to raise the ceiling before defaults on U.S. T-Bills starts inches ever closer.

While that is the major catalyst to watch, others such as the growing credit crunch as a result of the recent regional banking crisis will also provide cracks for equities to slip through.

As for the shorter term... well, the range will likely continue.

There just doesn't seem to be enough to steer equities towards different pricing at the current time.

Higher levels would need to be backed with concrete evidence that a recession is unlikely, while a move lower would need to be backed by concerns that further rate hikes are needed and a recession is likely.

While risks seem weighted to the downside given the number of possible bearish catalysts, markets are not too willing to price these in ahead of time, keeping overall price action stagnant.

Let's take a look at what we have coming up this week...

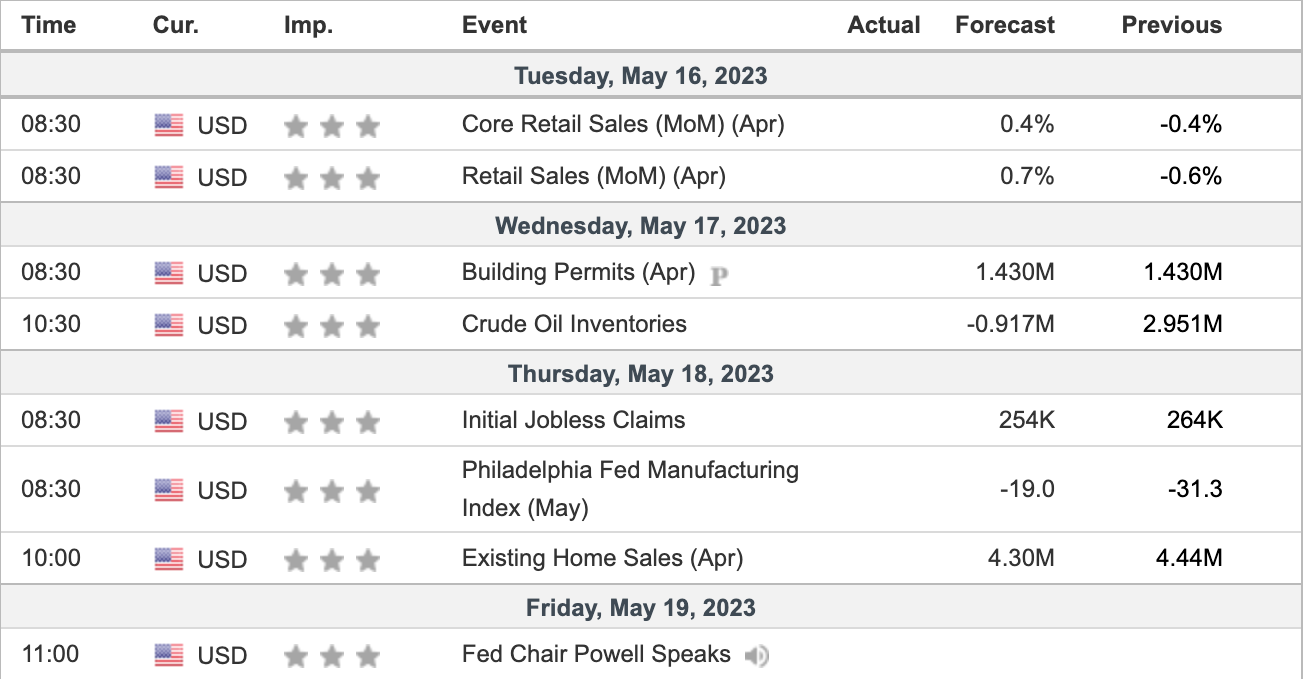

Economic Data

Week ending May 19, 2023

A key dynamic of this week will be constant Fed speakers.

Everyday is littered with them, and their comments will provide movement to equity markets, especially given the current assumption that rates have reached their peak.

Comments regarding further rate hikes or the potential of a recession will send waves throughout markets, albeit not enough to cause any major moves alone.

Monday sees Atlanta and Minneapolis Fed presidents Bostic and Kashkari give their comments. Kashkari in particular is one to watch as he has a history of being hawkish in relation to other Fed speakers and has been a supporter of higher rates throughout this cycle.

Tuesday's retail sales data is by far the most important release of the week, and investors will be looking for signs of strength, after months of hoping for weakness in sales, as recessionary fears have overtaken inflationary concerns.

April's figure is expected to show retail sales growth of 0.7% as compared to March, indicating higher spending and easing fears of an economic slowdown. A negative number here would likely rock markets as it would show consumer spending is legitimately slowing down and a recession could be much closer than initially anticipated.

Wednesday and Thursday feature a slew of housing data, with building permits housing starts and existing home sales. Once again, markets will prefer stronger data here as it will show the economy is humming right along despite tighter credit conditions and 5% rates.

Finally, Fed Chair Powell's panel with former Fed Chair Ben Bernanke on Friday, will be a robust way to close out the week. Expected to field questions on further rate hikes and recessionary concerns, Powell's comments should energize markets and provide some much needed volatility.

Closing Remarks

As can be inferred from the tone of this edition, we are maintaining U.S. equities with a neutral rating and expect markets to remain choppy through this week.

Markets have been range bound and are expected to stay that way until resolutions to the debt-ceiling and a verdict on a potential recession is reached, till then nothing can shake markets off this current equilibrium.

Internationally, Chinese growth and comments from the BOE regarding lower odds of a recession has encouraged investors in the idea that the global economy is stabilizing, which in turn will help U.S. markets.

Energy prices are also one to watch, and as our readers know, we are bullish on oil prices at current levels around $70/barrel, as we believe demand-side fears are well overblown with the odds of a recession fading. Pair that with tight supply, that is only going to get tighter due to OPEC production cuts, and we see potential for a solid move up in oil prices as the busy summer season approaches.

Finally, our next investing education piece is slated to be released next weekend, with an update on our recent value pick (up nearly 20% in two weeks in our Andy's Angle Investment Portfolio) to be released soon thereafter.

Thank you,

-Andy's Angle Writing Team-

Comments ()