A Look to the Week Ahead: Almost There

Closer to a big move...

Almost there...

That's what bulls are thinking after last week's market movement, which saw the Nasdaq break towards 10-month highs, and the S&P 500 making it out of its recent trading range.

SPX successfully broke out of the hard resistance range last week, but importantly, failed to hold the key 4200 level.

Moving into this week, with debt ceiling talks front and center, expect more volatility with a backtest of the range around 4150, if it holds we could see continuation to 4300+, but a break below that level would bring SPX right back in to the range, and likely shift momentum back in favor of the bears.

But this "rally" in both the Nasdaq and the S&P 500 is incredibly deceiving.

Looking at the Dow Jones to S&P 500, DJI/SPX ratio, we see that tech names, which are they key differentiator between both indexes, have led to a strong outperformance in SPX, leading to the DJI/SPX ratio to once again reach lows seen at the peak of the last bull market in 2021, and once again pushing lower to levels comparative to the dot-com bubble in the late 1990s and early 2000s.

In fact, according to research done by Societe General, market movements YTD have been characterized by just 20 stocks, all with heavy AI involvement. Their research showed that removing these 20 stocks, highlighted by Nvidia and its 30x Price to Sales ratio, the S&P500 would be in negative territory for the year instead of +10%.

This AI-led tech buying frenzy has sent many names up to early 2022 and even late 2021 levels, erasing most losses experienced during the current bear market.

But as alluded to, none beat out the king of bloat, Nvidia...

The monthly chart is just staggering.

A sharp and powerful recovery has seen Nvidia shares near their all time highs, despite annual profits and sales dropping 33% and 21% respectively.

Artificial Intelligence has gripped markets with a sense of euphoria not seen since the late 90s where every company was somehow going to revolutionize the up and coming internet.

Overall, we expect this fad to cool off in coming months as business fundamentals once again takeover, and as a result, another material drop in stocks could be on deck, especially given continued fears surrounding a contraction in U.S. output as well as the ongoing debt ceiling saga.

For now, all we can do is take it week by week and play markets accordingly, so lets take a look at this week's events.

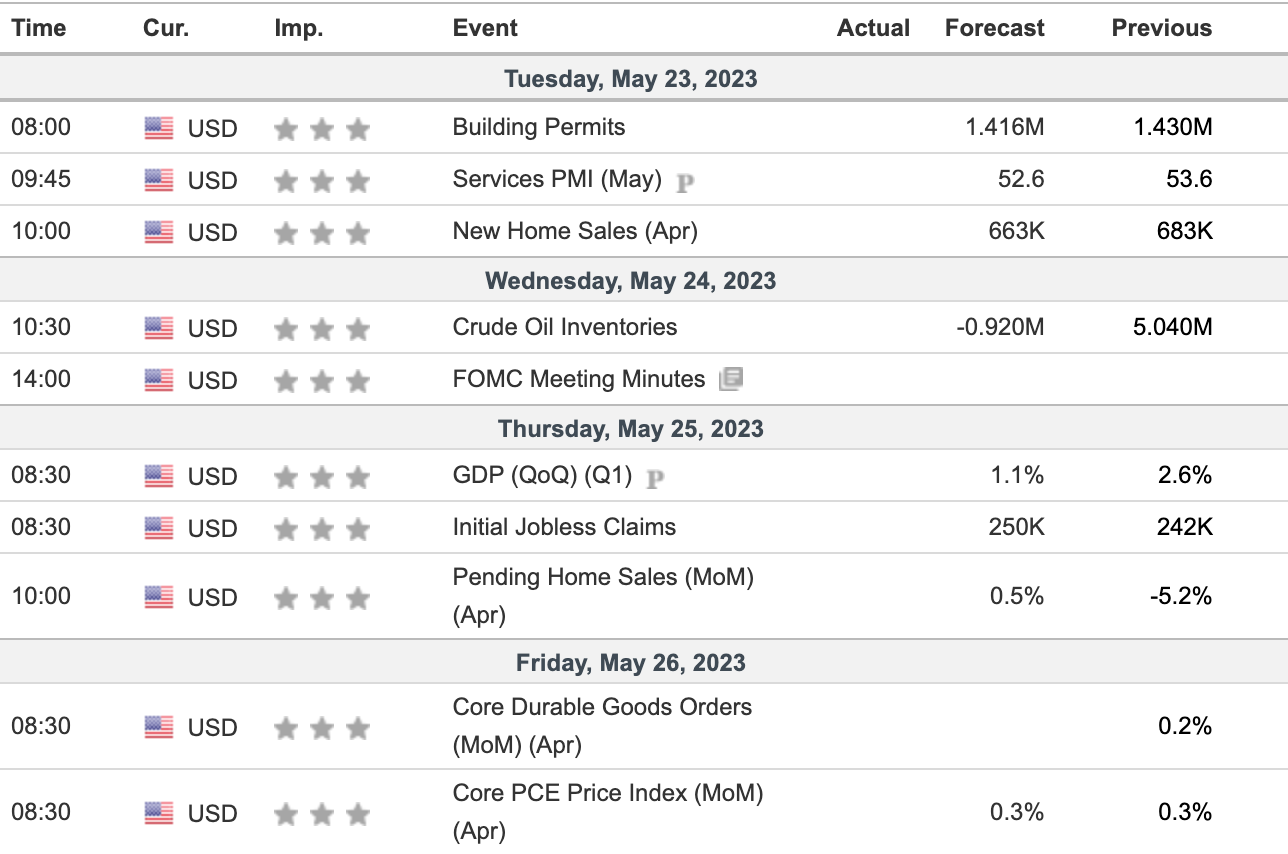

Economic Data

Looking at this week, there are a couple notable events that investors should be watching closely.

The most important of which will be Wednesday's FOMC meeting minutes, which will show the thought process and forecasts of the FOMC from their May meeting where they hiked rates 25bps.

These minutes will be critically important as they are going to contain the FOMC's forecast for where rates will go from here, and the overall sentiment of voting members and whether or not they believe ongoing rate hikes are necessary.

So far, through various speeches from FOMC members and Fed chair Jerome Powell last week, it seems as though the Fed is prepared to pause their rate hikes, although the odds of a June hike have creeped higher in the last week given stronger than expected economic data. As a result, these minutes will provide clarity and allow markets to be able to reasonably forecast what the Fed's next move will be.

Friday's PCE price index print will also be incredibly important as this inflation metric is widely regarded as the Fed's "favorite" measure of inflation. With inflation looking increasingly sticky, markets will look for a cold PCE print, further supporting the idea of a Fed pause, while a hotter print on PCE will likely spook markets and lead to the pricing in of another 25bps hike in just a couple weeks.

Housing data sprinkled in throughout the week will provide more insights into economic performance, but likely will not have major impacts on broader markets.

Overall it is a quiet week, but has explosive potential depending on what the FOMC forecasts going forward and how inflation is behaving amidst 5% interest rates.

Earnings To Watch

This week's earnings slate is relatively thin, but it cannot be ignored as the sixth largest company (god knows how) is set to report earnings.

Once again, its none other than Nvidia ($NVDA).

Nvidia’s Q1 earnings per share are expected to be $0.91, a decline of 33.1% from a year ago. Meanwhile, revenue is forecast to shrink 21.4% annually to $6.51 billion.

For a $770B company, $6.5B quarterly revenues are not only astonishing, but downright insane.

While we expect this report to be the turning point in Nvidia's stock, putting in a strong top for the rest of the year, we would not be surprised with another overextension from this report as Artificial Intelligence mentions go through the roof.

Needless to say, we, and the entire market, will be watching this report very closely.

Costco ($COST) and Lowe's ($LOW) are two other names to watch this week as they release their quarterly reports, which will be interesting to see given Walmart's upbeat report and Home Depot's abysmal one.

Closing Remarks

Markets remain more vulnerable than ever before, and the strong skewness towards tech has left indexes acutely exposed to downside if sentiment surrounding tech and AI normalizes.

As a result, we are now downgrading U.S. equities from neutral to bearish, we expect the current froth in markets to be sold off and interest rate expectations to normalize (coming to terms with 5%+ rates through 2023 with no cuts), bringing substantial downside back into financial markets.

In technical terms, last week's move could very easily be a false breakout, leading to substantial downside if it fails to hold, which could very well be the case between Nvidia earnings and FOMC minutes this week.

One thing's for sure, volatility is slated to make a big return, and its once again time to heir on the side of caution.

Good luck.

Thank you,

-Andy's Angle Writing Team-

Comments ()