A Look to the Week Ahead: Debit Suisse, FOMC

The drama builds.

It seems like every weekend we are given another act in a long and drawn out play.

Last weekend we had to deal with the second and third largest U.S. bank collapses with Silicon Valley Bank and Signature Bank. Fast forward one week and we are in the midsts of a global banking crisis, and the next domino to fall is the 166 year old Swiss banking institution, Credit Suisse.

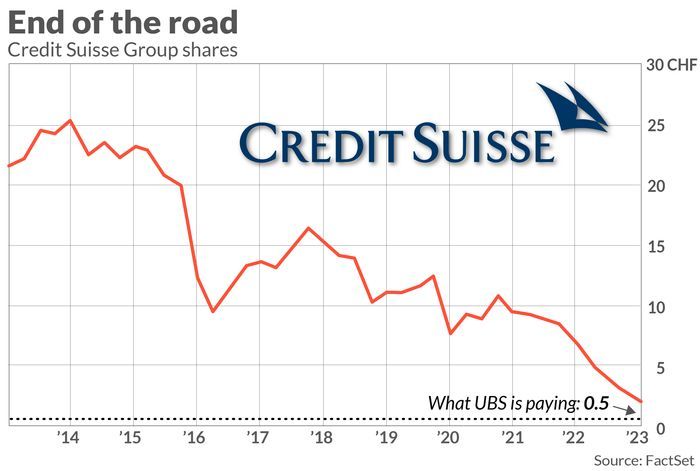

Credit Suisse has been the victim of its own actions and shares have been tumbling for decades now, with shares on a constant decline since 2007. Scandals and bad trading practices have run the bank into the ground, making it a ghost of its former self, a bank that used to stand firmly amongst the likes of JP Morgan and Wells Fargo.

Fears around Credit Suisse began amping up last week as the global banking system was put under scrutiny following the collapse of SVB and Signature. The fatal blow to Credit Suisse came when their largest investor, the Saudi National Bank, made a statement saying they would provide no further assistance to the ailing bank. This sent shares of the swiss bank spiraling to new all time lows below $2/share. By Friday CS had tapped a $54B rescue liquidity injection from the Swiss National Bank, but this would prove to be futile in saving the bank.

The final chapter of the Credit Suisse saga started in the wee hours of Sunday, where the Financial Times reported that competitor UBS had made an offer to buy the bank... for $1B. For context, shares closed at a roughly $8.6B valuation on Friday. Finally, just hours later, UBS upped their offer to $2B and was accepted by Credit Suisse shortly after. To aid the deal the Swiss National Bank also provided in excess of $100B in liquidity to UBS to ease the pressures of the acquisition.

Credit Suisse shareholders get wiped with a buyout price of just $0.54 compared to a closing price of $2.01 on Friday.

In other news, we expect yet another volatile week with an all important FOMC meeting highlighting the week, and likely being the grand finale for our bumpy two week drama.

Economic Data

Week ending March 24, 2023

In terms of economic data we start the week off silent on Monday, but markets are in for extreme volatility as they digest the Credit Suisse news and what it means for other banks across the globe. In addition to this, a lot of repositioning will be taking place as investors brace for the Fed later in the week.

Tuesday is once again very quiet in terms of economic data asides from existing home sales which are really of no effect to equity markets unless there is a major upside in one direction or the other, which we do not expect at this point in time.

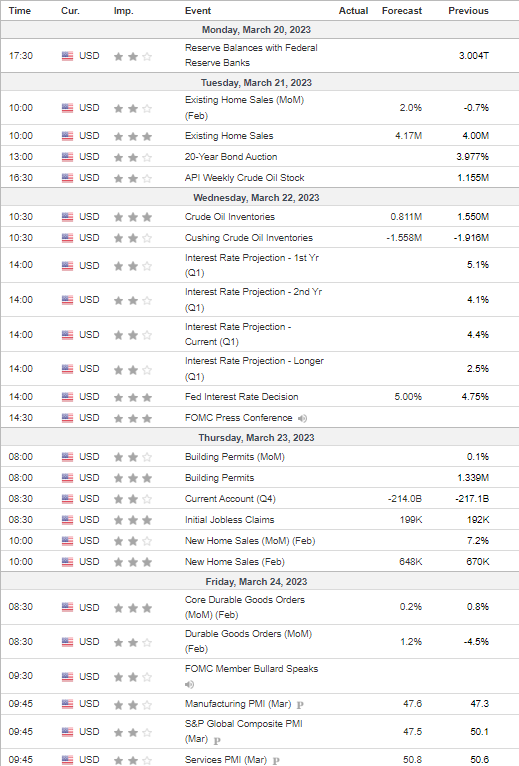

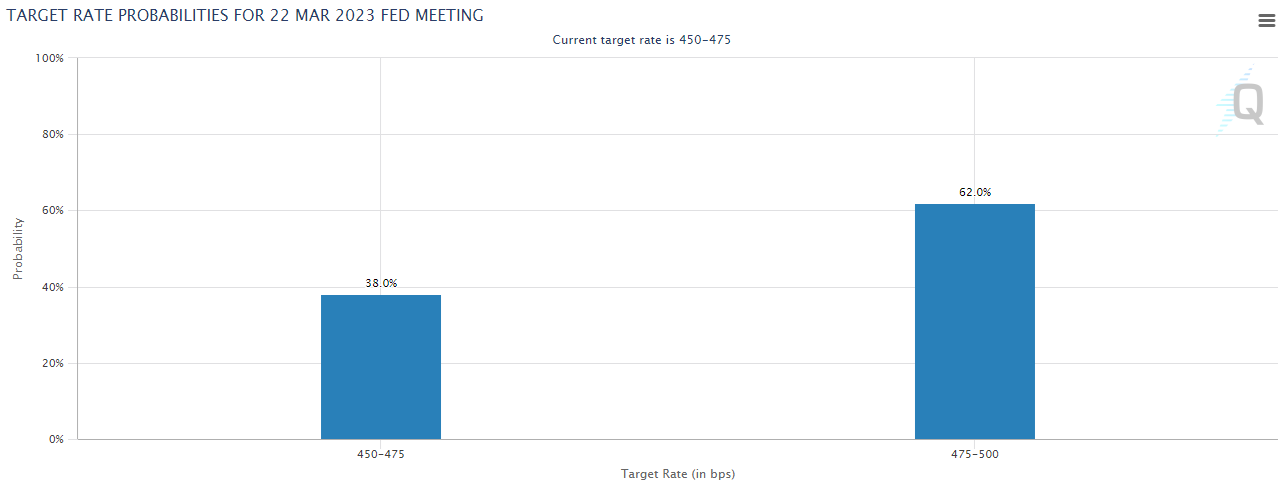

Then comes the big day. Wednesday and FOMC day. Just two weeks ago at a congressional testimony, Federal Reserve Chairman Jerome Powell had eluded to stepping up in the fight against inflation and markets had swung to price in a 50bps hike at the March FOMC meeting. Fast forward one week and as much as a 25bps CUT were being priced in following the collapse of SVB. Fast forward another week and now the consensus has normalized to the Fed hiking by just 25bps this week.

As of now Fed swaps indicate a:

38% chance of a pause in hikes and a 62% chance of a 25bps hike at Wednesday's meeting. Considering the consensus of 50bps just two weeks ago is not even in the current range of expectations, it is clear to see the immense volatility experienced by markets over the last half month.

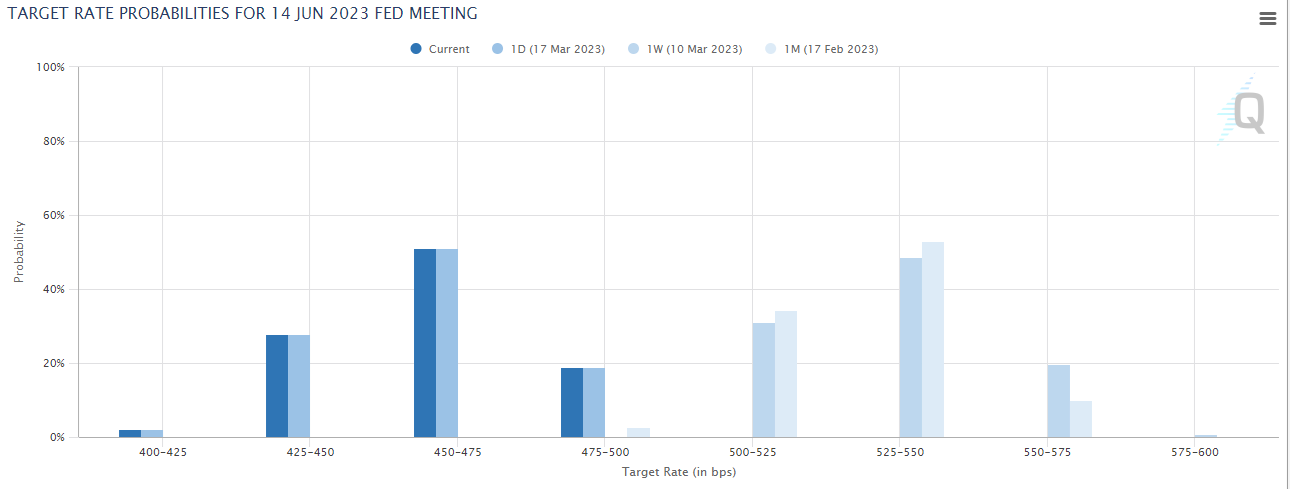

What's even wilder is when we look at terminal rate projections around June '23:

Previous estimates saw rates reaching as high as 6% in June with a consensus around 5.5%. In just a couple of weeks that expectation has completely collapsed to a consensus of just 4.75% rates in June, which is equivalent to the current rate, indicating the market believes the Fed is done...

A dangerous game.

For months it had been clear that the Fed was going to keep hiking, but now that their hikes of begun having material impacts on the economy, will they let off the gas? To pivot or not?

Its really a tough battle at this level for the Fed as on one hand you risk the integrity of the entire banking system if you continue raising rates higher from these levels and threaten to throw the U.S. economy into a deep recession.

On the other hand, if you pause or cut rates prematurely, you run the risk of inflation re-emerging and once again forcing you to hike rates, likely higher than previously anticipated at that.

If the Fed does pause, expect equities to pump and immense pressure being placed on inflation data as if rates at these levels can manage inflation, the Fed will likely not go higher. If inflation remains stubborn expect rates to continue to climb.

Thursday and Friday both are slim in terms of volatile economic data and won't have much effects on equity markets, but fallout from the Fed's decision on Wednesday will keep markets extremely volatile.

As you probably picked up by now, this week isn't very strong in terms of volume of economic data, but the magnitude of the FOMC meeting and subsequent interest rate decision on Wednesday paired with the ongoing banking situation will keep market more volatile than they have been in months this week.

Closing Remarks

Considering the immense volatility this week will contain, and the wide range of outcomes, we are keeping our rating on U.S. equities neutral, acknowledging that either we see massive upticks off a pause in hikes, or continued downward pressure on further hawkish policy from the Fed.

We believe the Fed should continue raising rates for now as we do not see the current banking crisis to be a full blown systemic failure, and rather as individual failures by banks with poor investment practices. The dangers in pausing rates too early and reigniting inflation are not worth the alleviation of pressures on the banking system at this juncture, and ideally the FOMC recognizes this.

Finally, Andy's Angle would like to present our newly formed post schedule in order to give reader's and idea of what to expect going forward:

- Week Ahead Posts including economic analysis and outlooks every Sunday evening.

2. Investing Education Pieces every other Wednesday (next edition 4/5)

3. Andy's Angle Value Stock Spotlight every fourth Sunday of month (next edition 4/30)

We will be adding in new articles with economic coverage as we see fit that will cover current events and keep our readers up to date with the best analysis and presentation of events taking place in the economy.

Thank You,

-Andy's Angle Writing Team and Investors-

Comments ()