A Look to the Week Ahead: Q4 Earnings and Inflation Data

As we've been discussing for the past couple of weeks and in our full 2023 outlook, earnings will be a major factor in market dynamics throughout the entire year as firms battle a higher interest rates and a potential recession. We get the first glimpse into fourth quarter earnings as banks kick off the season this week.

In addition to this, we receive important economic data on inflation as well as multiple speeches from top Fed officials, including Federal Reserve Chairman Jerome Powell.

From a technical standpoint, the S&P 500 seems to be forming a higher low on the weekly chart and we will be watching closely for this pattern to follow through to the upside and retest the bear market trendline over the next couple of weeks.

As part of our continued mission to be the best tool for investors and traders to use on a week to week basis, we have now added a "snapshot" segment to our week ahead articles that will allow readers to get a quick rundown of the week's events.

Andy's Snapshot

Week ending January 13, 2023

Monday: Minimal economic data, no earnings of note.

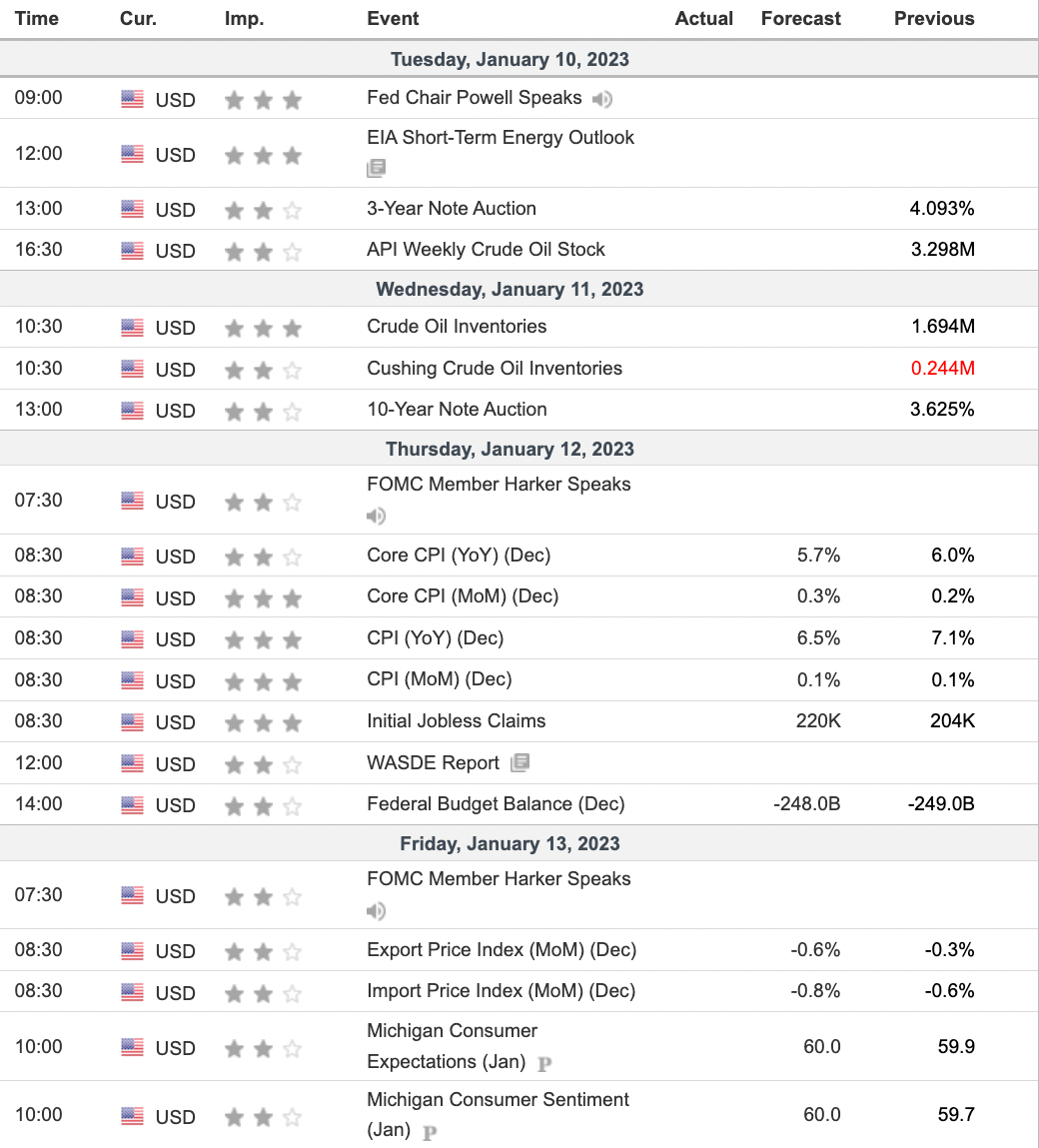

Tuesday: Powell speaks at the Sveriges Riksbank International Symposium on Central Bank Independence. EIA releases their short-term energy outlook. Albertson's reports earnings.

Wednesday: Another quiet day, no earnings or economic data of note.

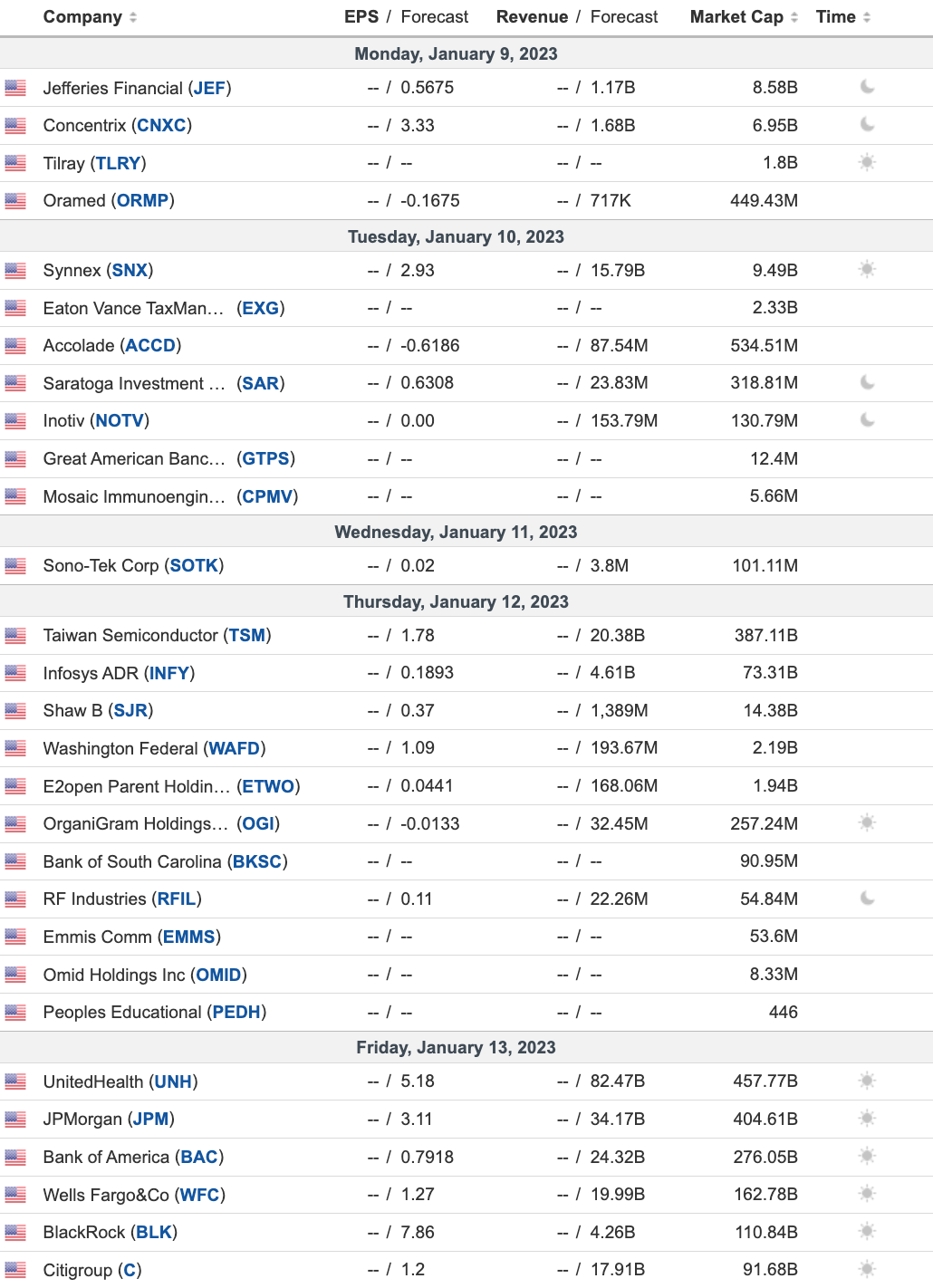

Thursday: Most important day of the week. U.S. CPI report, Initial Jobless claims, FOMC Member Pat Harker speech, Taiwan Semiconductor reports earnings.

Friday: Consumer sentiment and expectations released by the University of Michigan, FOMC Member Pat Harker speech. Major banks report earnings, including J.P. Morgan, Citi, BlackRock, Wells Fargo and Bank of America. UnitedHealth wraps up the week as the largest company to report earnings.

Overall we see that this is thin week in terms of economic data, but Thursday's CPI is going to carry major volatility as it will help clear up expectations for the Fed's rate hike path going forward.

Earnings are finally picking up as we kick off Q4 earnings season and this will bring more volatility to markets as investors gauge how resilient U.S. firms are.

Lets dig into our expectations and the implications of these data releases.

Economic Data

Week ending January 13, 2023

We start of this week with a quiet Monday, which is a step up from being closed the last two weeks, but nonetheless, there will be little added volatility from either data or earnings. The only point of note will be a release of U.S. consumer inflation expectations, that may give useful insights into the health and outlook of the consumer.

Tuesday is highlighted by a Jerome Powell speech at the Sveriges Riksbank International Symposium on Central Bank Independence. While this isn't expected to be a major market moving speech, given it is simply a panel discussion, we cannot discount the possibility that he drops some nuggets that may disturb the natural market movement. In addition to this, the Energy Information Administration (EIA) is set to release their monthly short term energy outlook. Each month, the STEO provides forecasts through the end of the next calendar year for consumption, supply, trade, and prices across major fuel types. In addition, the STEO provides in-depth market analysis for crude oil, petroleum products, and natural gas markets. This report should give energy traders a good summary of energy markets as investors flock to Crude and NatGas following their rapid declines to pre-war levels.

Wednesday is quiet with commodities in focus. The API is set to release their crude oil inventories report. Crude oil traders will look for a change in the trend where inventories have surprised to the upside for three of the last four data releases. Expect oil prices to rebound with a bigger draw in inventories than expected.

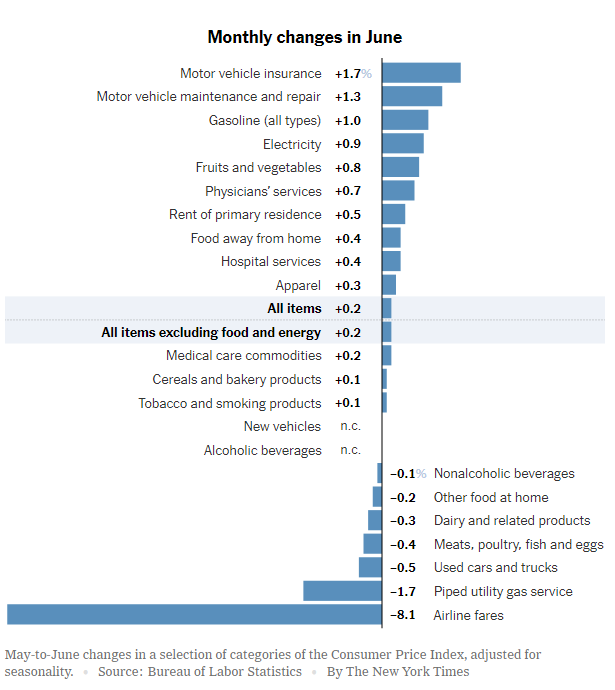

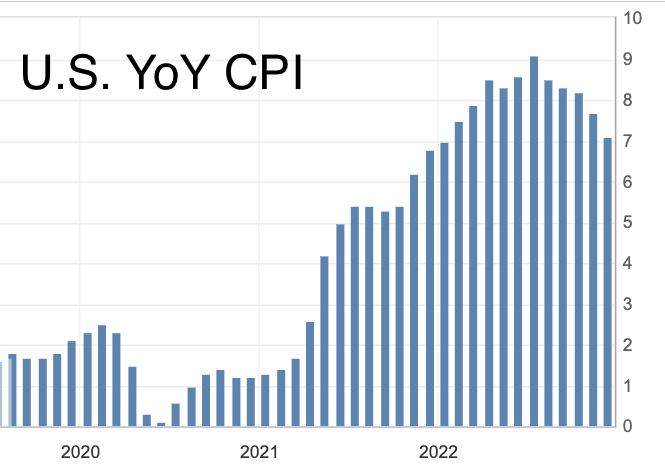

Then comes Thursday, where the week's fireworks are. As has been the case for the past year, all eyes will be on consumer prices when December CPI is released. The most popular metric of inflation has shown significant cooling over the last two months and this trend is expected to continue with the consensus expectation being that prices rose 6.5% in December from the year-ago period.

Year over year CPI has finally turned the corner after reaching an over 9% peak in the summer, and in fact seems to be accelerating to the downside in the last two months.

With a 6.5% YoY print in mind, here is our matrix:

CPI 7% or higher: S&P 500 loses 4%+

CPI 6.6% to 6.9%: S&P 500 loses 1-3%

CPI 6.2-6.5%: S&P 500 gains 1.5-3%

CPI 6.1% or lower: S&P 500 gains 4%+

The immense volatility from this event can be directly attributed to the fact that it will largely decide whether or not the Fed hikes by 25 or 50 basis points in their February meeting, and will also set the market trend for the next couple of weeks as it will clear the air in terms of what to expect from the Federal Reserve through 2023.

A cold print will signal that inflation is continuing to unravel at a faster than expected rate, which will satisfy Fed officials who have said that the current slowdown in inflation is "lagging" their expectations.

On the other hand, a hotter print could spell disaster for markets as even under the current inflation projection, with 2.5% inflation by summertime, there are still modest concerns of a U.S. recession. If inflation starts to fall at a slower rate, forcing the Fed to hike higher, the window of opportunity for the nation to skirt a recession would be all but shut.

In addition to CPI, we also get minor jobs data in the form of initial jobless claims as well as a speech from Philly Fed President Patrick Harker.

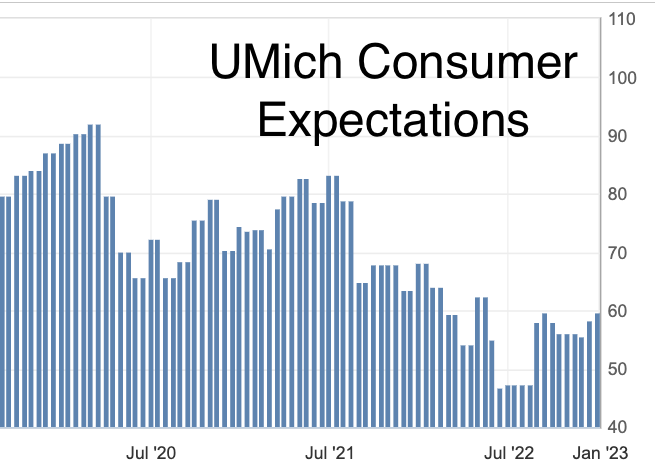

Moving onto Friday, we close out the week relatively quiet in terms of economic data, with more consumer sentiment data highlighting the slate. Harker takes the podium again to make more comments, and the University of Michigan releases both consumer sentiment and consumer expectations data.

Consumer expectations have reached historic lows this year following major inflation hurting consumers. Many consumers are now expecting a recession with lower economic activity over the next 12 months, however, there has been positive movement in sentiment and expectations over the last few months.

This metric is important as consumer spending is often dictated by consumer expectations. If more people are expecting a downturn in the economy in the near future, they will choose to save more rather than spend. This gives us a useful insight into how spending will trend over the short to medium term.

Earnings to Watch

Week ending January 13, 2023

Q4 earnings get under way this week, and our main watches for this week include big banks and Taiwan Semiconductor.

Taiwan Semiconductor is one of the world's largest semiconductor manufacturers and their earnings will foreshadow the earnings trends for many firms across the tech sector.

As for the big banks, their investing profits have collapsed in 2022 as markets dropped. In addition to this, they have also been impacted by lower economic activity in the form of less mergers and acquisitions. However, expect their earnings to be helped by higher interest rates.

Here is the full rundown of earnings expectations: