A Look to the Week Ahead: Let's have some fun

Fireworks time.

The macro calendar has been boring for a few weeks now, but that all changes this week.

Volatility returned to markets this week, with the S&P500 rising nearly 1%, but at least trading in a much larger range.

This weekly close brought us to six of the last seven weekly candles being green and the rally once again ended at our previously marked 4160 level on SPX... coincidence?

This shelf has proven to be the death of numerous bear market rallies and this one is being tested as we head into the new week.

However, earnings have come in better than feared, with the current SPX earnings decline sitting at just -1.9% for Q1, far better than the nearly 5% drop in earnings that was forecasted in the beginning of April.

Mega caps like Microsoft, Meta and Google soared on better than expected earnings, helping indexes salvage a green week.

However...

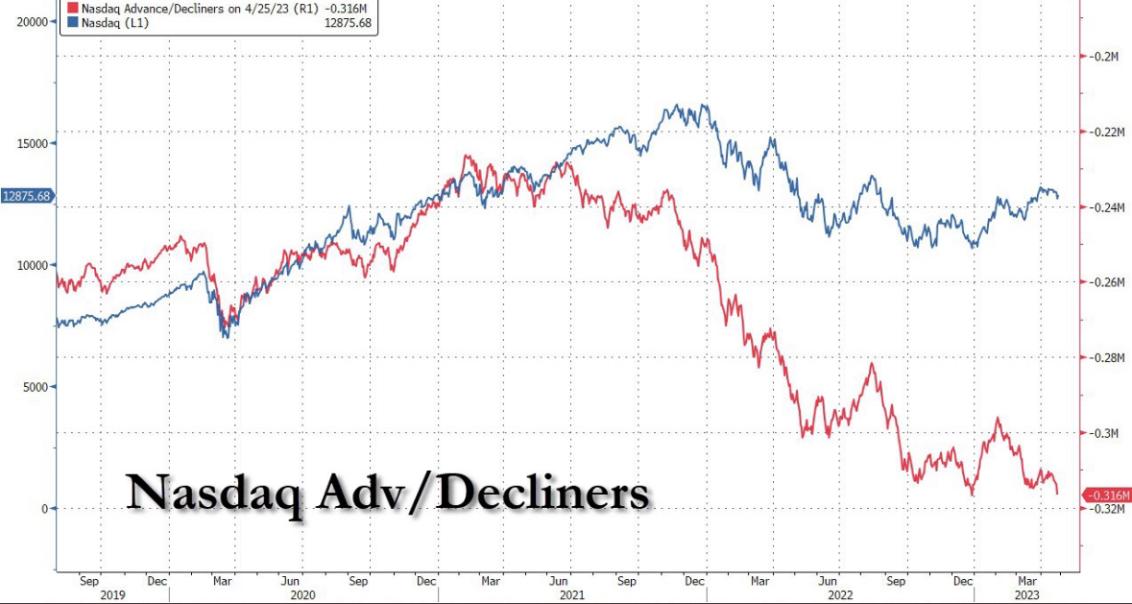

Market breadth remains historically weak.

This means that there are more decliners than advancers in the Nasdaq, the most on record in fact, despite the overall index moving higher.

This is a result of market cap weighting in indexes.

The larger the valuation of a company, the greater percentage of the index it takes up.

This is an issue now because the top six companies in the U.S. have become so much more valuable than the rest that they make up nearly 20% of the entire SPX index, with Apple and Microsoft alone accounting for nearly 13%.

This gives a skewed view of markets when looking solely at indexes, even though indexes may be going up, broader market returns may not be as strong...

Taking a look at small caps relative to the Nasdaq we can see this discrepancy crystal clear.

While small caps have been weakening against tech for years, they had been gaining relative strength throughout 2022, but in just four months to start 2023 that strength has been wiped out, with the correlation reaching all time lows yet again.

This goes to show the extent to which most market players have been continually weakening against a more skewed Nasdaq.

At this rate it isn't even unreasonable to assume Apple will hit a new all time high after their earnings on Thursday.

Indestructible.

Moving on, this week promises to be ultra important, with a highly anticipated jobs report, Apple earnings, and most important of all, the tenth straight interest rate hike being on deck.

Let's take a closer look at this week's events...

Economic Data

Week ending May 5th, 2023

While the volume of data isn't too big, the magnitude is immense.

Tuesday's JOLTs job openings will be an interesting data point, albeit likely inconsequential for markets. Job openings tumbled below 10 million in February for the first time in nearly two years, showing signs of a cracking labor market as firms wind down hiring. This drop in job openings is expected to have continued in March, a welcome sign for the Fed, which is desperate for any signs of weakness in the labor market to support a pause in rate hikes.

Moving on to the main event on Wednesday, the FOMC meeting and subsequent interest rate decision. Just a couple months ago you would have called us crazy for calling for a tenth straight rate hike in May, amidst the banking crisis many assumed rate hikes were done at 4.75% and cuts may have already begun by now.

Couldn't be further from the truth.

The consensus is the Fed hikes rates again, by 25bps, to bring the target range up to 5.00-5.25%, matching the highest rates since 2001. The ongoing battle against inflation has proven to be difficult and the jobs market remains robust, but something that seems to have gone under the radar was last week's GDP print.

The U.S. GDP only grew by a mere 1.1% in Q1, much weaker than expected, and we may already be in a contraction in Q2, but that data won't be available till late July...

The economy isn't as strong as the Fed believes.

Despite this, we agree with a 25bps hike this week, but expect it to be the last, with Fed minutes commentary to reflect that.

Friday's unemployment data will close out the week, with markets kind of in a limbo.

On one hand markets obviously want the higher unemployment print to favor lower inflation, but given the fact that the Fed is more than likely done hiking rates after Wednesday, it may be favorable for payrolls data to come in strong, reflecting lower odds of a recession, because lets face it...

We are on the edge of a nightmarish scenario.

Lower output and higher prices, stagflation.

While this has been discussed for months, its could be a reality as soon as this summer, as rates continue to cause bad debt to float up to the service, leading to an undeniable stench across the U.S. economy.

Years of bad credit and free money has caught up to us, but is there just enough gas in this economy to avoid the worst case scenerio?

That is to be seen, and the Fed has already screwed up enough times to render them useless in defending against any sort of stagflationary event.

Cutting rates once the first domino drops won't be enough to stop the tsunami of defaults that will follow.

Enough of the fearmongering though, there are still reasons to be optimistic given the low unemployment rate and, for now at least, a positive trend in inflation to the downside.

Look for markets to adopt a good = good and bad = bad news framework heading into Friday's jobs report.

Closing Remarks

Expect this week to be explosive for markets, especially sensitive to whatever Powell has to say on Wednesday.

Apple earnings on Thursday should provide marketwide volatility as well as the biggest company in the world gives its take on the global economy.

With indexes nearing resistance and macro events that will cause volatility it will be a massive move in one direction or another this week.

While we have been generally bearish, we have moved to a more neutral stance given the uncertainty of the current market.

Good news and a strong outlook from the Fed would be the fuel for this rally to extend much further, up to nearly 4300 on SPX, but on the other side we could easily see a rejection and slide back down to 3900.

We have begun reallocating our cash reserves in our Andy's Angle Investment Portfolio into value stocks we see fit in the current environment, and an update on that with our latest pick can be found here.

That about wraps it up, as has been the case for a few weeks now, we advise caution and recommend readers stay risk-off for this week and make investments following full digestion of both the FOMC and jobs report.

Trade safe,

-Andy's Angle Writing Team-

Comments ()