A Look to the Week Ahead: Tick, Tick, Tick...

Hear that?

That's the sound of an economy strapped to a time bomb, with the detonator in the hands of dinosaurs... colloquially known as politicians.

The treasury revealed in statements last week that their balances jumped $108B in one week in April, as a result of tax collection completion, but this was far below the expected range of $150-200B, putting further pressure on policymakers to raise the debt ceiling before the treasury goes broke.

Consensus estimates were that the treasury could make it to June 30th, where then extraordinary measures would be needed, once again, to stave off default. However, with this leaner than expected tax season, there are doubts to whether or not the treasury can even make it to June 15th, when few tax installments are received, giving our politicians roughly a month to come to an agreement regarding raising the debt ceiling.

The consequences of not doing so are far reaching and largely understood, so let's just assume they do get it dealt with in time...

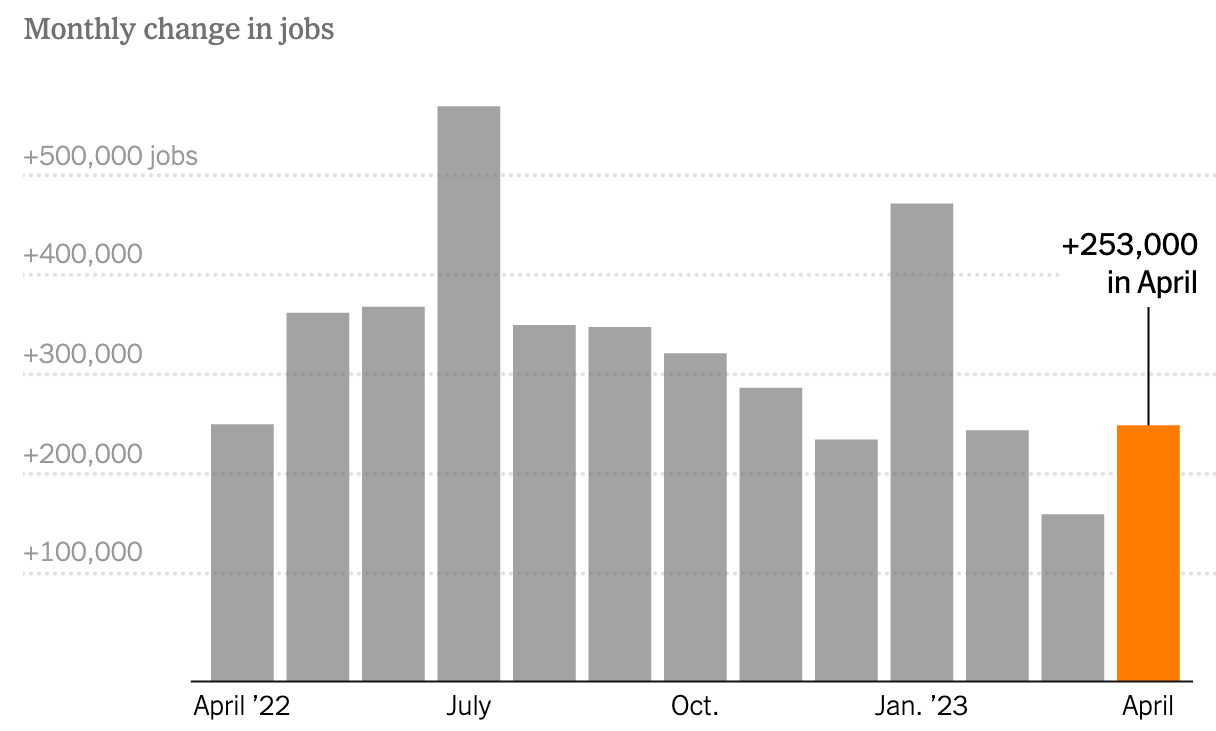

In other news, the economy is nowhere near a recession yet, at least not looking at the jobs market, as April saw over 250,000 new jobs added, brining the unemployment rate down to 3.4%.

Jobs are being added relentlessly, and this helped markets, and more specifically oil, rebound off what was initially a pretty weak week.

Oil prices in particular fell over 10%, with West Texas Intermediate crude prices dropping all the way down to $63/barrel in a flash crash Wednesday evening.

Demand fears revolving around a phantom recession roiled oil markets, but positive news from the jobs market aided a rebound to close out the week.

Oil prices have fallen sharply from their early-April OPEC induced jump, but we believe this sell-off is well overdone and will be corrected higher as the U.S. enters peak consumption season with record high demand for travel expected this summer.

Paired with dwindling supply, oil prices may see a return to $90/barrel in summer, undermining the Fed's efforts to tame inflation, despite 10 straight rate hikes and a 5.00-5.25% fed funds range.

Moving on, earnings season is largely wrapped up, and most numbers came in better than feared, once again going against the recession narrative. With continued compression in earnings expected throughout the year, we are not out of the woods yet, but so far things are looking more optimistic than once expected.

However, banks, regional banks, continue to experience record volatility, especially after First Republic ($FRCB) went belly-up this week. Other names like PacWest ($PACW) and Western Alliance ($WAL) came under pressure as well as it looked more and more likely that bank runs would continue, leaving gaping holes in the balance sheets of these companies.

The banking saga has created massive uncertainty within the economy, but for now we have been assured that the worst is behind us... until the next bank goes up in flames this week.

Finally, the Fed raised rates by 25bps last week, marking the tenth straight hike, and brining the FFR to the highest level since 2007. In his remarks on Wednesday, chair Jay Powell said a recession is not expected, although growth will likely come in much softer than expected, in the 0-1% range for the year.

Looking ahead to this week, inflation data will be key, especially given the market has been more sensitive to recessionary data points as of late, and with those failing to materialize, inflationary pressures will return to the spotlight.

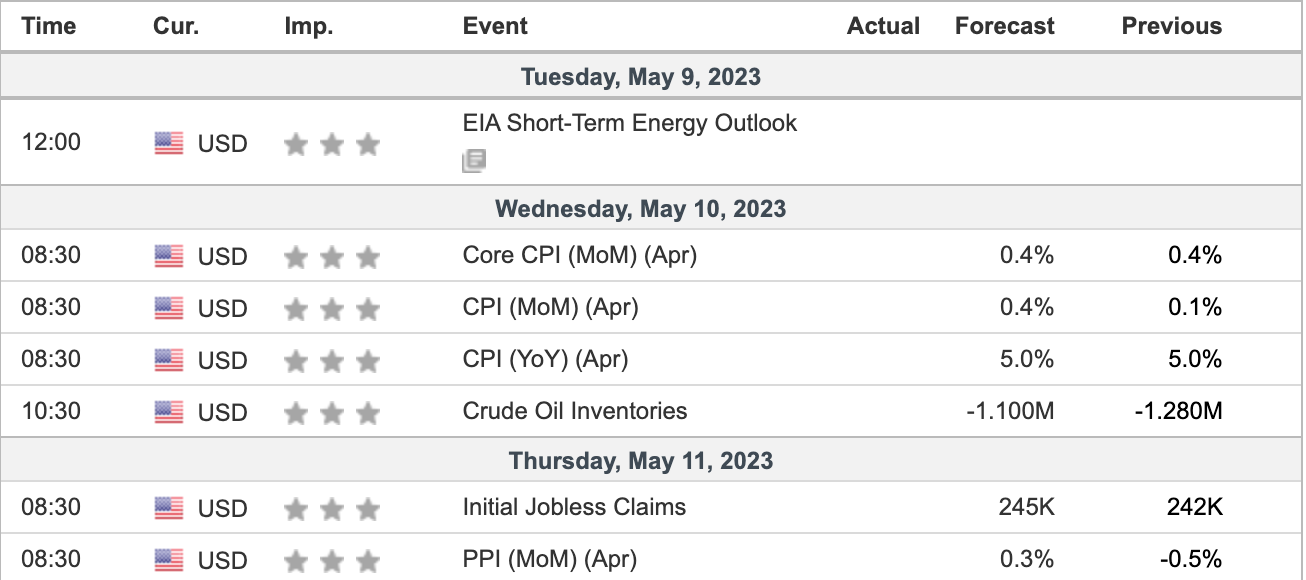

Economic Data

Week ending May 12, 2023

Really is a quiet week, but important inflation data points will keep markets on edge.

As usual, the highlight will be CPI, slated to be released on Wednesday.

But here's the kicker, consensus expectations for April CPI are 5-5.1%, which would represent either flat or higher inflation for the year ending April 2023, as compared to March, which was also 5.0%.

This would indicate inflation is sticking and would cause concerns for the Fed, but given real rates have finally reached 0, or slightly negative, we expect inflation to continue to collapse.

Markets would love a 4-handle on this week's CPI, enabling them to finally break out of a tight trading range.

Thursday's PPI data is less important, and is also expected to show a return in inflation with a 0.3% MoM rate, compared to -0.5% in March.

Quiet week, but overall sentiment regarding both the debt ceiling situation, Fed guidance and the banking crisis will dictate price action, although risks seem to be weighted to the upside apart from those sharp negative catalysts given earnings strength and incoming economic data.

Closing Remarks

We are upgrading U.S. equities from slight bearish to neutral, as we anticipate softer inflation data and overall digestion of earnings and strong labor data to ease market jitters regarding inflation.

Markets have been trading in the same range for well over a month now, and it really isn't far fetched to assume this trend continues for a bit longer as there are no real catalysts to interfere with current market pricing.

Overall breadth, as we stated in our last article, remains extremely skewed, but this can be seen as bullish as markets will gain another tailwind once the broader underperformance is normalized.

In addition to this, we anticipate oil prices to rebound and energy names to catch a bid as we expect geopolitical tensions with Iran and supply concerns to far outweigh recent demand concerns regarding a potential recession.

In general this week is expected to follow what has been the norm for 2023, and really the past year if you really zoom out, choppy and directionless, but inflation data that surprises to the upside may cause concerns and rattle markets once again, especially given the consensus that the Fed is already done raising rates.

Andy's Angle Investing Portfolio

Finally, we would like to provide an update on our investing portfolio...

Our portfolio is currently up 9.3% since inception, aided by our 30% trade on RumbleON ($RMBL), and hindered by a small loss on Cumulus Media.

As we move forward, here are our current and future investments and theses: