A Look to the Week Ahead: Troubled Waters

Volatility is set to reign over markets this week

Last week was... eventful, to say the least.

Markets dove with the S&P 500 shedding 4.5%, firmly breaking what bulls had hoped would be a newfound uptrend.

While we stated that jobs would be the highlight of the week, with major employment data released on Friday, it was another event that took all the attention.

The collapse of Silicon Valley Bank, the second largest bank collapse in U.S. history, second only to the failure of Washington Mutual during the height of the Great Financial Crisis in 2008.

The story unraveled remarkably quick, within just a span of 48 hours.

Silicon Valley Bank (SVB) announced on Thursday that they failed to raise capital to cover their losses on investments in short term treasury securities, whose value had been sunk by raising interest rates. This news almost immediately led to a bank run, with depositors racing to get their money out before the bank ran out of money to pay out all depositors. By Friday morning SVB had been looking for a complete sale of the bank and just hours after market open California regulators shut the bank down and appointed the Federal Deposit Insurance Corporation (FDIC) to oversee disposition of assets.

This extravagant collapse led to fears all across the banking sector, with regional banks such as First Republic and Western Alliance plunging over 30% in value as investors grew concern of further bank runs across the nation.

The collapse for SVB is immense as thousands of tech companies had relied on the bank for their deposits and following the collapse their funds were now stranded, with no clear indication if they would ever be returned in full.

Notable companies with major deposits at SVB include Roku and Roblox, along with a plethora of startups and venture capital portfolios, many of which may not survive till the end of the week without access to their funds at SVB.

How this progresses is yet to be seen as the FDIC is working to auction off the bank and possibly enact a backstop with the Federal reserve to make all uninsured funds and depositors whole again.

Contagion fears will run high until a conclusion is reached and volatility is set to remain sky high heading into the new week.

And this is just the tip of the iceberg, lets look at this week's economic data slate...

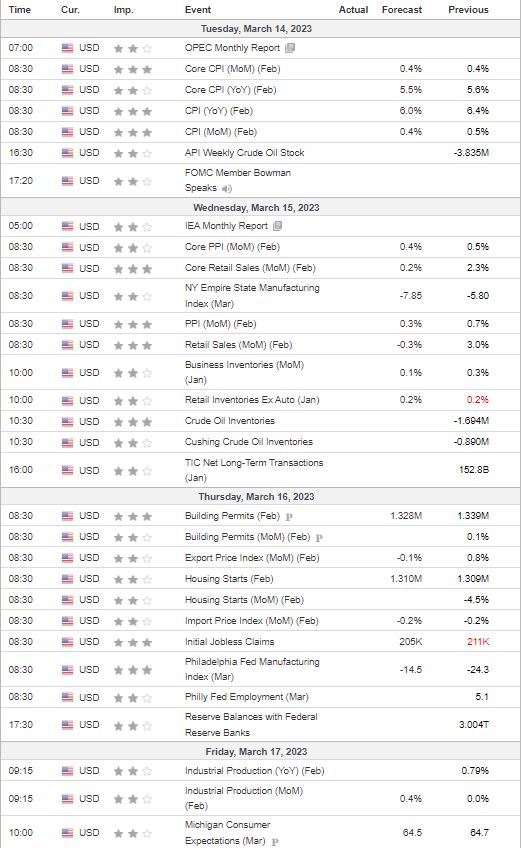

Economic Data

Week ending March 17, 2023

Nothing in terms of economic data on Monday, although there are many factors relating to the banking sector as stated earlier that will keep things very active. However, we do have an emergency FOMC meeting called for Monday as the Federal Reserve meets to decide how to take appropriate action in mitigating the fallout from the SVB collapse. This will keep markets on its toes and could have major ramifications depending on what the FOMC members decide to do.

Tuesday comes in to throw even more volatility into the mix with all important inflation data in the form of February CPI. Inflation seemed to get stuck in January, falling to just 6.4% from 6.5% in December. Markets will be looking for any positive news at this point and will be highly sensitive to this CPI report, which expects inflation to fall lower to 6% YoY in February. A drop below 6% will embolden markets as Fed officials have repeatedly eluded to higher rates over the last few weeks, but a higher than expected print would only justify these assertions and undoubtedly drop markets further.

Wednesday brings us another major slate of economic data led by The Producer Price Index (PPI) which measures the change in the price of goods sold by manufacturers. It is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation. Inflation has been in the spotlight for equity markets for over a year, so it should come as no surprise that a lower a print than the consensus of 0.3% MoM PPI inflation will be bullish for markets. In addition to this retail sales will be in focus as markets will look for any signs of a weakening consumer and softer spending trends to support the narrative that the economy is weakening and Fed hikes are doing their job.

Thursday brings us more data, this time with an emphasis on housing. As we have discussed in the past, housing has been on a historic drawdown since its absurd peaks in 2021. Housing starts and building permits will both give insights into the health and activity of the housing market at the present time. Equity markets have generally desensitized from housing data, so don't expect much volatility as a result, but it is something to keep on watch. We also get updates from the Philly Fed in both manufacturing and employment, but considering these are regional data points we do not expect much volatility. However, their employment figures are a great metric as they have been disputing the claims by the Bureau for Labor Statistics jobs data as of late. This discrepancy in data helps us analyze why the Fed seems to be overtightening even though jobs data seems to be pointing positive.

Friday quietly closes out the week with industrial data and consumer sentiment, both of which should not have a major effect on equity markets.

Closing Remarks

As we head into an eventful week it goes without saying that volatility will be high.

As a result, we have once again lowered our outlook on U.S. equities from neutral to bearish, tilting nearly extremely bearish, as we anticipate aftershocks from the SVB collapse to compound with higher than expected inflation numbers to create a rough week for equities.

We anticipate strong risk-off moves and yields to push back higher following an unprecedented drop last week as a result of strong moves into bonds and fixed income to escape equities.

All of this comes during the Fed blackout period, further adding to the uncertainty and risk-off environment as the next FOMC meeting looms the following week.

The outcome of the SVB saga will be in focus and details will be coming out throughout Sunday night and into Monday morning as next steps in the process are taken by both the FDIC and Federal Reserve.

Due to all of this, we recommend readers heed caution this week and to analyze data and news when it comes out rather than jumping the gun on head fake moves in either direction.

Trade safe.

-Andy's Angle Writing Team-

Comments ()