23 in '23: A Trader's Guide to 2023 Markets

Understanding themes that will drive 2023 markets

As markets close for the last time in 2022 it goes down as the seventh worst year in stock market history, with bears pretty much in full control from start to finish.

2022 was the year of inflation, war, supply chain issues and record rate hikes, a true recipe for disaster, and as it bows out it leaves 2023 with the tough task of recouping its losses.

In this special edition of Andy's Angle we will highlight our "23 in '23", an in-depth look into 23 events and trends that will shape markets in 2023. These events and trends will include a broad spectrum of data and analysis, as well as our projections for the year and will serve as a supplement to our 2023 trading strategies segment that will be released soon.

A Look Back: 2022

Before we jump the gun and start looking at 2023, it is important to truly understand what happened in 2022 first.

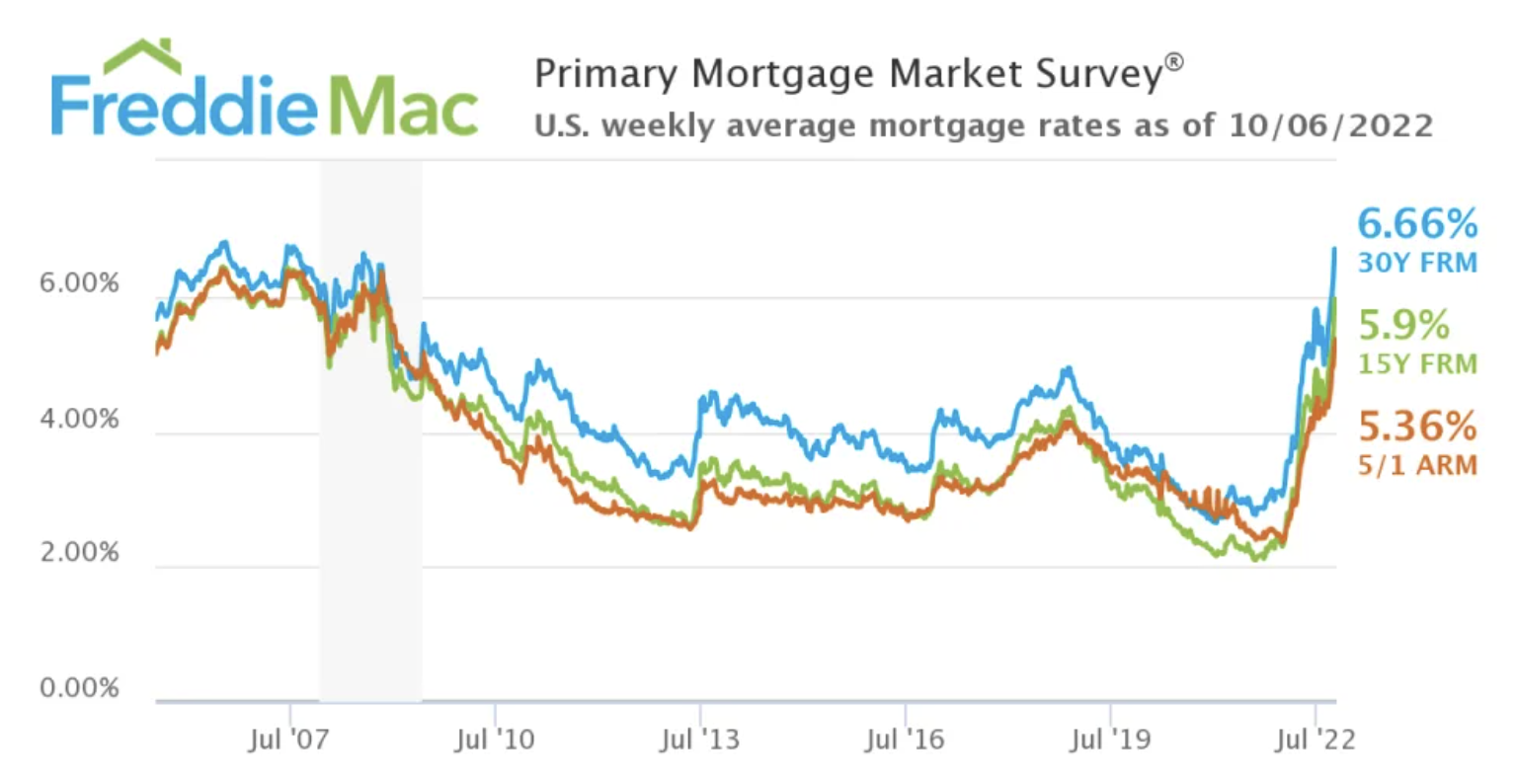

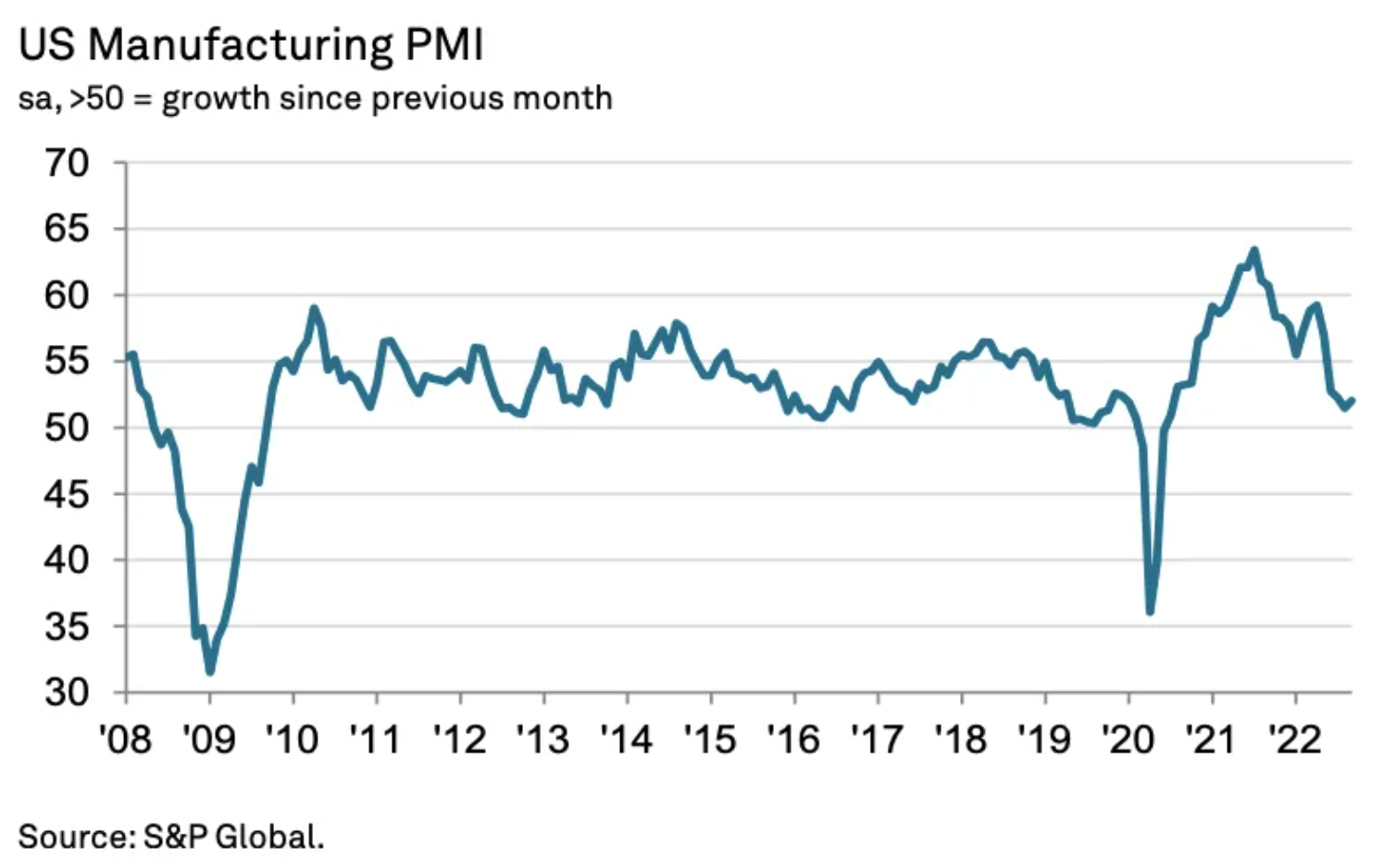

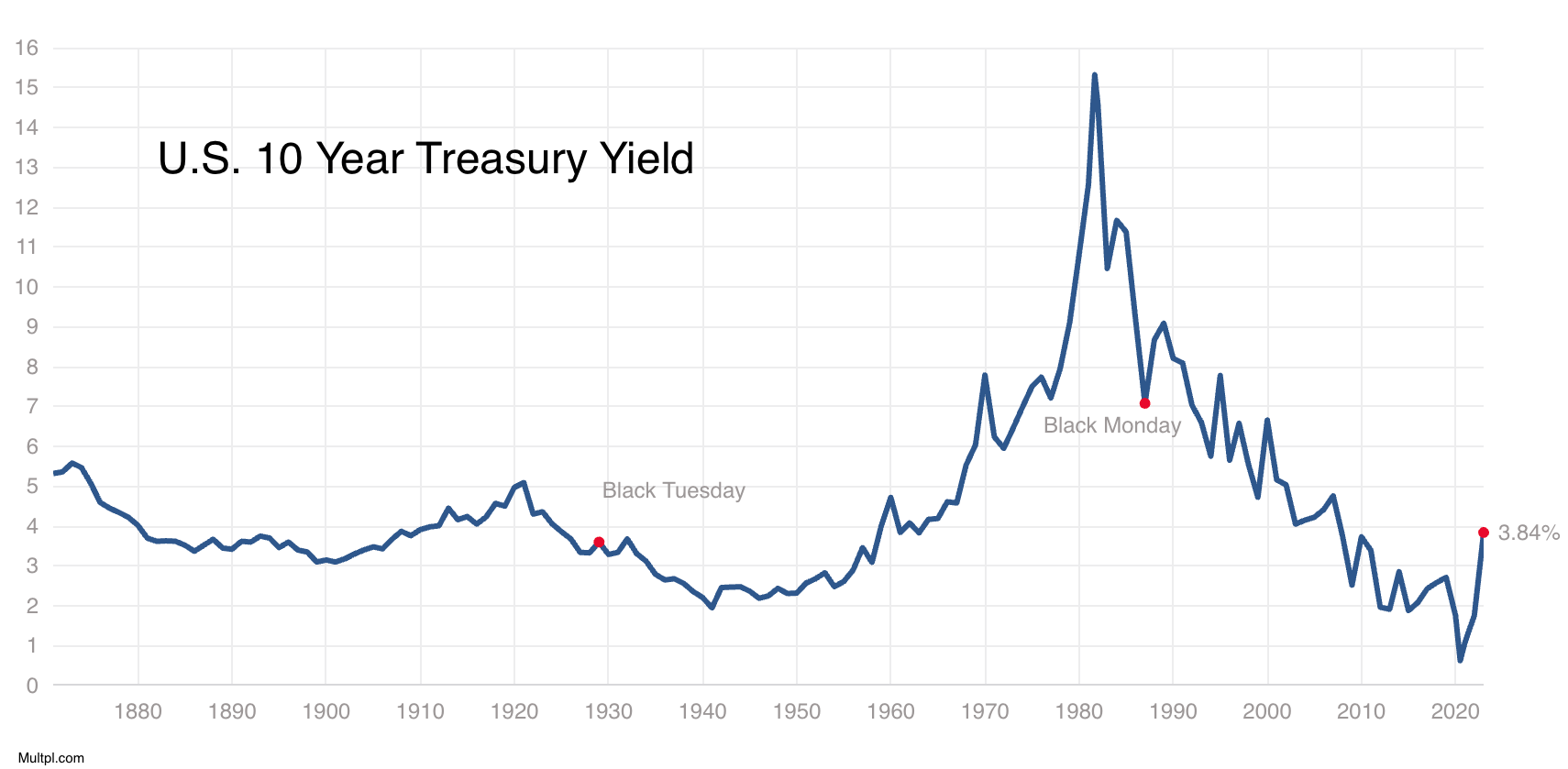

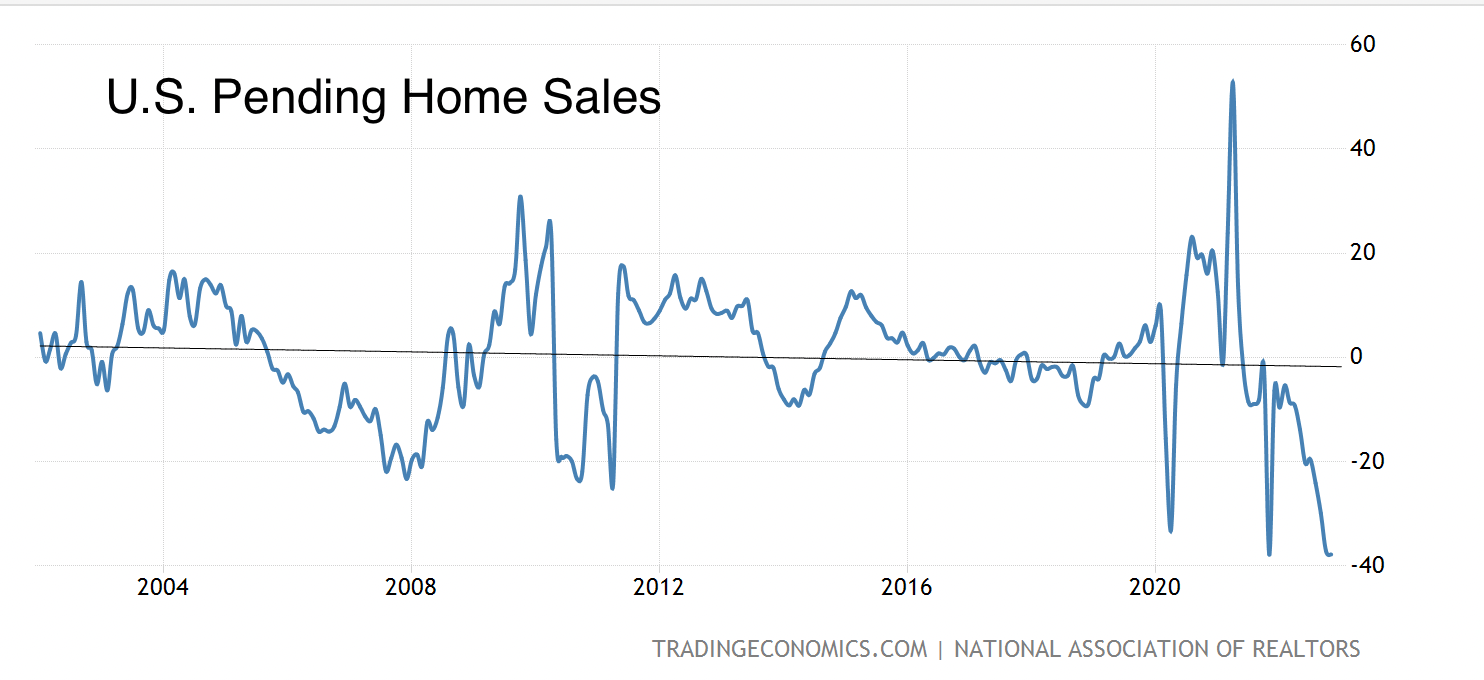

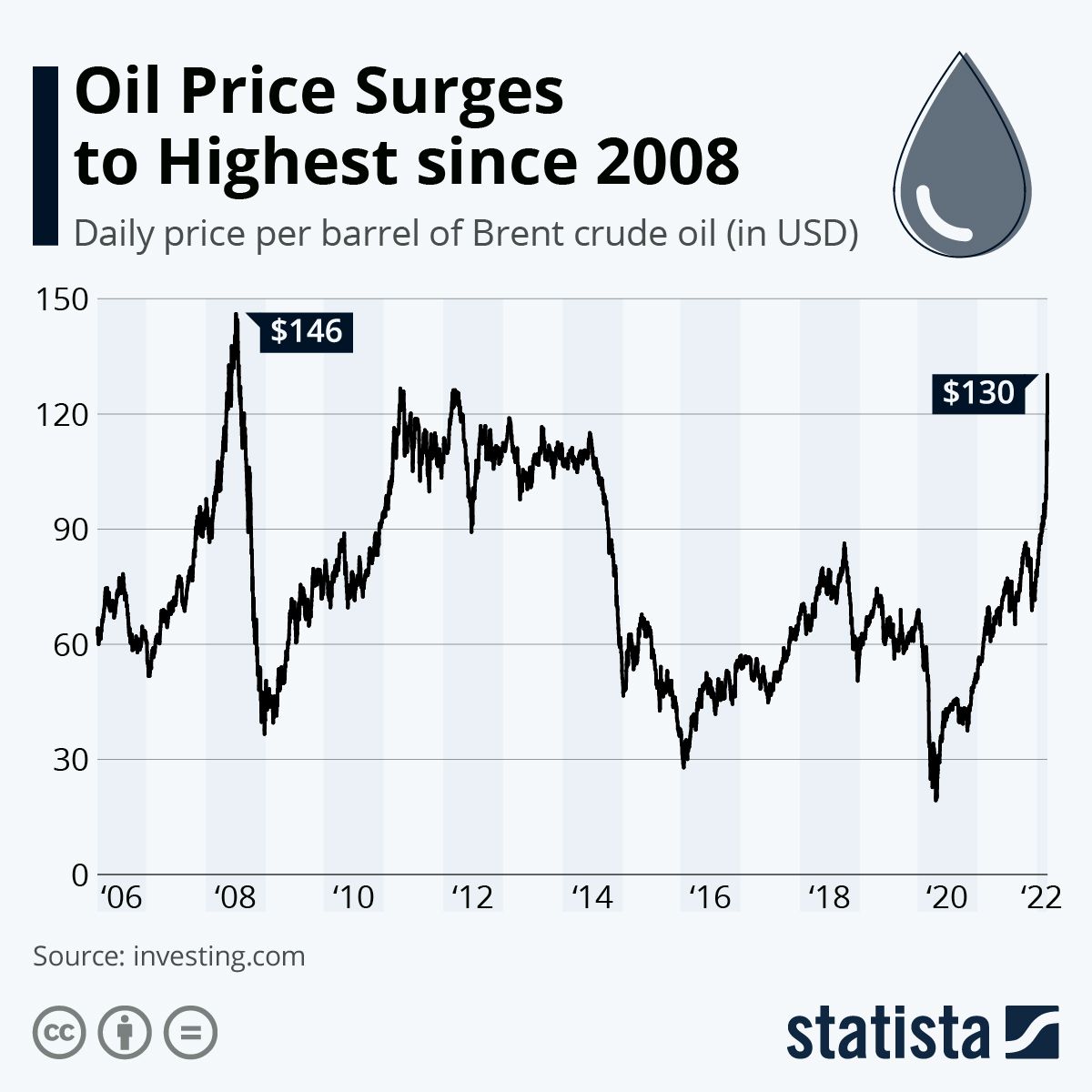

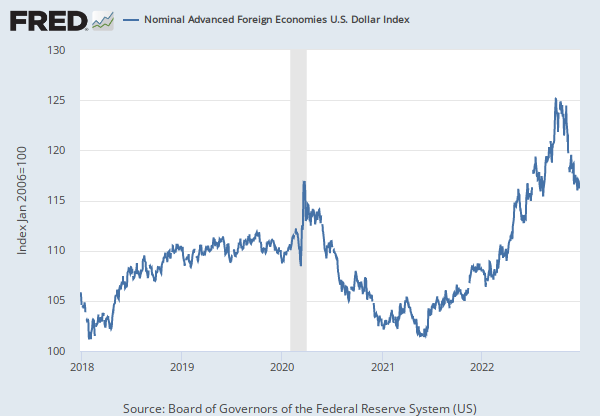

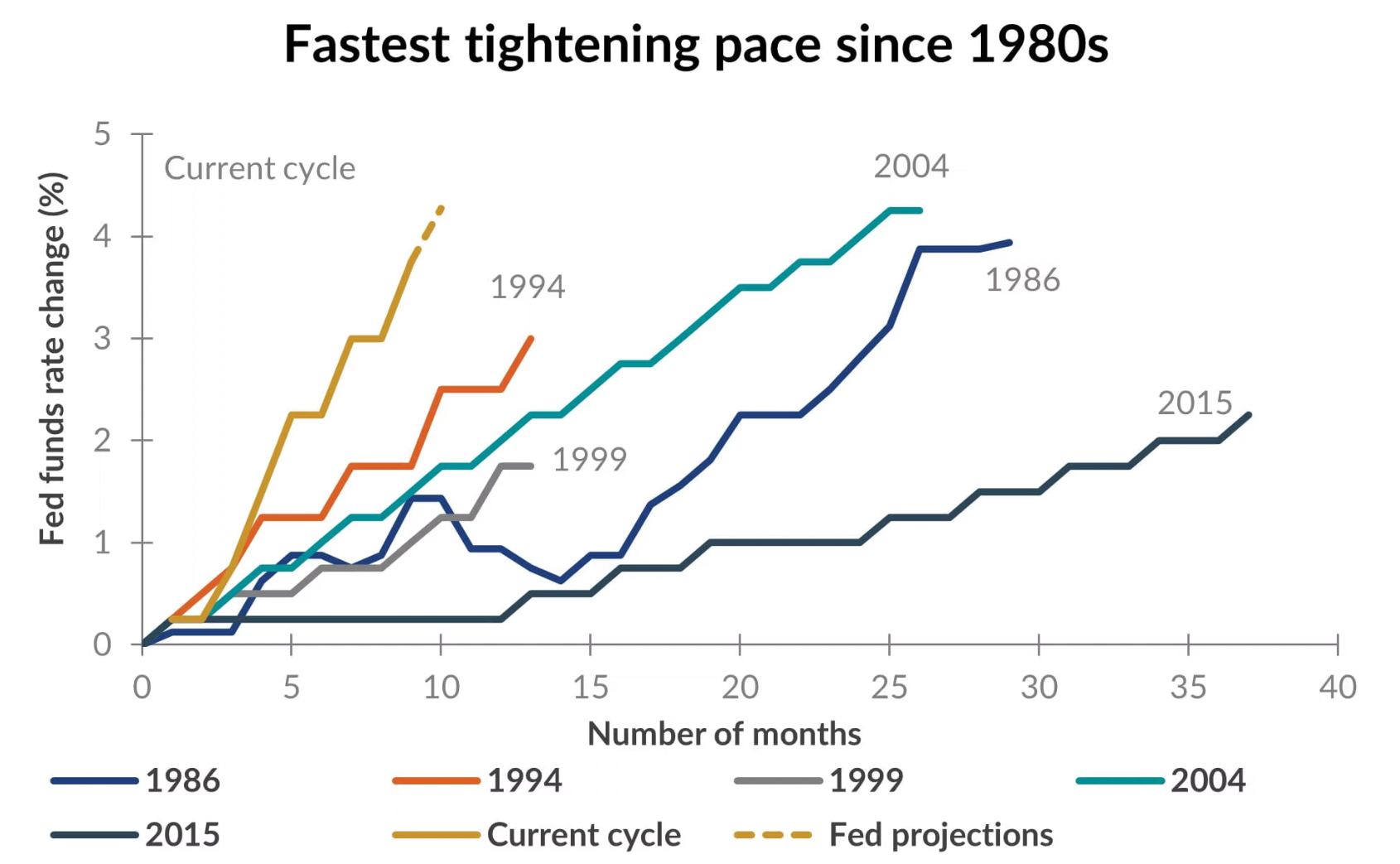

For that, we have collected various charts that best depict what happened in the year:

These charts only scratch the surface of what happened in 2022, but highlight the key narratives.

Let's take a short walkthrough of 2022 to wrap our flashback up.

2022 started off exuberant, with the S&P 500 hitting an all time high of $4,800 on January 4th, just the second trading day of the year. It looked like the lavish bull market of 2020-21 was continuing into 2022 and the post-pandemic era would prove to be fruitful for bulls. Things were looking real good for investors...

January 4th would be the highest point of the entire year.

The S&P 500 would go on to drop over 5% in under a week following this, foreshadowing what would happen throughout the entirety of the year. Whispers of high inflation were going around inner circles in markets, but nothing to worry about yet...

Then came war.

Russia invaded Ukraine in a full-scale military exercise and chaos reigned across markets. Oil prices surged to decade highs and Europe was brought to its knees as sanctions were levied against Russia. International trade was crippled and the global supply chain was snarled. This accelerated inflation worldwide and now it was a big time problem.

Out stepped the Federal Reserve.

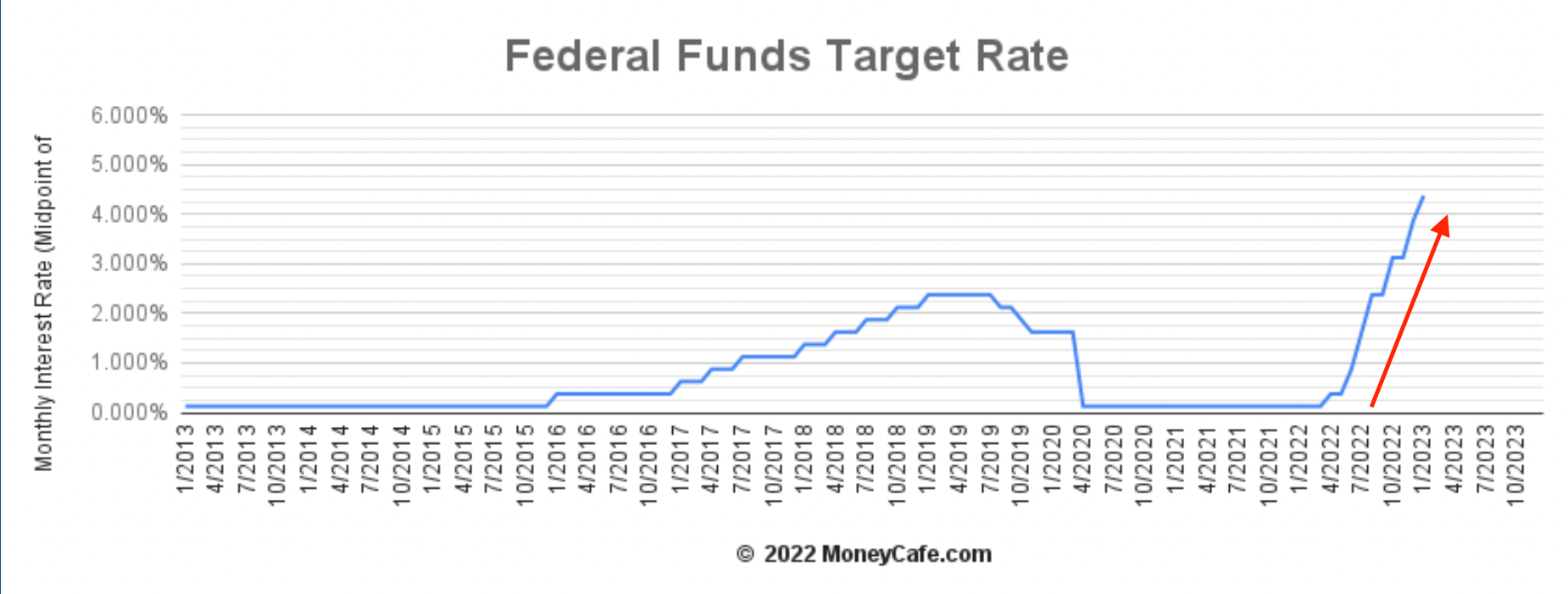

By March it was clear that inflation was becoming an issue, partly fueled by Russia's war, but mostly by the reckless amount of stimulus passed by both the Trump and Biden administration, almost doubling the country's money supply in under 18 months. To begin combating this, the Fed raised their key rate by 25 basis points, beginning their record-breaking hike to 4.5% to close out 2022.

Then inflation peaked... for a little bit

March's inflation print came in lower than February's, sparking a monster rally from $4,200 to $4,600+ in just weeks on the S&P 500. The Fed did their job and inflation was transitory just like they said! Back to the bull market we go.

Or not..

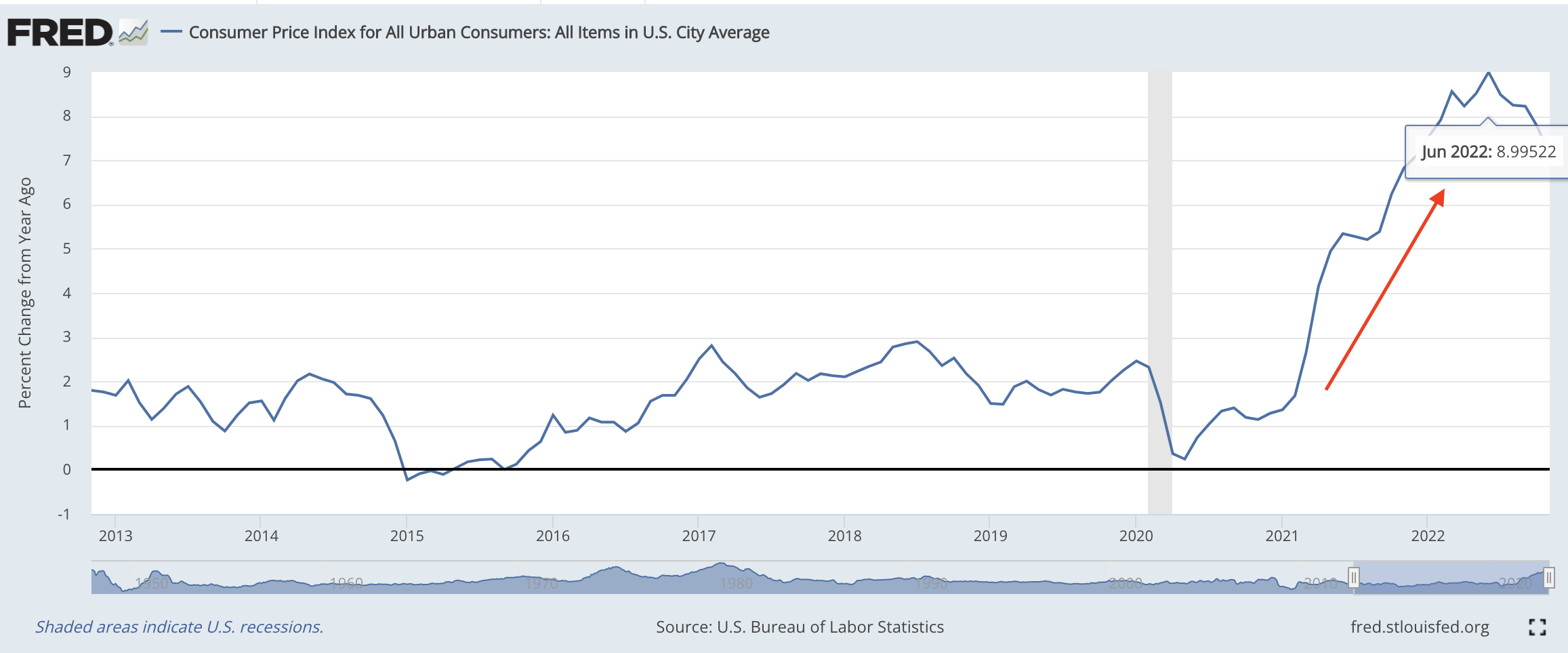

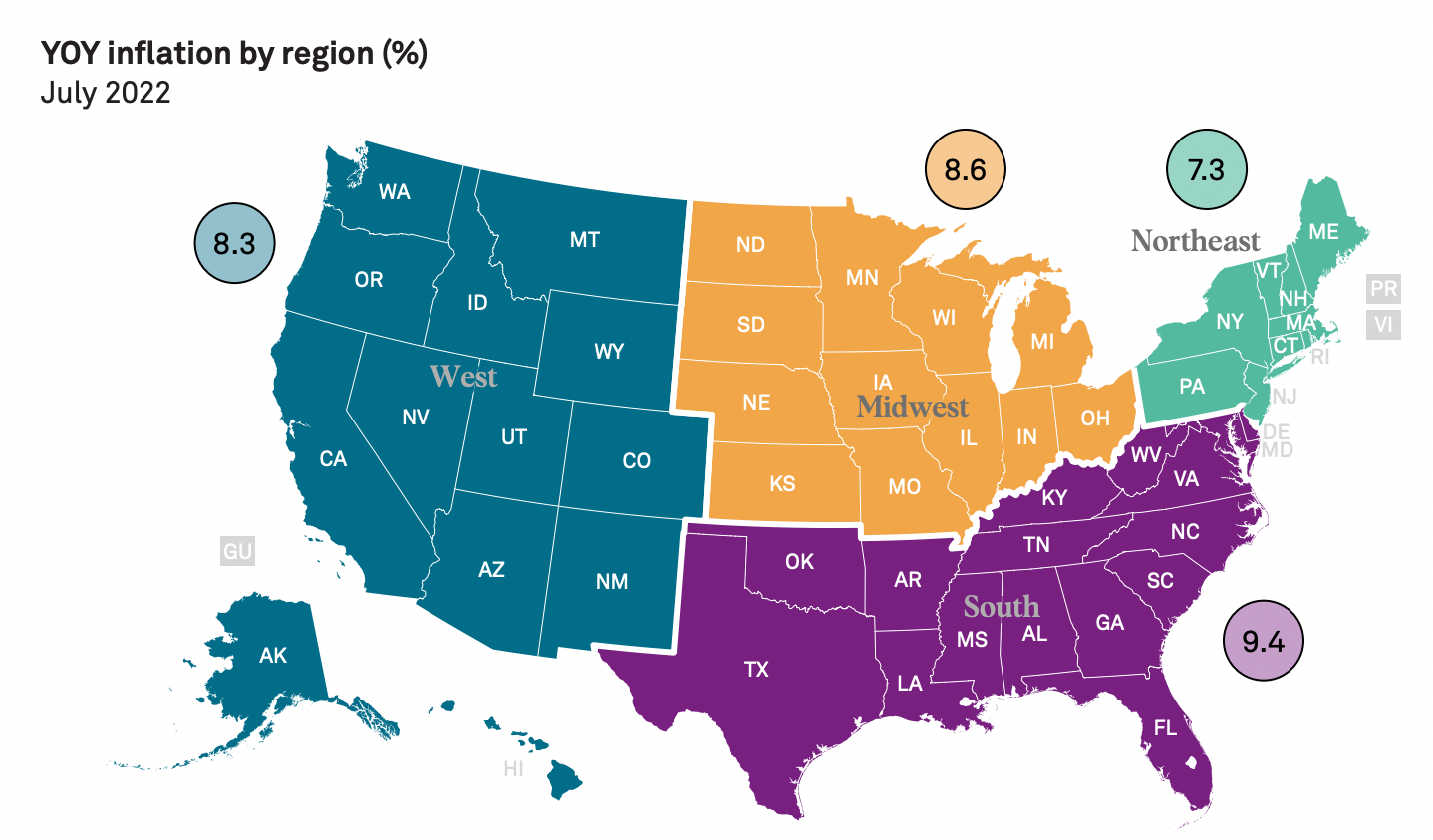

By summer markets were in disarray. Inflation had gone completely haywire with consumer prices rising nearly 9% from the previous year, nowhere near the Fed's 2% target. By June markets had dropped 25% on the year and the Fed was now raising rates with jumbo 100 basis point jumps, we truly entered the twilight zone. GDP growth was negative for the second quarter in a row in Q2 and earnings were hammered as inflation bit corporate margins.

Then came the true inflation peak.

Inflation began to drop, helped by lower energy prices, and markets begin another face-ripping bear market rally through the back half of summer, rising over 15% from their bottoms. The expectation was the Fed was going to stop hiking soon and even ideas of a pivot started dancing around in investors heads.

The phantom pivot of 2022.

By September inflation was proving to be sticky and the Fed showed no signs that they were going to stop hiking, let alone pivot back into Quantitative Easing (QE). Markets began retreating back to their lows, punctuated by a higher than expected CPI print in October that took the S&P 500 below $3,500, a mere 3% above its pre-covid highs. As it turns out, that would be the bottom for markets in 2022 as yet another 15%+ bear market rally began. This time it was more grounded as inflation expectations began matching reality and prices really started falling.

But the Fed didn't care.

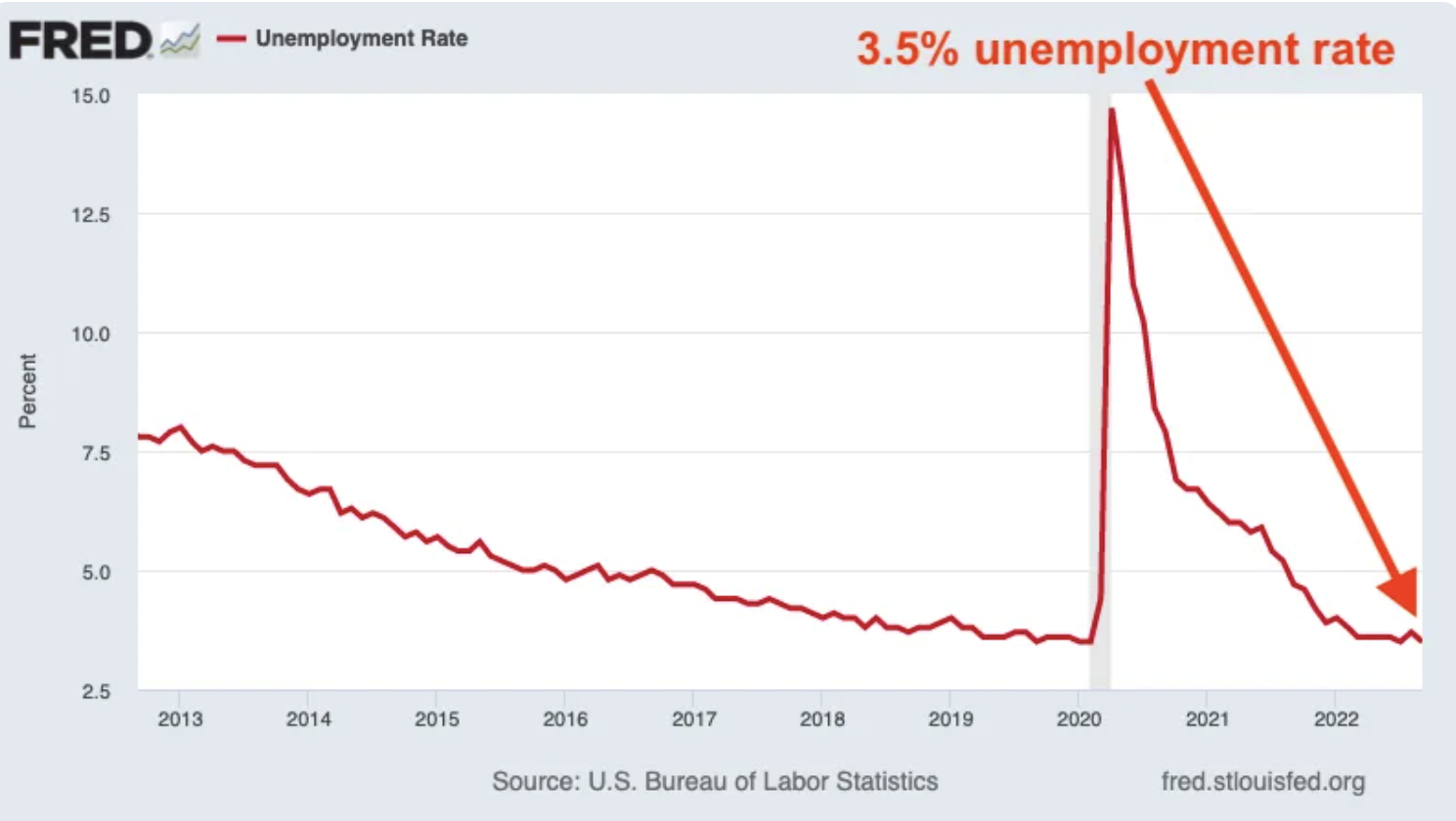

They reiterated their hawkish standpoint and emphasized the tight labor market as a point of contention. They obviously need markets to suffer and this strong economy was not going to do them any favors in their war against inflation. Their December meeting was the nail in the coffin for 2022 as they indicated a terminal rate for 2023 exceeding 5%, over 90 basis points higher than what the market was currently pricing. The Santa rally never came and bulls were left with only coal. Tech stumbled to close the year out and the messy ending to the year was fitting.

While this was a quick summary of events in 2022, and skimmed over many smaller details, the overall theme was clear. The pandemic-era money printing finally caught up with markets as inflation roared in 2022. To combat this the Fed launched the largest rate hike cycle in over four decades at the expense of equities.

With all these details in mind and our latest data and estimates from large banks and financial institutions, we present our 23 in '23 as well as our multiple trading strategies to employ in 2023.

23 in '23

23 Themes to Watch in 2023

As we dive into our comprehensive 2023 outlook with data analysis from Goldman Sachs, Morgan Stanley, Bloomberg, S&P Global Research and other big banks, we would like to suggest to readers to pick and choose which facts and snippets to note down right now, and other trading plans that they can save as markets evolve in the coming year. This outlook is intended to be a fluid trading plan and will see occasional updates as the year progresses, so check back in from time to time!

We want our readers to be the best investors possible by using our data and analysis and believe this report is a key building block for the future.

Lets dig in.