A Week In Review: A Bull Market Reborn?

Markets continued to push higher this week, showings signs of a strengthening uptrend.

Bulls reared their horns for the second straight week with the S&P 500 gaining another 2.69% on the week, aided by a welcome easing of inflation while shrugging off softer than expected bank earnings. The tech-heavy Nasdaq finished the week with its sixth straight gain, which is better than any stretch in 2022 and the longest such streak since late 2021, and we're only nine trading days into 2023...

As the market shows signs of reversing it is prudent for investors to develop a trading thesis and understand what factors in the near to mid-term will cause major movements in stocks.

As our readers know by now, we at Andy's Angle have been monitoring a few key market elements over the last few weeks...

The element we have been monitoring the closest has been the technical setup present on the S&P 500.

The higher low has been confirmed this week with a strong follow through week and it looks like we will see a clash of both the year-old downtrend line and our newly formed uptrend within the next couple of days. Our trading thesis regarding this will be discussed in our closing remarks.

Moving on, the second most important element we have been tracking over the last few weeks has been key economic data points and their effects on market expectations for what the Federal Reserve will do in reaction.

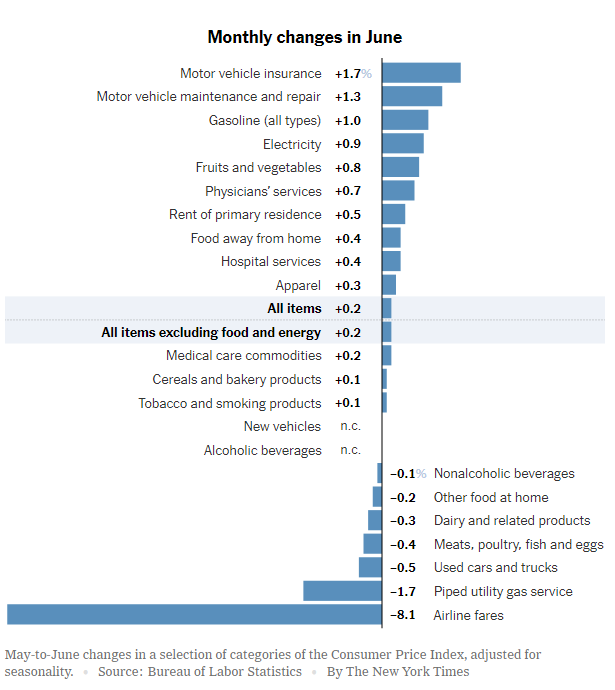

This week we got key inflation data in the form of CPI, more on that soon, but importantly, market expectations for Fed rate hikes were drastically shifted.

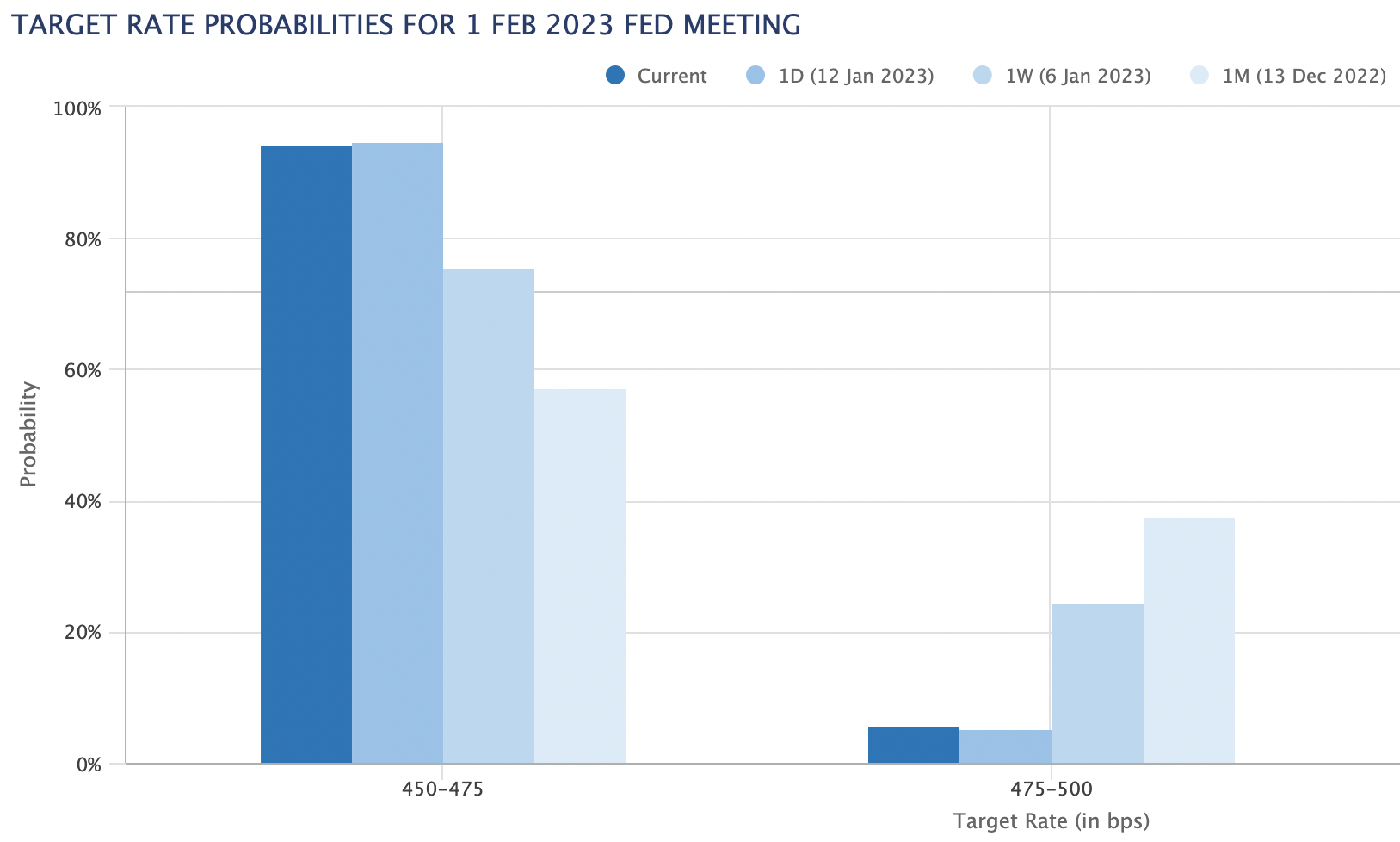

Following the softer CPI print on Thursday the odds for just a 25 basis point interest rate hike at the February FOMC meeting soared to nearly 95%, up from 75% the day before.

This is a big positive for markets as the Fed is finally nearing the end of their rate hike cycle, and there are now talks swirling around that the February 1st rate hike may be the last of the cycle.

In contrast to these positive data points, bank earnings largely confirmed what analysts feared, softer earnings are going to be the norm.

With this background in mind, let's dive into this week's events...