A Week In Review: Jobs Data Highlight Volatile Start to 2023

Markets kicked off 2023 just how it spent the most of 2022, volatile.

Markets snapped a four week losing streak to close out 2022, with the S&P 500 advancing over 1% on the week, with most of these gains coming on a major Friday rally following a weaker than expected print in payrolls.

As we have been highlighting for the past two weeks, we have been closely watching a potential higher low developing on the S&P 500's weekly chart.

We took a major step in justifying this conjecture this week with a strong bullish hammer. Markets opened the week higher and faded to the downside on Wednesday and Thursday, before picking up steam and turning positive on Friday.

This potential higher low, which can be confirmed with a follow through to the upside next week, would be the first of the current bear market, and could even potentially put an end to it.

However, putting in a follow through won't be easy next week given yet another loaded slate of data and events, highlighted by CPI.

Next week's full outlook will come later, but for now let's dive into the events of this week.

Economic Data

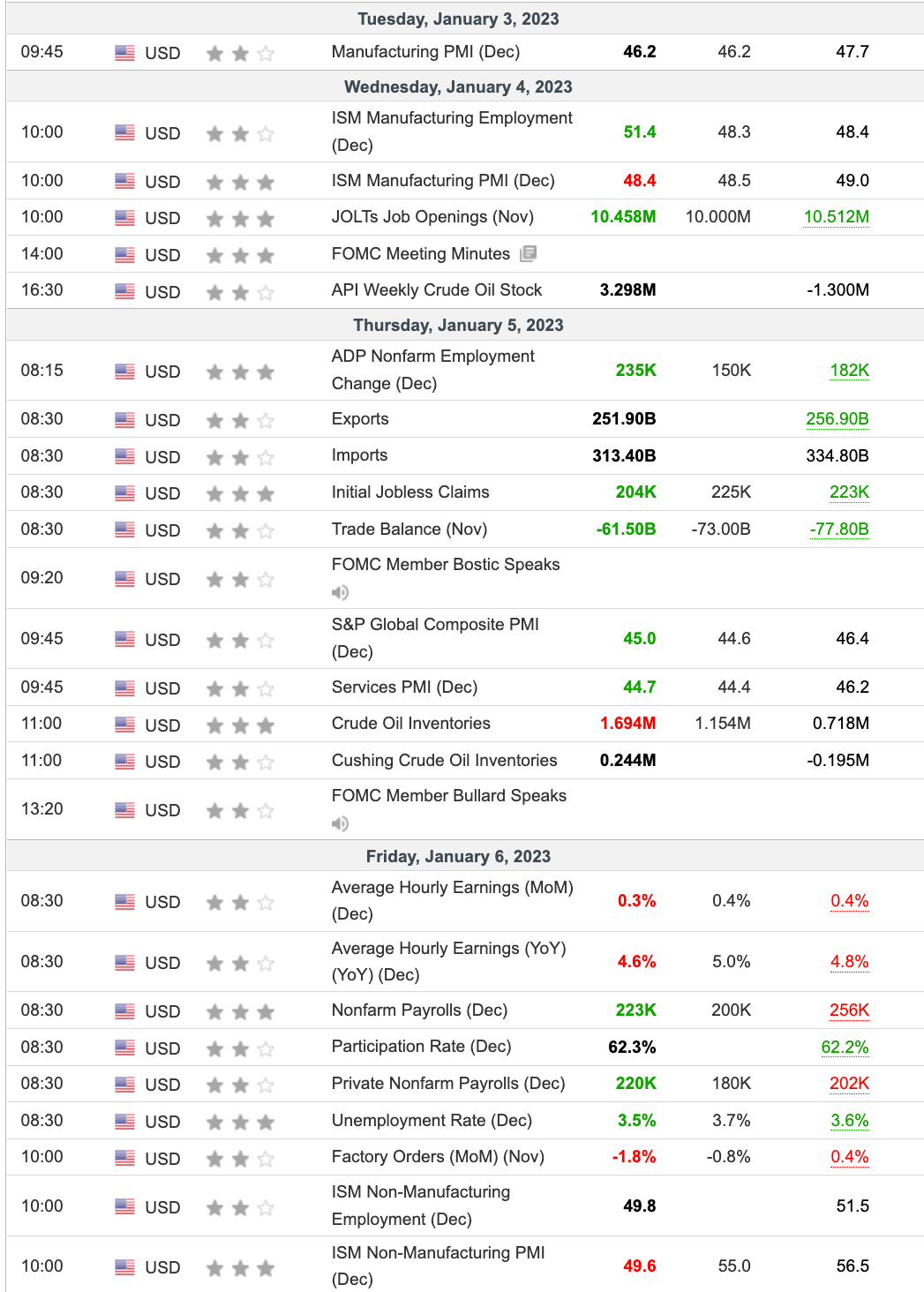

Week ending December 6, 2023

For the second straight week, markets were closed on Monday, this time in observance of New Year's Day.

Markets started off the year strong on Tuesday with all indexes gapping up to open. These gains were quickly reversed though following a manufacturing PMI print that fell to all time lows (ex-2020), as well as overall weakness in tech, once again led by Tesla shares that fell over 15% intraday following a weak Q4 sales release.

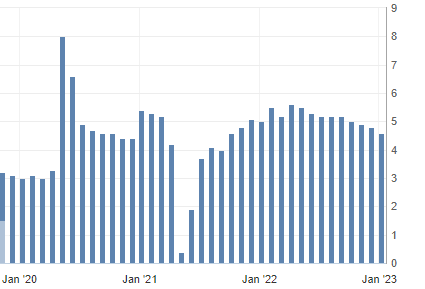

Markets once again gapped up on Wednesday, and once again gains were reversed, this time after strong ISM Manufacturing employment and well higher than expected job openings as indicated in the JOLTs report. ISM Manufacturing PMI dipped to the lowest levels since the onset of the Covid-19 pandemic in March 2020, further emphasizing that the economy has begun to contract as a result of the Federal Reserve's interest rate hikes. The more interesting data point was definitely the JOLTs job openings print, coming in at 10.5m vs. a consensus of just 10m for the month. This release in particular spooked markets as it showed that employers were still looking to hire more employees than expected and indicated a still strong labor market. This data point would also be a precursor to Thursday and Friday's jobs data. FOMC minutes from December's meeting also showed that members were not prepared to cut rates in 2023 and continued to see inflation as a key risk factor. While this put a small stutter in markets, they still managed to close generally higher. Besides this, Microsoft shares sunk over 4% following a downgrade by UBS, citing concerns over growth in their Azure cloud computing platform, while Amazon released plans to layoff nearly 17,000 employees.

Thursday is when the major data points began coming in, highlighted by ADP payrolls and initial jobless claims. Both releases came against the wishes of the markets, with ADP payrolls coming in at +235k in December, well higher than the consensus estimate of +150k. On the other hand, jobless claims missed, with claims for the week coming in at 204k, well below the expected 22k. These prints again showed a jobs market that was both hiring at a hotter than expected pace, and less than expected unemployment claims were being made. While we at Andy's Angle chalk up these December prints to seasonality and mainly holiday hiring, the Fed will only see these as supporting data points for their hawkish agenda.

Then came the biggest day of the week, Friday. Friday contained multiple key employment releases including unemployment rate, labor participation rate, nonfarm payrolls and wage growth figures.

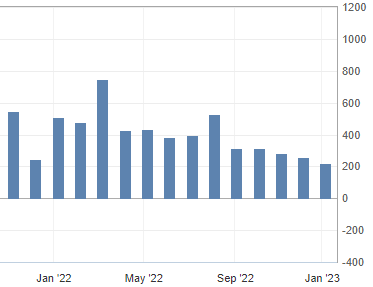

December payrolls rose 223K, down from last month's revised 256K, but it was still a hotter than expected print, with the consensus estimate at 202K.

The even more shocking data point was the unemployment rate, which fell to 3.5% in December, tying a 50-year low...

And all of this happened with an UPTICK in the labor force participation rate to 62.3%. We highlighted the tremendous weakness in the LFPR in our 2023 outlook and attributed the tighter jobs market to an overall smaller pool of workers, but this unanticipated divergence between the LFPR and unemployment rate shows the true strength of the current labor market.

As we have been covering for the past month, a stronger jobs market has been negative news for markets for the past year as it gives the Fed a reasonable reason to raise rates and keep them higher for longer. Even earlier this week we saw markets negatively react to strong jobs data, so why did all three major indexes gap up over 1% to open up trading on Friday?

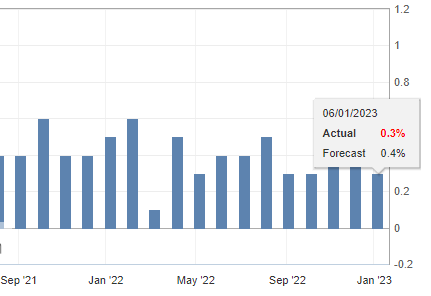

The devil is in the details, and in this case its in wages.

Both year over year and month over month wage growth came in far weaker than expected, with both of November's numbers revised downwards as well. The wage growth spiral seems to have finally cracked under the pressure of the Fed's rate hikes and Powell will love these softer figures.

Pairing both a slowing in payrolls and much softer than anticipated wage growth, and we get a big rally, which is exactly what happened on Friday. The lower wage growth figures gives the Fed precedent to be slower in their hikes from here on out, and potentially ease up completely following the February hike given that key inflation data over the next few weeks support it.

However, it is key to note that Raphael Bostic, President of the Atlanta Federal Reserve Bank and FOMC board member, said that "We need to stay at rate peak to stay there well into 2024", continuing the nonstop hawkish commentary by Fed officials. The other three Fed officials to speak on Friday sounded like the same old broken record we've been hearing from them for the past two months, keeping rates higher for longer and inflation is the main concern.... yada yada.

Commodities

In an effort to continue providing top tier value to our readers, we have installed a new commodities portion to our weekly releases that will be included if there are any major developments in the space. While we do not expect this to be a weekly segment, we will ensure to cover major stories in commodities to give our readers further exposure to other securities rather than just equities.

This week the biggest player in the commodities space was Natural Gas.

Henry Hub natural gas prices continued their freefall, dropping to $3.53/mmbtu in early New York trade on Friday, down over 60% from their 14-year highs just five months ago.

This historic collapse in NG prices is not uncommon though, as these major rallies we see in NatGas tend to always end up collapsing in extraordinary fashion

However, this collapse is one of the fastest we've seen, and with almost no bounce in between. Driven by a warmer than expected winter in the U.S., decreasing demand for NG-powered heating and a storage glut due to the shuttering of the Freeport LNG plant, NatGas prices have drooped near their natural levels.

We would like to draw attention to the daily chart (first image) where a stopping doji developed on Friday following a dip to yearly lows paired with a strong bounce. We believe this doji may finally signal a bounce for NG after a touch with yearly lows.

This bounce is expected to be violent and could see NG tap $4.75+ before either continuing a trend higher or completing the downside move to $3.00 and under.

We anticipate that Freeport will come back online sometime in late January, which will help to reduce domestic supplies and help Henry Hub prices normalize with European and Global NG prices that are trending well higher. We also anticipate a colder weather pattern to come into play over the next few weeks, reigniting a bullish cycle in NG prices, at least in the short term.

Closing Remarks

As we get into 2023, it seems like volatile markets are here to stay.

Economic data points continue to rattle equity markets nearly everyday and the line in the sand between investors and the Fed seems to get messier by the day.

With this being said, we are raising our rating on U.S. equities to bullish from neutral last week. This upgrade is based off of a stronger technical setup, as elaborated on earlier, and positive data points next week, which will be discussed in our weekly preview.

As we continue to navigate turbulent markets, we want to emphasize that investors maintain vigilance and still keep conservative amounts of cash on hand, especially through the February FOMC meeting, given the outlook will likely be much more clear after that. We would like to direct readers to our newly launched Andy's Angle Investing Portfolio, found here, to keep track of what trades we are making and how we are allocating our cash and equities exposure.

Comments ()