Andy's Angle Annual Letter

- Strong 2023 Portfolio Returns - 2024 Outlook - A Note From Andy -

2023 has come and gone and we are extremely proud of how far we have come in our first full year of service at Andy's Angle.

Coming off a rough 2022 featuring the deepest bear market since the Great Financial Crisis, 2023 flipped the switch, with U.S. markets roaring to close near all time highs once again.

The Nasdaq rose just over 50% in the year, making it the index's best year since 1999. The S&P500 rose a more modest 24% on the year, still well above the index's average returns of about 7-10%.

At Andy's Angle, our value-based investing thesis fared even better than all the major U.S. indexes, with our benchmark value portfolio growing over 60% for the year, including picks that rallied 60%+ and 40%+ from our calls.

As we enter 2024 we expect an even more prosperous year awaits, especially for value investors as interest rates are expected to come down and the overall economy is expected to be able to make it out of this historic rate hike cycle relatively unscathed.

More on our full 2024 outlook later, for now lets rewind and take a look at the great year 2023 was for Andy's Angle...

2023 Recap

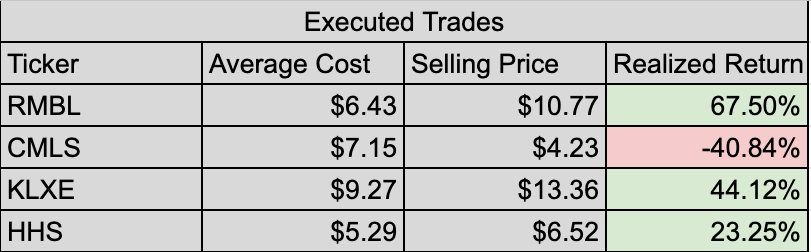

In 2023 we executed four trades in our flagship value portfolio, as shown above.

RumbleON was our best investment, with a near 100% return from our call, with the final trade yielding 67.50% upon closing. This was a favorite pick of mine given their niche business within the motorcycle and motor racing space, allowing for some creative freedom in valuing the business, and obviously it paid off nicely.

Moving on, Cumulus is a trade that still leaves a sour taste in my mouth, especially given the fact that with just a little bit of patience it too could have been a nearly 100%+ pick. Nevertheless, the trade did not pan out the way I wanted and we had to bite a pretty significant loss on the name, which of course is part of the game and something I want to learn from to help implement improvements in our portfolio in order to generate even stronger returns in 2024.

KLXE comes in next with another monster 44% return, and those that know me outside of Andy's Angle know that this has been a favorite company of mine for years now. From my initial call below $3 two years ago to its rally over $18 it has been a stalwart of my portfolios, and that trend is likely to continue into 2024.

Finally, we have Harte-Hanks, a modest pick that rallied 23% over the summer months of 2023 until I eventually cut it due to low liquidity and frankly better opportunities. However, since selling out it has grown over $7, making it another pick that yielded over 30% from our call.

All in all 2023 was a year that was largely on cruise control, with strong value picks...

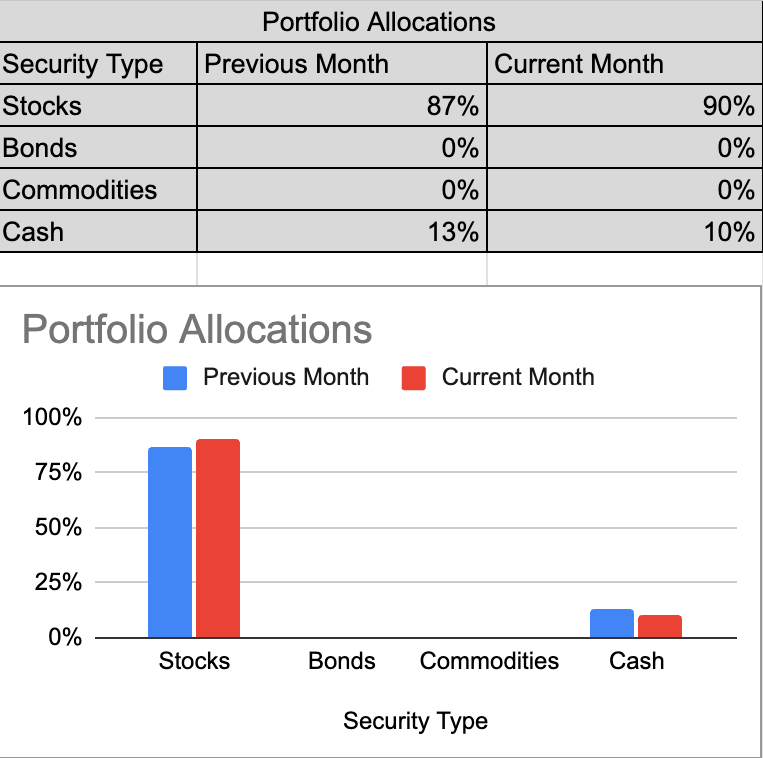

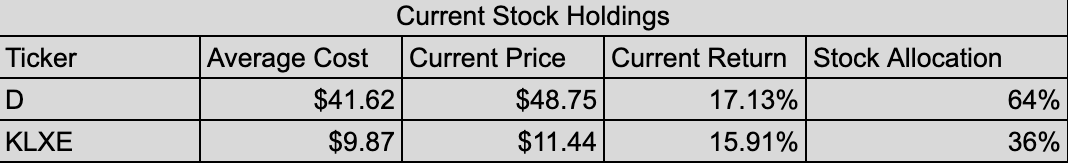

Our final portfolio allocations looked like this:

We are still holding our shares in Dominion Energy and KLX Energy Services for now, and both positions are up a healthy amount from our call.

We expect new picks to rotate into our portfolio in a similar fashion as 2023 as we close out trades.

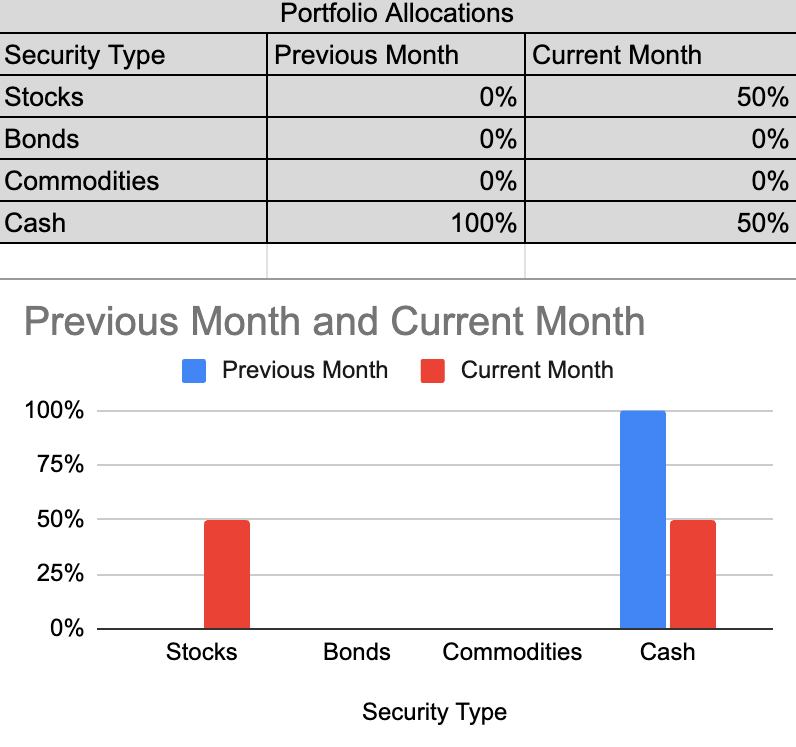

Moving on, we also introduced our new Andy's Angle Speculative Portfolio in 2023, a portfolio that focuses more on aggressive growth through investments in more risky and speculative value stocks.

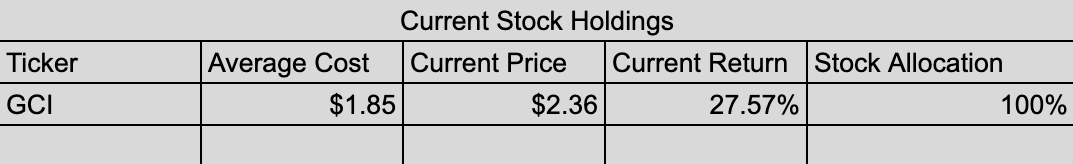

Here's where it currently sits:

Launched in December with our first pick in Gannett, the portfolio is already up over 13%, led by Gannett surging nearly 30% in just a month since our call.

We expect this portfolio to grow over the next couple of months as we add more investment picks, and readers should look forward to more announcements regarding the speculative portfolio in the coming weeks.

In all, the investing arm of Andy's Angle did wonderful in 2023, handily leading readers to a market beating year, and we have no doubt that we will deliver a similar, if not better, performance in 2024.

In the value investing field, consistency is key, and you will soon realize the powerful effects of compounding winning picks.

We look forward to 2024, and with that let's get a little market commentary on how we see things playing out...

2024 Outlook

2024 promises to be another volatile year as we enter the second stage of the historic rate hike cycle we are currently in.

As rates come down, we expect a lot of pressure to be lifted off of stocks, especially smaller value names, which is the exact space in which we operate.

As a result, we expect numerous value stocks to finally become investable without the large, oftentimes insurmountable, burden of interest payments being slighly alleviated.

In a broader sense it is easy to see why the bullish trend from 2023 may continue, and while we largely agree with this point of view, seeing the S&P500 crossing the $5,000 level and likely going higher than that too, we must acknowledge the risks.

Once again, inflation and the labor market are the factors to watch.

In 2023 both of those key factors trended favorably, with inflation staying at bay with higher rates and unemployment surprisingly sticking at historically low levels.

In 2024 we may see these trends reverse unfavorably for markets.

As global rates are stepped down the most important thing to note will be how inflation reacts and whether or not it once again begins making a turn higher, which would in turn force the Fed to revisit their policy and keep rates higher for longer than the market would like.

While we do anticipate some bumps to arise this year, we anticipate it to be a healthy bull year, maybe not to the tune of the AI frenzy-led 50% return the Nasdaq saw in 2023, but green nonetheless.

Building on this, we anticipate the small cap and value space to finally become more favorable and for rotation from mega caps and growth stocks to finally take place as more money comes into markets from the sidelines.

As rates drop, money will begin flowing into equities from fixed income and money markets, once again having an effect similar to the one we saw in 2020-21 with stimulus checks in which the small cap market was absolutely roaring.

Closing Remarks

Finally, I would like to take the time to close out this letter with a direct thank you to all of our readers that make Andy's Angle possible.

Without the feedback and contribution from each of you, we would not have been able to reach the stage that we are now, or reach our future goals.

Moving forward, readers can expect 1-2 articles a month, with one article containing a new stock pick that will be slotted into one of our two portfolios and the other being an overall market commentary in order to help readers in adjusting their own portfolios.

We would also like to direct new members to our catalog of educational pieces, in which we lay out a strong foundation for a value investor to learn from, including how we do it at Andy's Angle.

Once again, thank you to all existing and future readers, and I cannot wait to lead Andy's Angle through another prosperous year.

Cheers, Andy.

-Andy's Angle Writing Team-

Comments ()