Andy's Angle Annual Letter

We hope this finds you well on a cozy Christmas Eve.

What a year it has been.

The whole idea behind the creation of Andy's Angle was to showcase the craft of value investing as a portfolio management strategy and its continued application in the modern era of investing, despite being in a time where it seems like chasing new fads and the hype train leads to higher returns.

Throughout our numerous pieces over the course of this year we have incessantly talked about how the art of value investing seems to be lost in this market, and that it's futile to try to swim against that current, but nonetheless we pushed on.

Our readers stuck the course, and my team and I are proud to deliver our results for 2024, a year I would call tough, especially against our first full year of operation in 2023, but successful nevertheless.

As we dive into our annual review, I would like to remind subscribers to hit the comment section, at least on this one post, and to give their feedback and comments, whether that be their favorite trade of 2024, or any suggestions they have for our portfolio moving into 2025 (especially this part since we have cash to use in both of our portfolio segments).

With that being said, let's dive in...

Flagship Portfolio Wrap

101.4% Lifetime Return

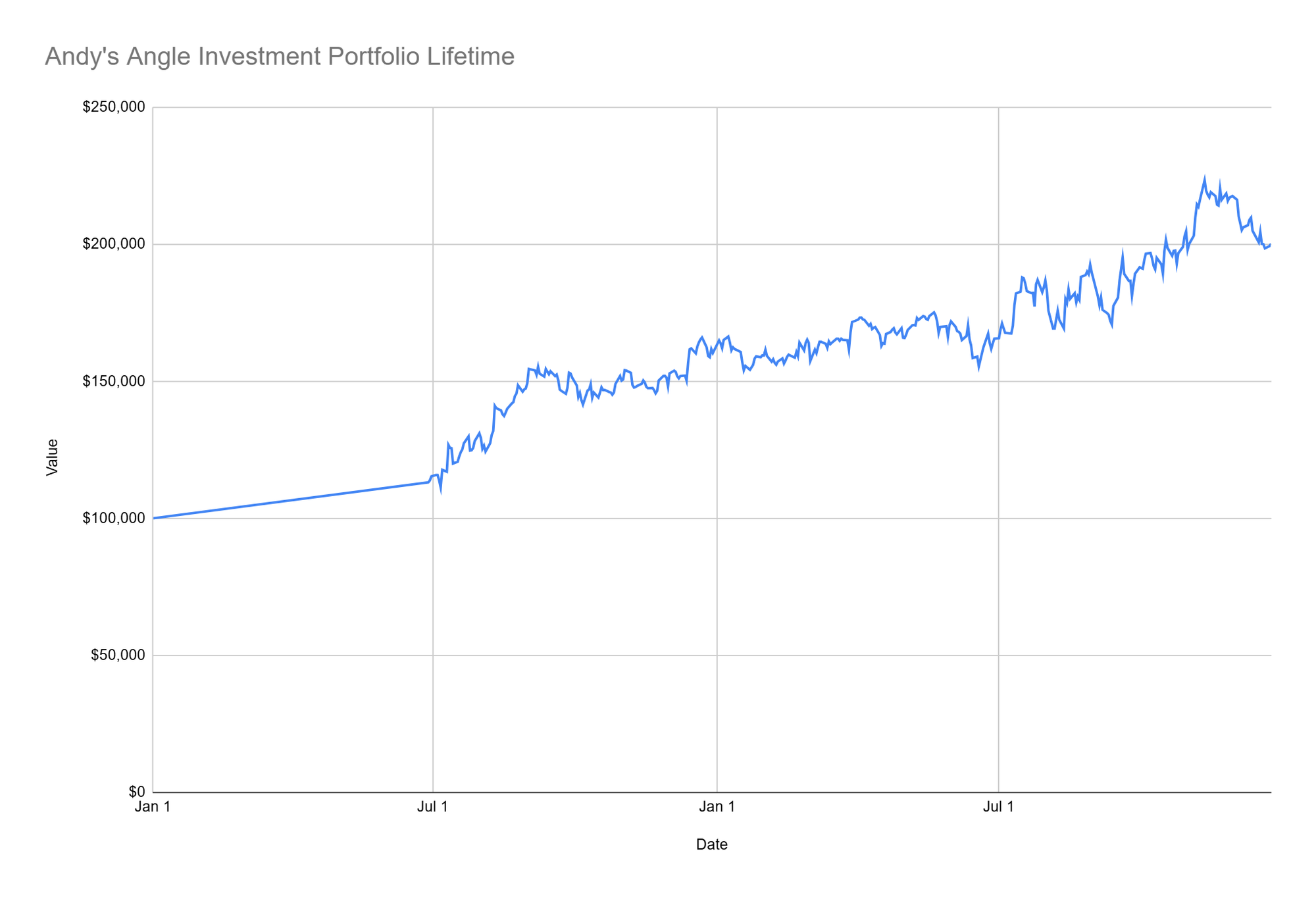

First off, let's take a look at our flagship value portfolio which follows our in house investing principles:

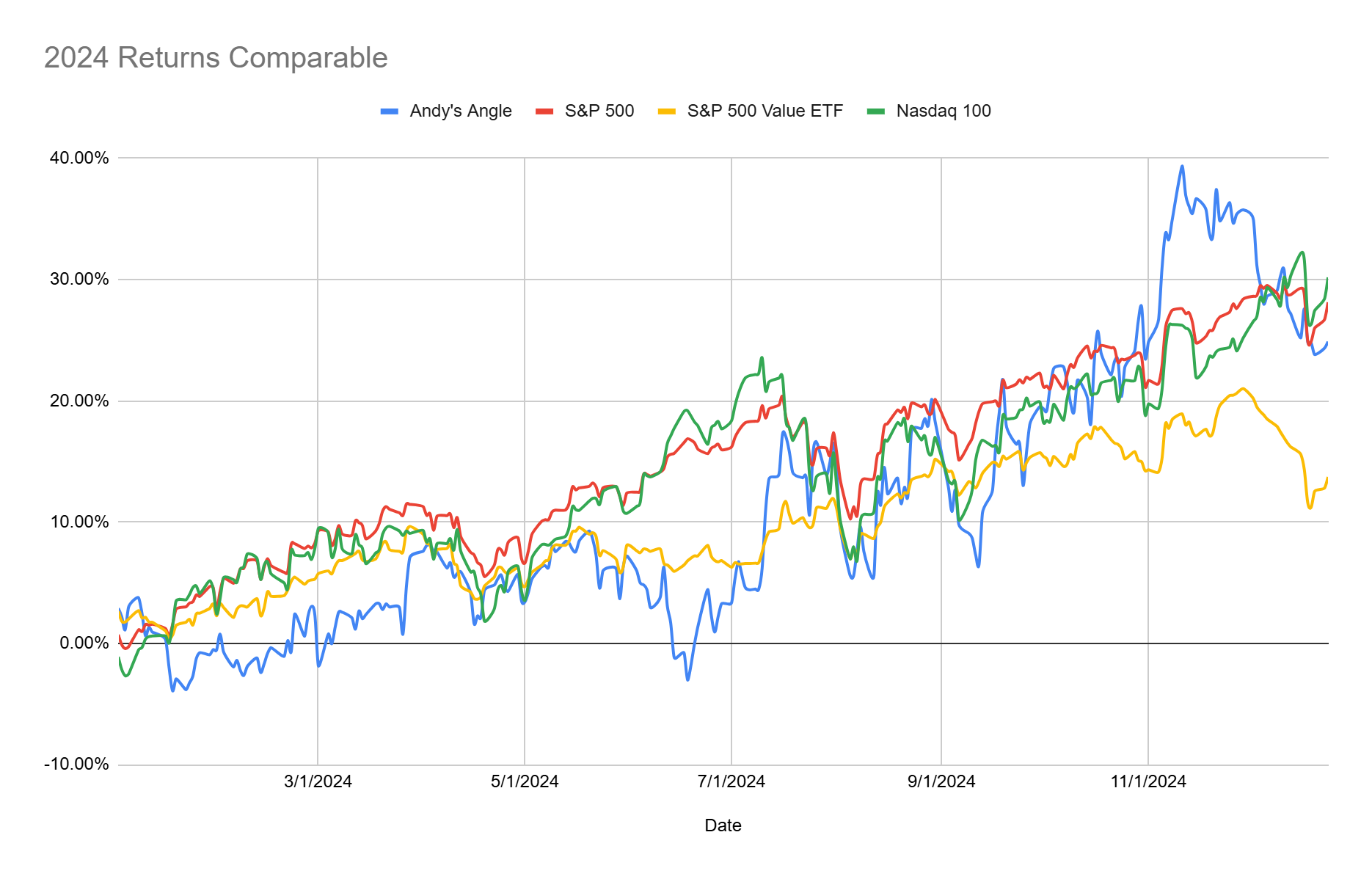

Our 2024 YTD returns came in at 24.9%, and as depicted in the chart above, this figure came just short of the S&P 500 and Nasdaq 100 returns of 28.1% and 30.2% respectively. We did, however, blowout our main value investing benchmark, the S&P 500 value ETF, which only posted a 13.7% return for the year, highlighting the less than ideal value investing period of 2024.

Despite the year end results, we had been outpacing all three benchmarks by over 10% just a few weeks ago as some of our investments caught a second wind, and we overcame a very slow start that saw us with negative returns as late as June. We expect this strong momentum from the second half of the year to continue into 2025.

On a more impressive note, our flagship value portfolio is now up over 100% to close out its second operational year, which is a massive outperformance compared to the S&P's 54% return over the same time period and an even more impressive outperformance against the Nasdaq's 88% return over that time period.

So much for the tech and AI narrative... we are a firm of excellence.

Only about a quarter of firms are able to beat the broader market over a two year period, and we have done so handily, and we are proud to serve our passionate subscriber base heading into 2025, providing top tier investing analysis and portfolio management as we aim to be a part of a very elite group of firms that can consistently beat market returns.

With that being reviewed, our outlook for the flagship portfolio remains the same, following our strict principles of investing only in stocks that we find to be trading at enticing valuations that do not represent the true value of the company.

To end the year we only maintain our 7.0 pick as an active holding, and as we head into 2025 we will be initiating a new pick to continue cycling our cash, especially as we expect stronger returns for value stocks in 2025 as compared to this year.

Speculative Portfolio Wrap

55.45% YTD Returns

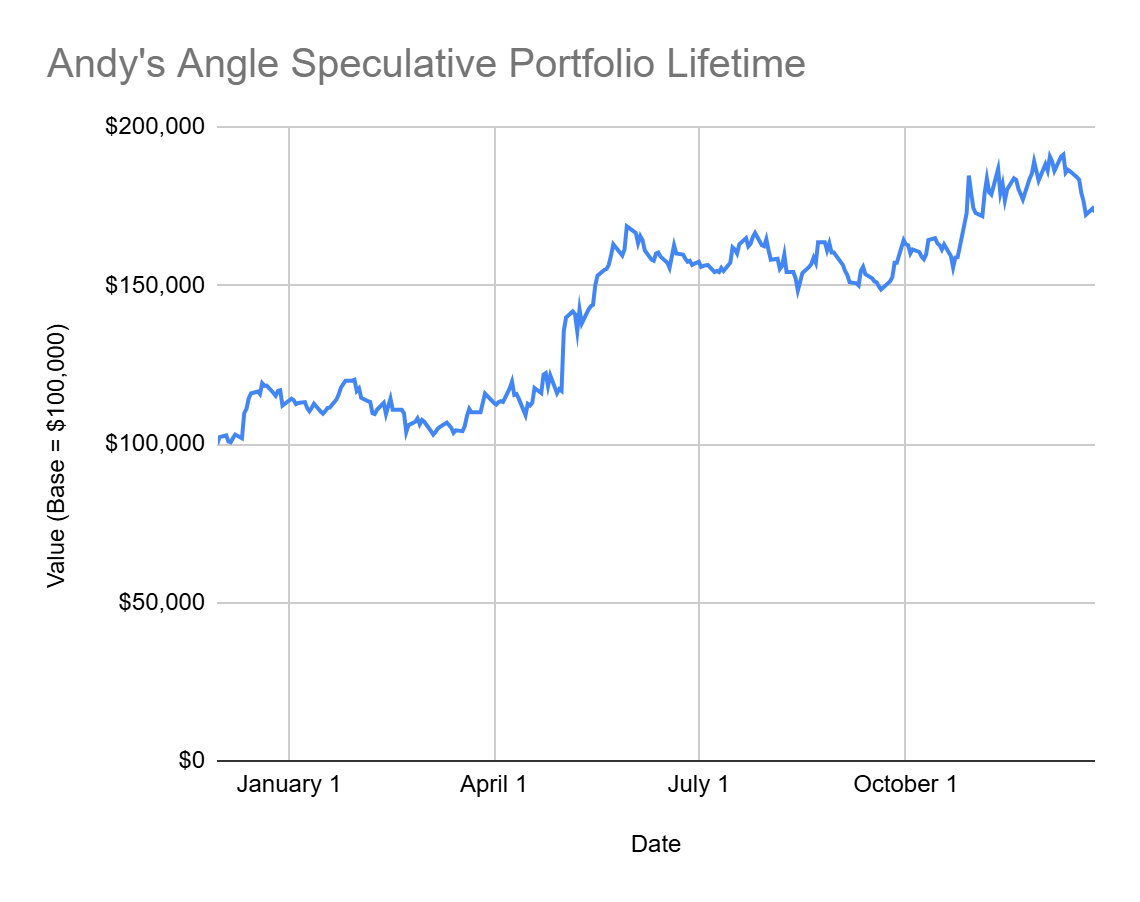

Now we check in on everyone's favorite segment of Andy's Angle, our speculative division.

While conditions were not favorable for our flagship value investing portfolio, despite its impressive returns, they were conducive for massive return in speculative investments.

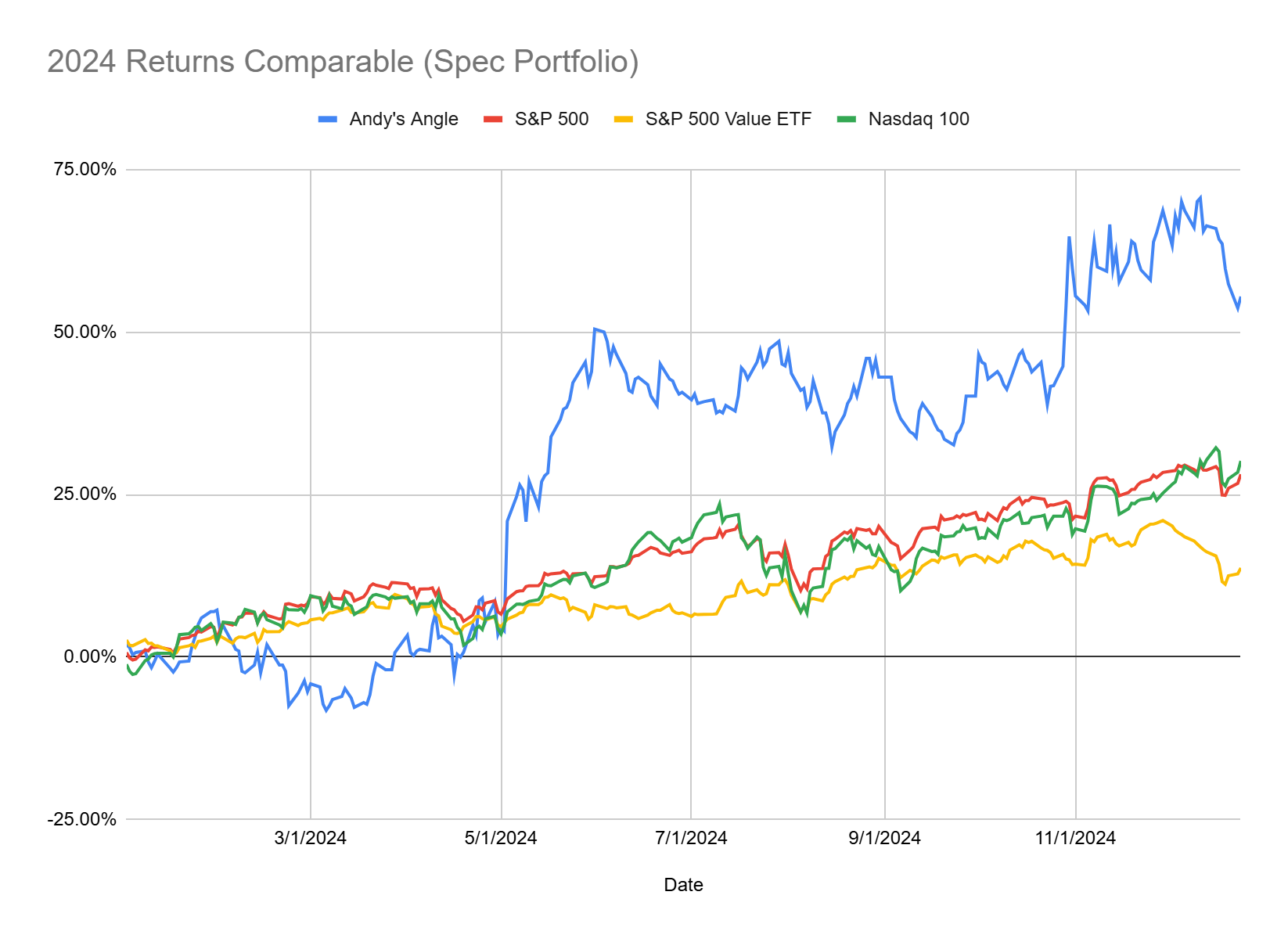

Our speculative portfolio ended the year up over 55%, blowing out even the Nasdaq's 30% return, led by superstar picks Gannett and Largo, as discussed here.

Our speculative portfolio provides readers with picks that are a perfect blend of risk and speculation, but also fit under our value investing principles, albeit at a looser extent. This allows us to find stocks that are in prime positions to explode to higher valuations, making them extremely attractive picks, and once again... the results speak for themselves.

As stated earlier, we also have a large sum of cash in our speculative portfolio after taking profits on earlier positions, and we continue to look for new names that fit our mold for this segment.

We expect to have a new pick out very soon for this segment, and will leave the ticker name at the very end of this letter for readers to get a headstart on their own research before we come out with our detailed piece.

Andy's Angle on 2024/5

This brings us to my favorite part of any piece.

The part where I get to talk to our strong reader base with no framework.

To start, 2024 has been a pretty tough year. No matter what broader market, and even our, returns show. Many stocks struggled this year as rate pressures and inflation continued to steal the show.

While most index returns were skewed by the top 5% of stocks posting staggering gains (ie. Nvidia, Tesla, etc.), most people managing their own portfolios may not have had this luxury, and definitely not me while managing our portfolios at Andy's Angle.

Our dedicated value-based approach sometimes hamstrings us in terms of how much risk or euphoria we can buy into, and stuff like Nvidia at its astronomical valuations simply do not fit this mold.

And the beauty of this?

Despite not having exposure to these outlandish returns, we still managed to post a year with returns broadly in line with the market, and even exceeding the market when we took a more risk-based approach as seen in our speculative segment.

The whole idea behind Andy's Angle was to create a place where our readers and followers can come and be exposed to a different angle of market analysis, one that is almost all but forgotten in the modern era of investing.

We spend copious amounts of time into selecting the names that eventually get pushed towards our readers, and then enter an even more strenuous process when crafting our portfolios with precise allocations to ensure maximum returns.

And so far... I think we've done well.

Posting the type of returns that we have in the last two years of operations is nothing to brush off, but we understand that there is no time to reflect on past performances.

We did great... but we expected excellence from the start.

The only thing that matters now is continuing this tradition of excellence into 2025, and posting yet another stellar year for our readers.

I, for one, expect 2025 to be an intriguing year, especially with how markets have been treating the start of the Fed rate cut cycle, with inflation expectations and treasury yield rising instead of falling as expected. It shows that the market is skeptical of inflation really being done with, and that the Fed may be headed towards a period of stagflation... something many of us have never seen in our lifetimes.

We have had two strong market years in a row now, and while broader market breadth hasn't been great, you don't need me to tell you that even if some stocks haven't followed the rally up, they sure as hell will follow any fall down.

My expectations for 2025 are evolving, and we will have pieces out as usual throughout the year as we tackle any and all obstacles together.

As I said earlier, I would like to hear comments from all subscribers this holiday, whether its lengthy feedback, or a short note on something we could work on, anything is appreciated!

Our next value stock pick is in the works, and as for the speculative pick I hinted at earlier, the ticker is...