Andy's Angle Speculative Portfolio 1.0

Our first addition to our secondary investment portfolio

As we alluded to in our last piece, we have two new portfolios coming for readers as we head into 2024, the first of which being our "Andy's Angle Speculative Portfolio" that will include higher risk value picks that will carry higher returns.

This portfolio will include stocks that may be facing numerous headwinds, leading to a depreciated stock price, which is exactly where a value investor wants to investigate and see if there is a substantial opportunity for gain.

So what will we look for in stocks for this portfolio?

- Strong Fundamentals

At the end of the day this is still under our larger umbrella of value investing, and as a result, fundamentals will be at the forefront of our stock picking for this portfolio.

As usual we will be looking for stocks following our two-pronged strategy:

Undervalued Industries -> Undervalued Companies

Using this formula we have been able to find premier value stocks for our flagship portfolio and we have no doubt that that success will carry over to our speculative portfolio.

- Growth

Here's where things begin to differ between the portfolios.

In this portfolio we will be looking for companies that are not only undervalued with their current business, but are also expected to expand and grow into stronger companies as time passes.

Whereas in our flagship portfolio we may be content with stable revenues and overall company health, in this portfolio we will be looking for companies with more aggressive financial growth, albeit at the expense of complete health and safety of the company.

- Risk

At the end of the day this portfolio will be heavily focused on speculation, and as a result, we are almost hunting for risk.

Things like leveraged companies, highly cyclical industries and radical management are some of the criterias that fall under this category.

For example, companies that may be carrying tons of debt may not be able to make it through our screening process for our main portfolio, but in our speculative portfolio they may be able to squeak by enough to be considered. Often times we steer away from small, highly-levered companies as its usually a slippery slope most companies can't escape, but in this case we will give companies the benefit of the doubt and assess the growth potential the leverage provides.

With that being said, this portfolio will naturally carry more risk and we expect returns to be highly volatile... fair warning for our more risk-averse readers.

Without further ado, let's get into our very first pick for the Andy's Angle Speculative Portfolio...

Gannett ($GCI)

Gannett Co., Inc. engages in the provision of digital media and marketing solutions. It operates through the following segments: Publishing and Digital Marketing Solutions. The Publishing segment consists of a portfolio of local, regional, national, and international newspaper publishers. The Digital Marketing Solutions segment consists of digital marketing solutions subsidiaries, ReachLocal and UpCurve. The company was founded in 1906 and is headquartered in McLean, VA.

A newspaper company.

Well, little more than that obviously, with their digital presence ever growing, but at its core, a newspaper company... the largest in the nation at that.

And thats what makes Gannett such a prototypical stock for this portfolio, an industry that is facing immense pressure and a company that itself is facing immense pressure from slowing business to large debt loads... we'll get into that later.

For now there are a few important things to consider, and how I interpreted them as I began research on this name:

- Newspapers.

The unquestioned forefront question with this thing was how much potential is even left in newspapers in this new digital era?

Well... not much in my opinion. Despite being the largest distributor of newspapers in the country that market itself is shrinking and more and more people are not only turning away from physical news but even large media companies in favor of social media news off places such as X.

A huge concern for an investor looking for value, but there's a glimmer of hope, and thats in the fact the Gannett is tirelessly working to transition large swaths of revenue to be full digital, helping them keep up with the changing times.

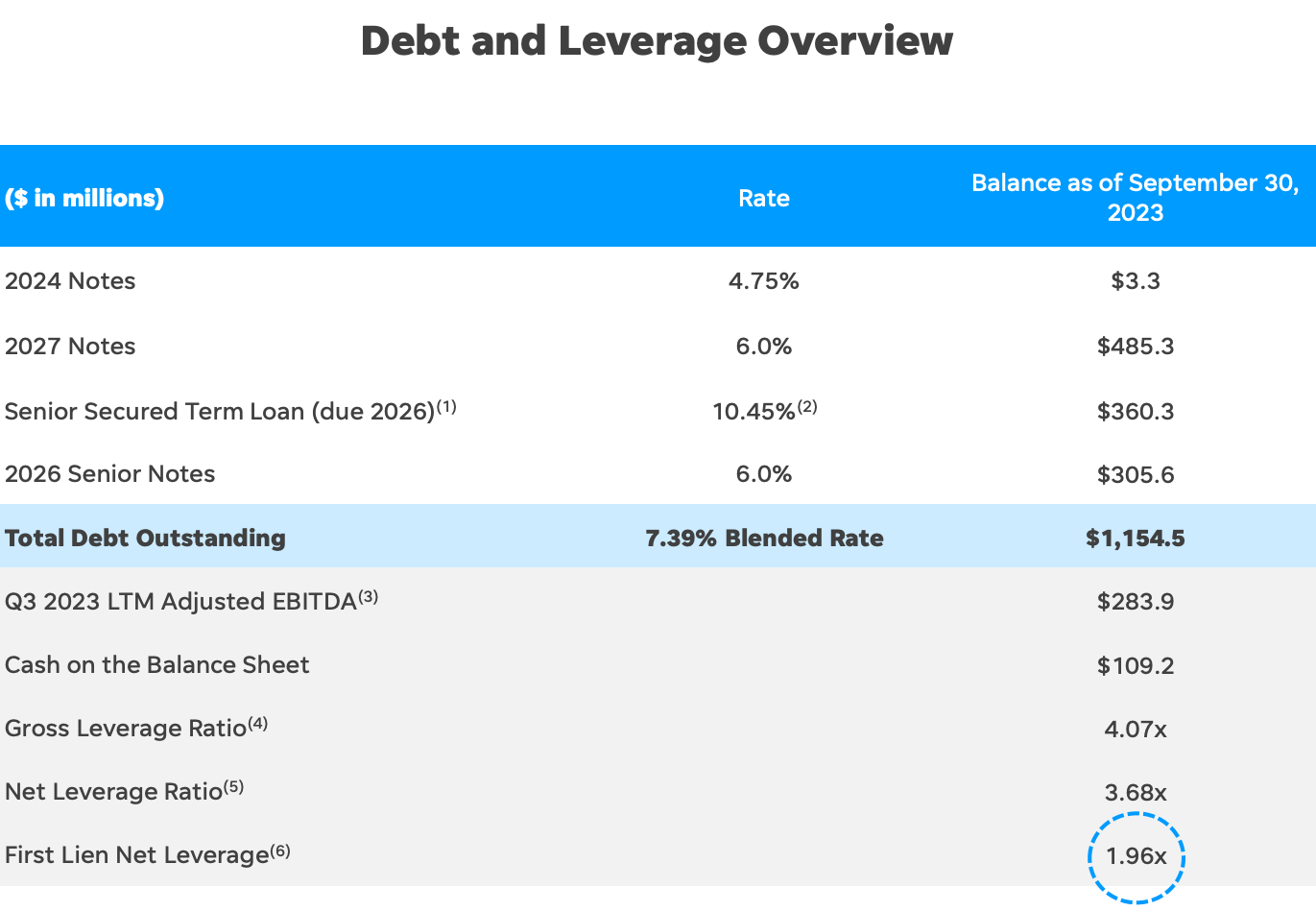

- Debt.

The debt is... staggering.

Nearly $1.1B worth at a blended rate north of 7%, a burden that's almost insurmountable for most companies, but given their strong revenues and alright cash flow situation, they have been able to tidy it up a bit, with their first lien net leverage down below 2.0x, not great, but not an absolutely pressing concern in my eyes.

With that being said let's dive into the financials...

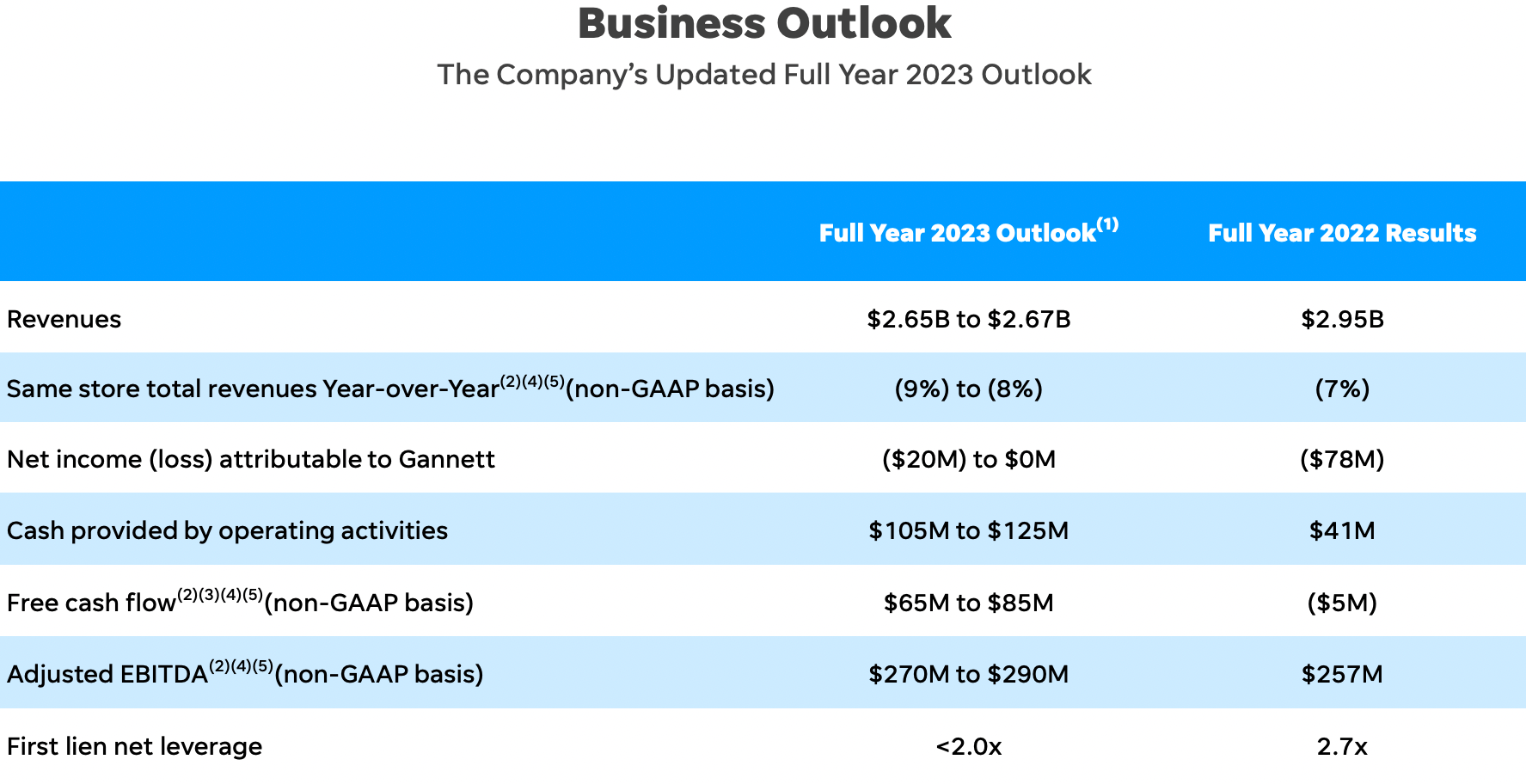

Taking a brief look at their business overview and we can already see clear improvements on the surface.

Revenues have taken a hit in 2023 but they have been able to expand their margins and as a result are expected to hit breakeven on a net basis, with free cash flow swinging decisively positive, a huge bonus given the huge debt load they must service.

Key thing to note there is also the fact that they have gotten first lien leverage down from 2.7x to sub 2.0x, a huge step in getting the company de-levered as debt maturities approach.

Let's dive deeper into the three financial statements from their most recent quarter:

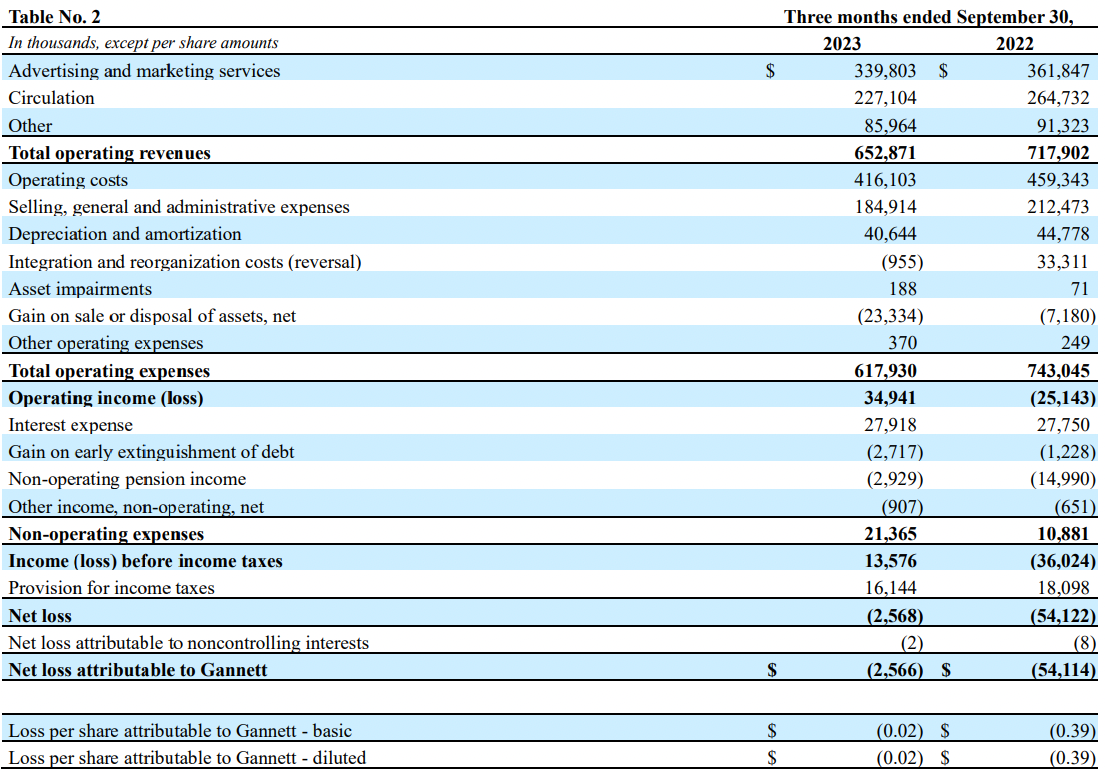

- Income Statement

Where to begin...

- Revenues took a hit on a Y/Y basis, largely attributable to the fact that the overall business has been contracting as a result of previously highlighted concerns in the news industry.

- Operating expenses actually dropped further than last year though, leading to an operating profit... but there is a red flag. The fact that this operating income is driven almost completely by gains from asset sales... never a good thing.

- Moving right down the line, Gannett actually ended the quarter with a pre-tax profit... but again, cuts in pension spending are what drove the bulk of this figure, and while cutting costs are good, it isn't exactly a mark of a healthy company.

The narrower loss is nice, but the reasons aren't what you would love to see.

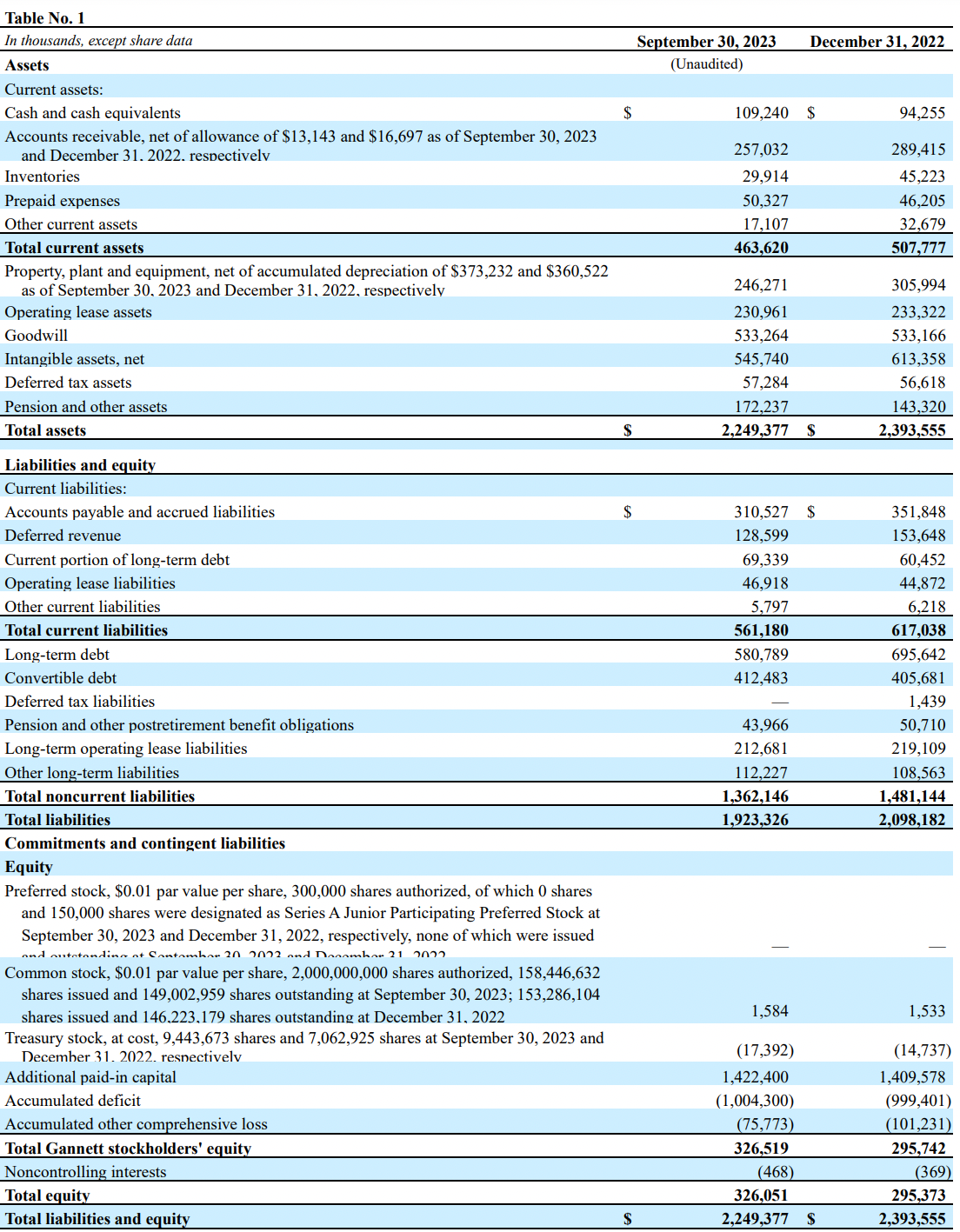

- Balance Sheet

Key points here:

- Cash balance grew Y/Y as expected given the better cashflow situation, which we will get to next.

- Overall assets declined Y/Y with a large portion of this attributable to a decrease in inventory, which given their current cost structure isn't a terrible change

- Moving to liabilities the most standout item is the drastic reduction in long term debt to the tune of $115m Y/Y, a trend that is expected to continue.

- As a result of this, shareholder's equity actually grew in the Y/Y period and us now greater than the current market capitalization of the company.

Not the ugliest balance sheet, especially given how negative we started off, things could have been far more disastrous here.

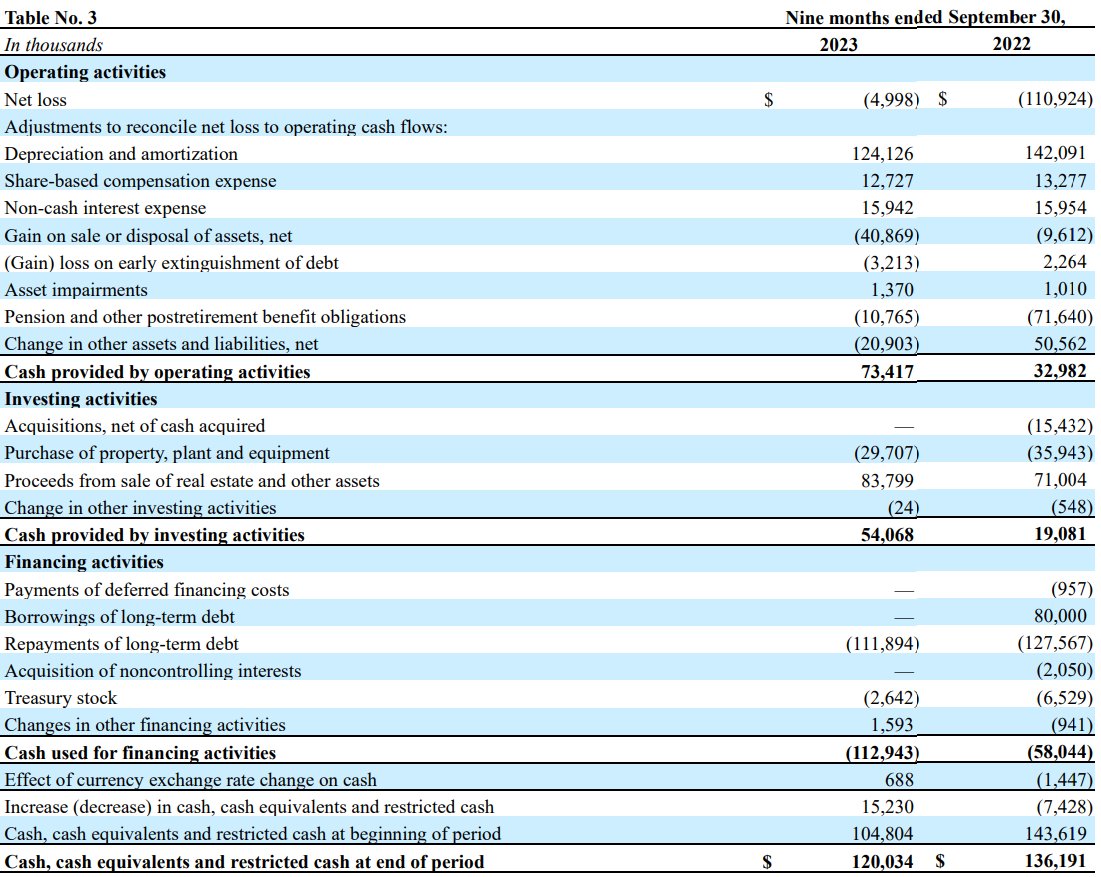

- Cash Flow Statement

- Significant cashflow improvements Y/Y, but again, sale of assets leads the pack.

Overall pretty bland, but it's better not seeing any major red flags on these three statements given the company's situation.

Moving onto debt:

The maturities are well spread out, with 2027 carrying the bulk of the weight, very far out.

The 7.39% blended rate is going to hamper earnings for a bit as interest expenses continue to bite, but they have been swift in paying off debt as seen before, so at the current moment I do not see any major concerns with the company being able to service this debt.

That being said, material downturns in business can put Gannett in a bad situation fast, so it's worth watching when investing here.

Closing Remarks

With all that being said, I see Gannett at a $275m valuation and it feels like an easy buy, especially if you are going to buy in to, or speculate, that management's efforts to drive digital revenues higher comes to fruition.

The company is trading at depressed valuations as a result of high debt and a waning industry, but I believe these concerns to be overblown in the short term and as a result the share price now sits at an extremely attractive price for a value investor.

Obviously this is a risky investment though.

The industry is not glamorous to say the least and there are real concerns surrounding the future of Gannett's business and whether or not they will be able to maintain viability in an environment that is quickly shifting away from their core businesses.

I'm putting my faith in the seasoned management team here and giving them the benefit of the doubt, the red flags are not as big and bright as you would expect and as a result there is some room to be optimistic in Gannett.

I'll buy into this turnaround story.

Andy's Angle Speculative Portfolio

December Update

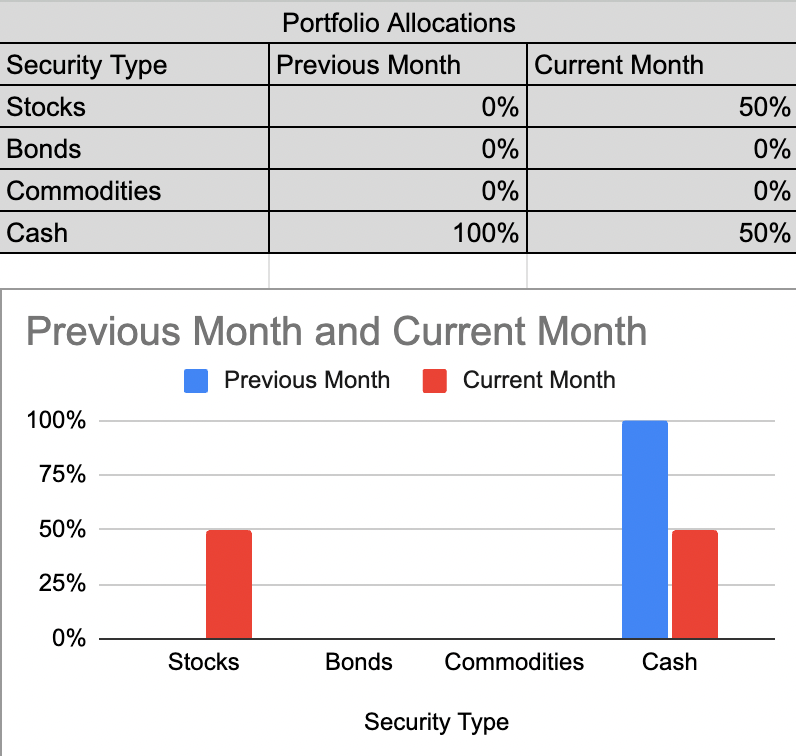

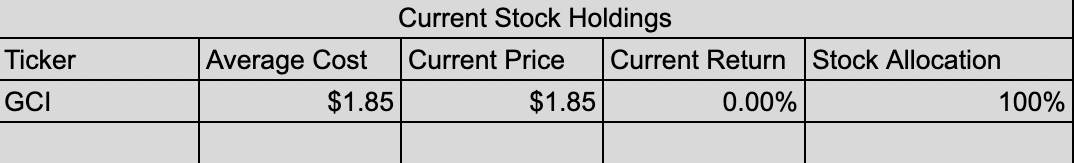

Here's an initial look at our newest portfolio:

We have allocated half of our capital to Gannett at $1.85 and intend to average down if deemed necessary.

We expect a few more stocks to join in on this portfolio and updates will be given as we make them, but as always you can see all of our portfolio moves and allocations in real time on our sheet.

This is just the first step in our brand new portfolio and we are excited to continue updating this explosive addition to Andy's Angle.

Feedback is always appreciated and leave suggestions for any other stocks you believe fit into this portfolio and we will consider them for our next stock pick.

-Andy's Angle Writing Team-

Comments ()