Andy's Angle Speculative Spotlight 2.0

A lottery ticket.

While we focus on value stocks the most here at Andy's Angle, yielding stellar returns at a near 100% clip, it's always important to be aware of much stronger market trends and opportunities.

Value names often come short in returns, while our picks usually yield somewhere between 30-100% on average, speculative plays offer more explosive results that cannot be matched.

In our 1.0 piece we highlighted Gannett ($GCI), which has since rallied about 30% from our announcement, and looks to be heading higher as the company begins to succeed in their digital transformation.

This time around we have something much bigger.

Our philosophy when starting this arm of our investment research division was to find riskier investments with potential for outsized returns, but revisiting this we realized that it may be smarter to simply look for future growth trends and find the winners.

Like AI, find something undiscovered with potential for growth and watch how it unfolds.

Investing like this is often difficult because finding "the next big thing" is like looking for a needle in a haystack, fortunately, that is what our research has done, and our 2.0 piece will discuss what we believe could be a potential 1,000%+ play over the long term.

Largo Inc. ($LGO)

Largo Inc. is a natural resource and battery energy storage system company. It is engaged in the exploration and production of vanadium at the Maracas Menchen Mine located in Brazil. The firm mines and sells vanadium pentoxide flakes, high purity vanadium pentoxide flakes, and high purity vanadium pentoxide powder. It also focuses on the advancement of renewable energy storage solutions through its vanadium redox flow battery technology. The company was founded on April 18, 1988 and is headquartered in Toronto, Canada.

Vanadium.

In our search for the next true market trend we scoured tech, healthcare and finally, you may sense a pattern here, energy.

While we love oil here at Andy's Angle, it must be accepted that the green energy transition is coming, albeit slower than most anticipated.

EV rollout has been slower than expected and renewables still account for less than 10% of U.S. energy consumption.

Understanding that green energy would be the next big trend is one thing, anybody can tell you that, but we dug further.

What's taking so long?

For that you have to look at the U.S. power grid.

The way electricity flows into our houses, industries, and businesses is the result of a set of complex engineering processes and components. If we were to break these systems down and simplify them, we could say three central areas make things run: the energy generation plant, the storage system, and the distribution.

When demands for electricity are low, storage systems store surplus power. When demands for energy peak, the systems release them back to the grid.

But there's an issue.

Green energy generation isn't as discretionary as legacy fossil fuels.

You can't just turn the sun on and off whenever demand goes higher or lower, you must be able to store the power generated and be able to control the levels being distributed to where they are needed.

The prominent batteries used for power storage are Lithium-ion, but they have numerous issues and are not expected to be the solution for the broader power grid:

- Cost: Lithium-ion batteries are relatively expensive for grid-level storage due to the high-quality materials required, such as cobalt and nickel, which are in limited supply and costly to mine and process. This makes them prohibitive for storing large amounts of energy for extended periods.

- Lifespan: Lithium-ion batteries have a shorter lifespan compared to other battery technologies due to electrode degradation over time, resulting in a loss of capacity. This frequent need for replacement adds to the overall cost and maintenance efforts, making them less practical for long-term grid-level storage.

- Safety Concerns: Safety is a significant issue with lithium-ion batteries at the grid level, as their flammable electrolytes pose a risk of fire and explosion, especially when used in large-scale storage setups. This safety risk is particularly concerning when large numbers of batteries are stored in close proximity, necessitating additional safety measures and precautions.

There will have to be a better solution, and we think we see what that solution will be.

Vanadium.

Vanadium, a critical mineral with diverse industrial applications, such as using it to create stronger steel, has garnered attention for its potential role in grid-scale energy storage. VRFBs, which utilize vanadium-based electrolytes to store energy in liquid form, offer several advantages over conventional lithium-ion batteries.

Unlike lithium-ion batteries, which degrade over time and require frequent replacement, VRFBs boast an impressive lifespan with minimal capacity loss, making them ideal for long-term grid-level storage needs.

Furthermore, vanadium's abundance and recyclability contribute to the sustainability of VRFB technology, aligning with the renewable ethos of modern energy systems. VRFBs also address safety concerns inherent in lithium-ion batteries, as their non-flammable electrolytes eliminate the risk of fire and explosion, ensuring reliability and peace of mind in grid-scale storage applications.

Moreover, VRFBs excel in scalability, allowing for the seamless expansion of storage capacity to meet growing energy demands. As demonstrated in recent studies and pilot projects, VRFBs exhibit promising performance and cost-effectiveness, positioning vanadium as a key catalyst for the future of grid-scale energy storage.

Vanadium redox flow batteries represent a compelling solution to storage problems for the future renewable power grid. With their longevity, safety, sustainability, and scalability, VRFBs harness the power of vanadium to enable efficient, reliable, and environmentally friendly energy storage, paving the way for a more sustainable and resilient energy future.

Massive projects in China have already begun using Vanadium as their choice for power storage, and demand for the mineral is, at least in our view, going to soar.

Vanadium.

That led us to looking at who produces the most Vanadium, you find just a few players, with South African player Bushveld and Canadian Largo highlighting the pack.

However, Largo produces the highest-grade V2O5 in the world of 3-3.2% from its Brazilian mine.

The Rhovan mine in South Africa’s Bushveld Complex produces just 1.6-1.8% V2O5.

Largo is also the sole pure Vanadium play, while others like Bushveld and Glencore also operate in other minerals.

In addition to being one of the largest miners of Vanadium in the world, Largo has also begun researching its own flow battery tech, making it an all in one play.

In terms of financials there really isn't much to look at, this is a play on the commodity Vanadium.

The company has sufficient resources to fund operations without any dilution or other financial risks for the foreseeable future, and with them being one of the largest miners, and THE miner with the highest grade Vanadium, their success mirrors Vanadium's.

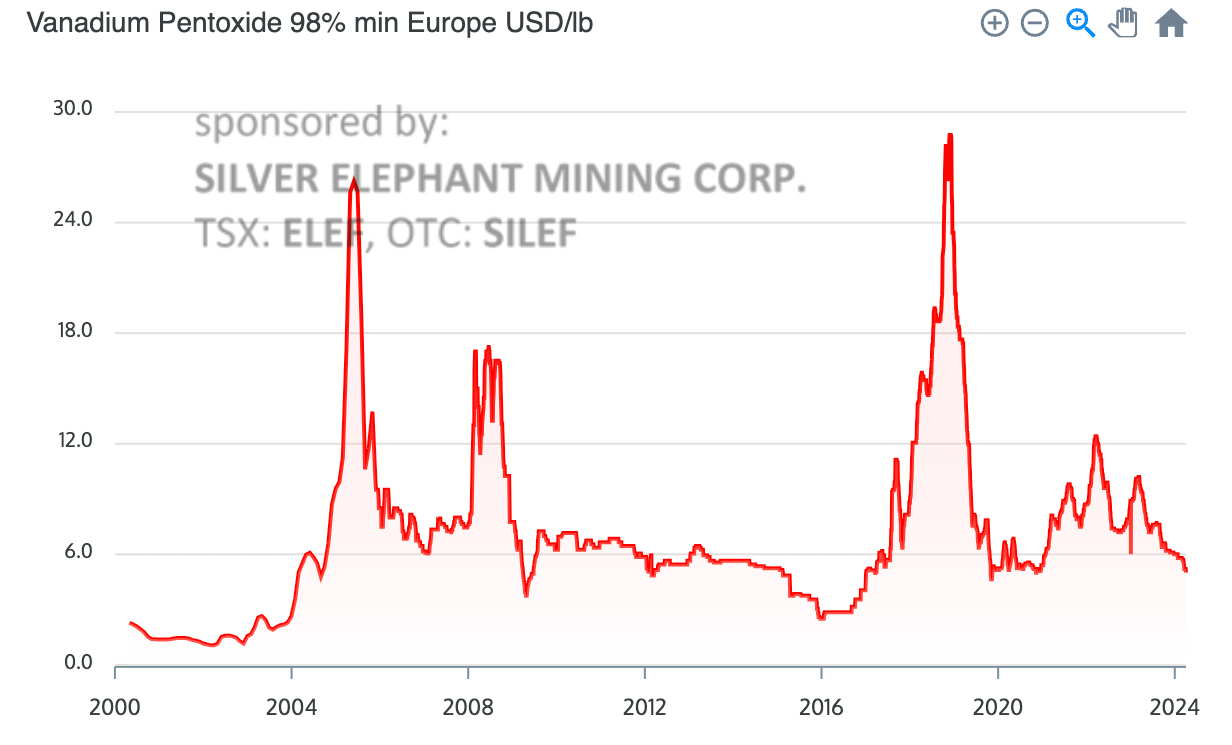

So how's Vanadium been doing?

It's been... rough.

Prices have fallen to $5/lb, but that level represents a historic support level.

In 2018, fueled by heavy Chinese demand for Vanadium in use for their mega battery project, Vanadium prices surged nearly 1,000% as shortage fears grew rapant.

In that time period Largo stock rallied over 1,000%.

Now with Vanadium back to strong support levels, Largo is back to its lows, and demand for Vanadium is about to grow once again, in a huge way as flow battery tech improves.

Closing Remarks

This is a totally different play.

Not based off financials or cheap valuations, but off a prediction of a future market trend.

And with that comes the most risk of any play we have given, albeit at these levels I'm not sure that Largo stock will fall too much further.

With that being said, opportunity cost is a risk, so I would never add too much portfolio allocation into this one, but definitely worth accumulating over time with some profits, and definitely one you absolutely want to monitor.

With that said, Largo is a Strong Buy at $1.54, and we expect sideways/slight downwards movement until major catalysts begin supporting Vanadium prices.

If the flow state battery thesis plays out how we modeled, we could see Vanadium demand skyrocket, sending Largo shares 1,000-5,000% higher, especially if their own flow batteries are the ones being used, making them both the miner and maker for what could be the backbone of the U.S. power grid in 5-10 years.

A lottery ticket.

-Andy

Comments ()