Insight: Are Calmer Markets Here to Stay?

Market fear is low... and for good reason

As we barrel towards the midpoint of 2023, there have been two distinct patterns that have characterized markets to date.

Tech and Volatility, or the lack thereof.

Market dynamics to begin the year have been much more positive than expected, with earnings remaining resilient and overall economic data points coming in much better than initially feared.

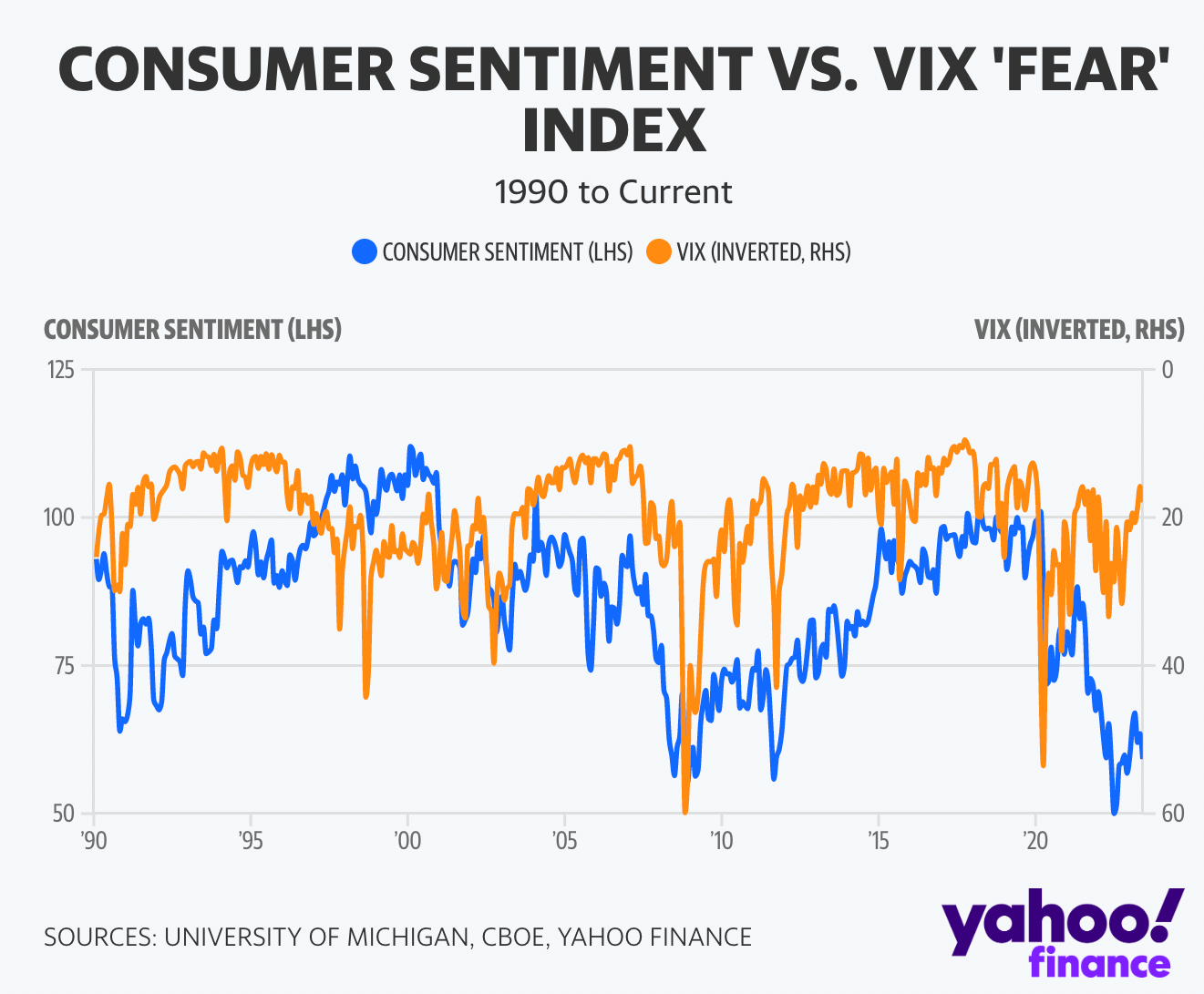

All of this had led to the VIX being crushed to near pre-pandemic lows...

While this seems like major complacency in markets, especially while comparing against the last couple of years... VIX being this low is not out of the ordinary.

In fact, it is the hallmark of bull markets for VIX to languish below 15.

With that being said... are we in a new bull market?

This question has sprung up in the minds of Wall Street analysts and retail investors alike, and with good reason.

The Nasdaq is up over 30% on the year and is showing no signs of stopping, and economic data from both the government and comments from the Federal Reserve shows that the elusive soft landing may actually materialize.

To see this, we can take a look at a few data trends:

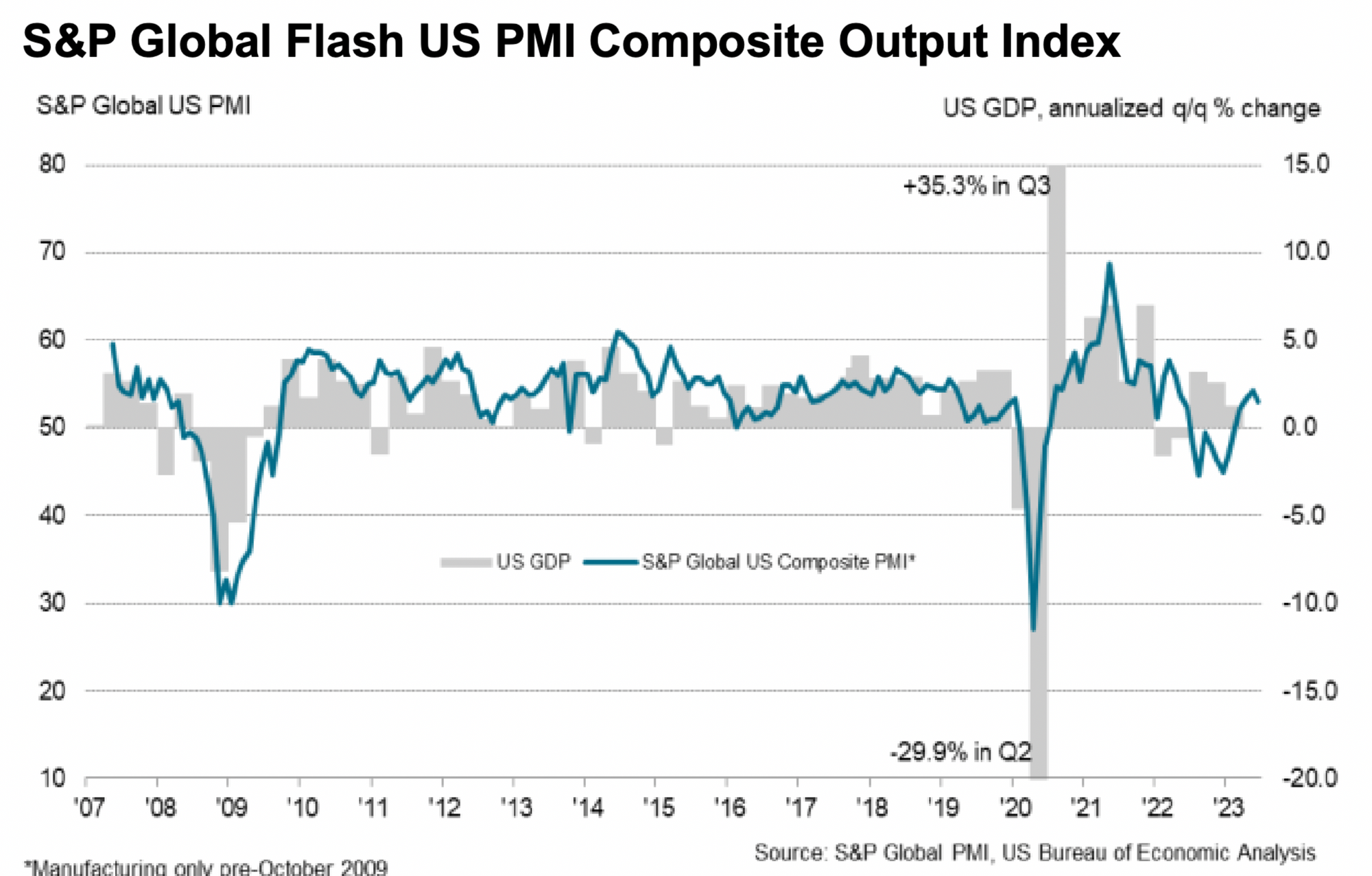

U.S. output remains robust. June's PMI report showed an equivalent GDP growth of 2% in the second quarter, easing fears of an imminent contraction and recession.

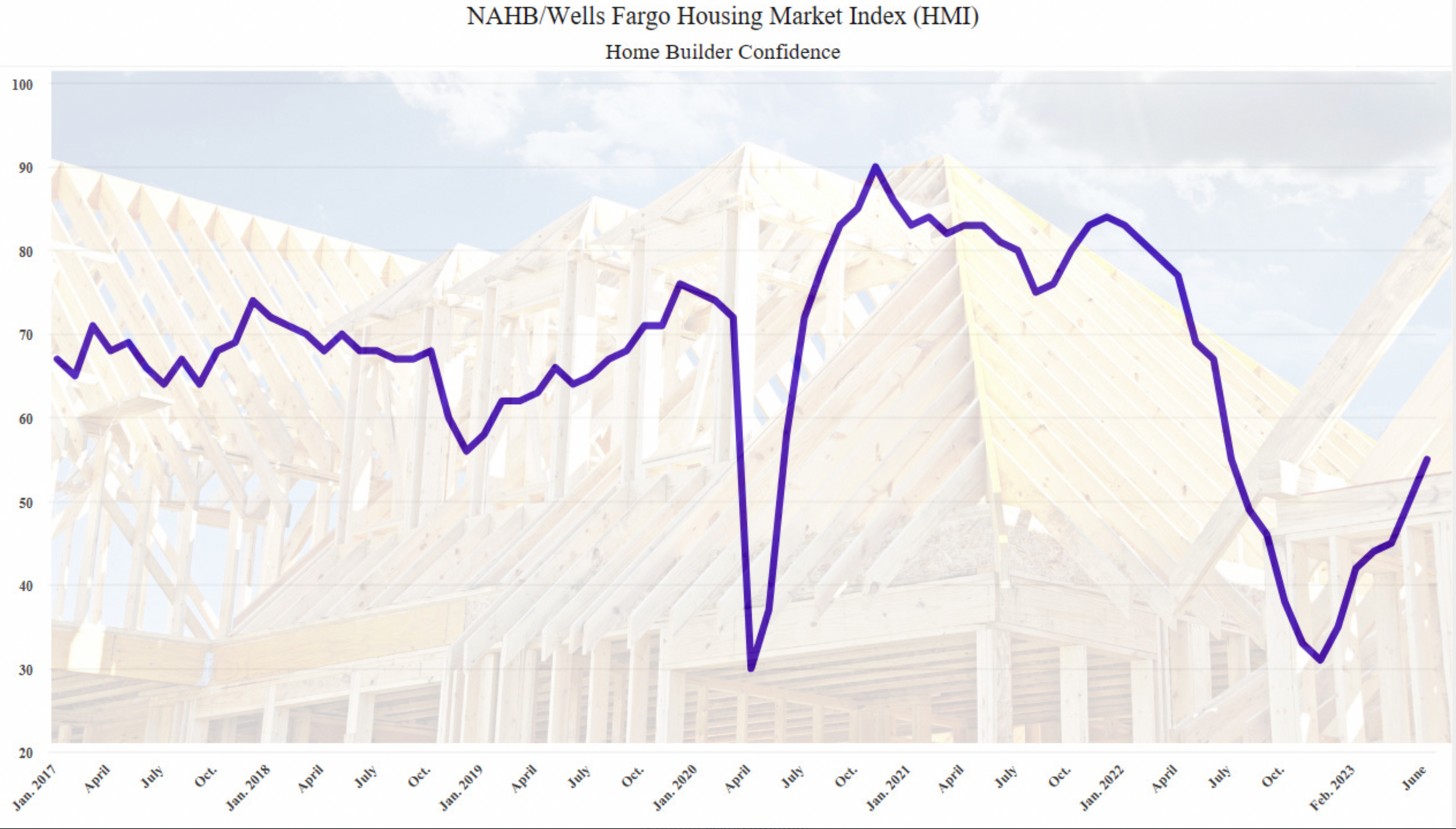

Homebuilder sentiment goes positive. After 11 months of being negative (Below 50 on the HMI Index), homebuilder sentiment has finally returned to positive territory as the housing market shows signs of a sustained recovery after the post-pandemic correction in 2022. This is another welcome sign for the economy and one that reflects both strong consumer and producer participation in the current economy.

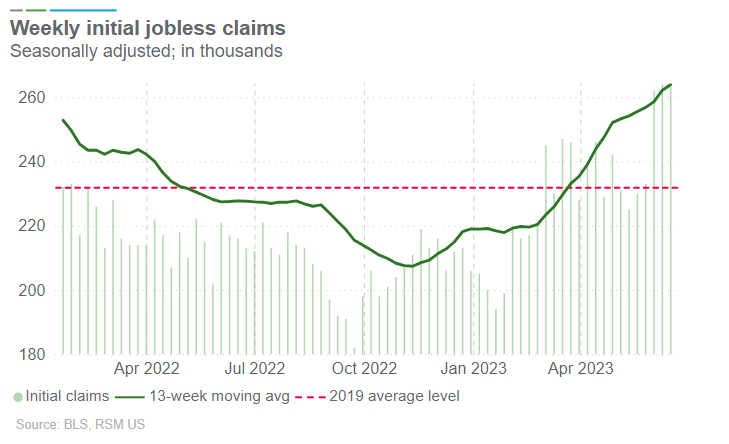

Jobless claims begin to tick higher. After months of a tight labor market, jobless claims finally begin to tick higher, with both May and June claims totaling over 260,000. While this would be consistent with a pre-recessionary jobs market, the rising labor force participation rate is helping ease fears. On top of this, a slight uptick in unemployment is healthy for the economy as of now as it will help in easing inflation and allowing the Fed to finally pause rate hikes.

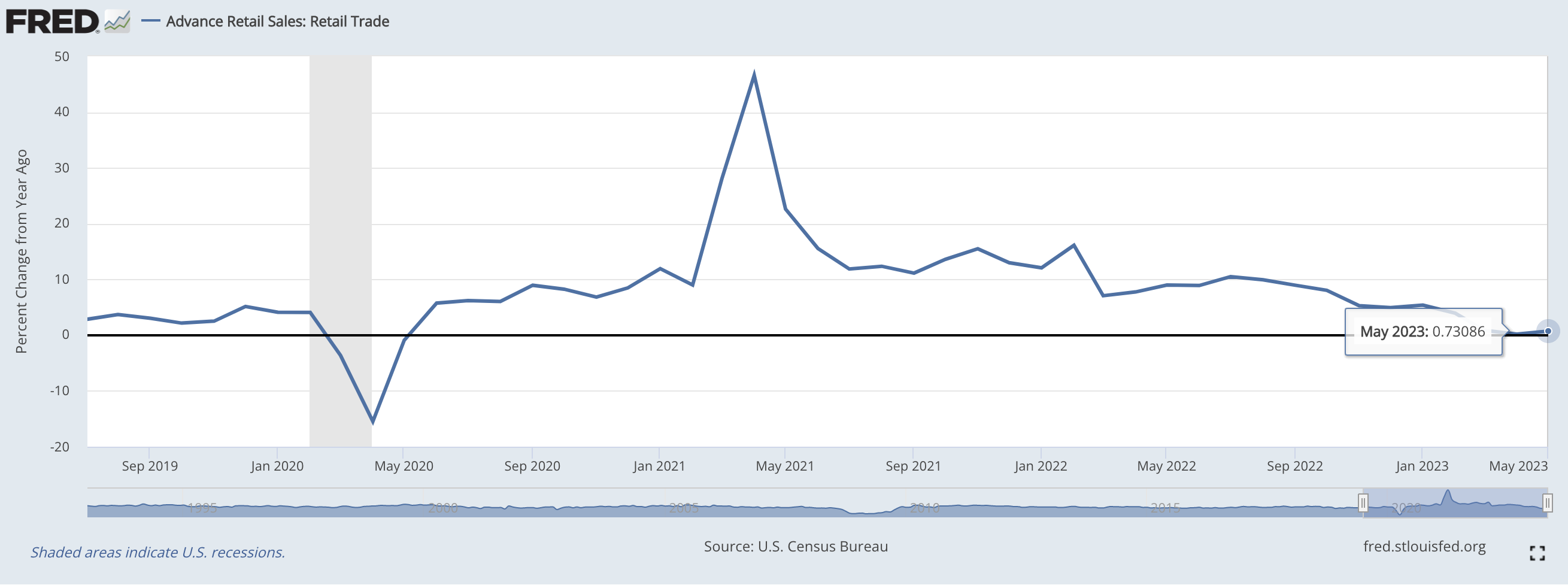

Retail sales remain positive. May retail sales rose 0.7% YoY, up from 0.2% in April, and showing signs of a return to higher growth, in the range of 4-5% that was common pre-pandemic.

Fear down, sentiment up. Consumer sentiment has begun its rebound off lows not even seen in the Great Financial Crisis of 2008, all the while the VIX index gets crushed towards its natural resting place during bull markets. This wide gap between VIX (inverted) and Consumer Sentiment is extremely rare, and usually short-lived, meaning one will have to break towards the other relativly soon. Considering all aspects of the economy in the present moment, we are leaning towards a sharp move higher in consumer sentiment, with fear remaining low, but ofcourse a catalyst will be needed to cause any major shift there.

In aggregate these data points paint a very positive picture for the U.S. economy, and as investors, especially as value investors, this is a great sign...