FOMC Recap: What the Fed is saying and the market isn't accepting

Today's FOMC meeting arrived with the expectation that the Federal Reserve would hold rates steady at 5.0-5.25%, and that is exactly what they did.

But there were a few key surprises.

First of all, the FOMC notably revised their expectations for growth, employment and inflation within the United States going forward in their latest Summary of Economic Projections (SEP).

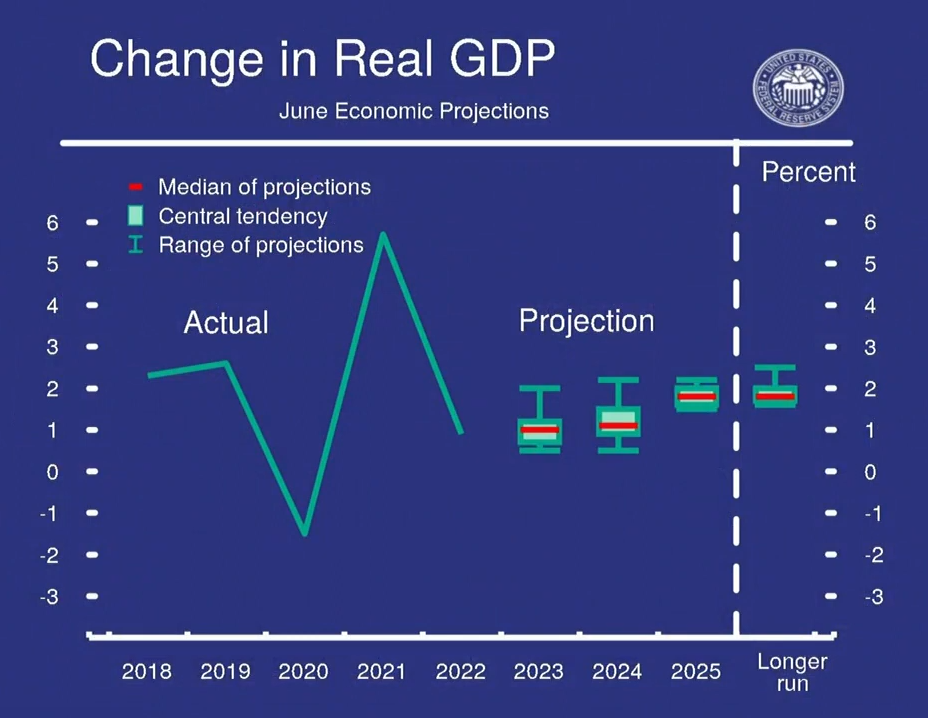

Real GDP projections were revised higher from 0.4% growth in 2023 predicted in March to 1.0% now being the median expectation in June.

This is a key shift as now FOMC members are seeing the economy staying more resilient than initially expected, going a long way in cooling recession fears that have been swirling through markets, seen most in risk-on equities.

Higher GDP growth is also what led to revisions in inflation expectations, which we will discuss a little later on...

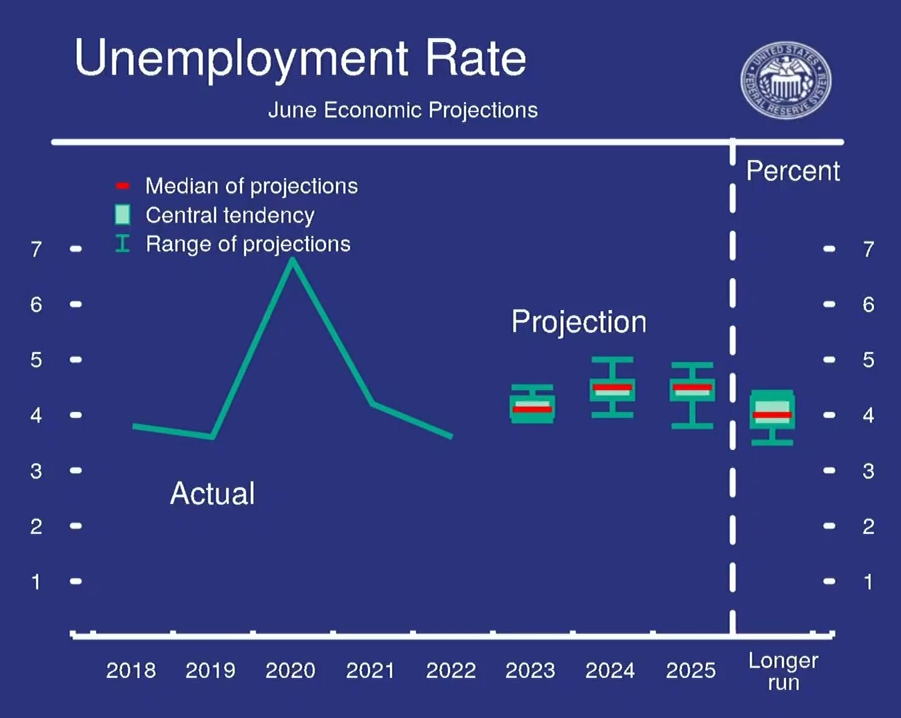

Another optimistic revision in the Fed's SEP came within unemployment. The Fed expected nearly 5% unemployment to close out 2023 in March, but this expectation has come down to 4.1% in their June revision, indicating the extreme tightness we have witnessed within the labor market.

This once again reflects optimism within the economy, but again, feeds into the higher inflation narrative that seems to be developing within the FOMC.

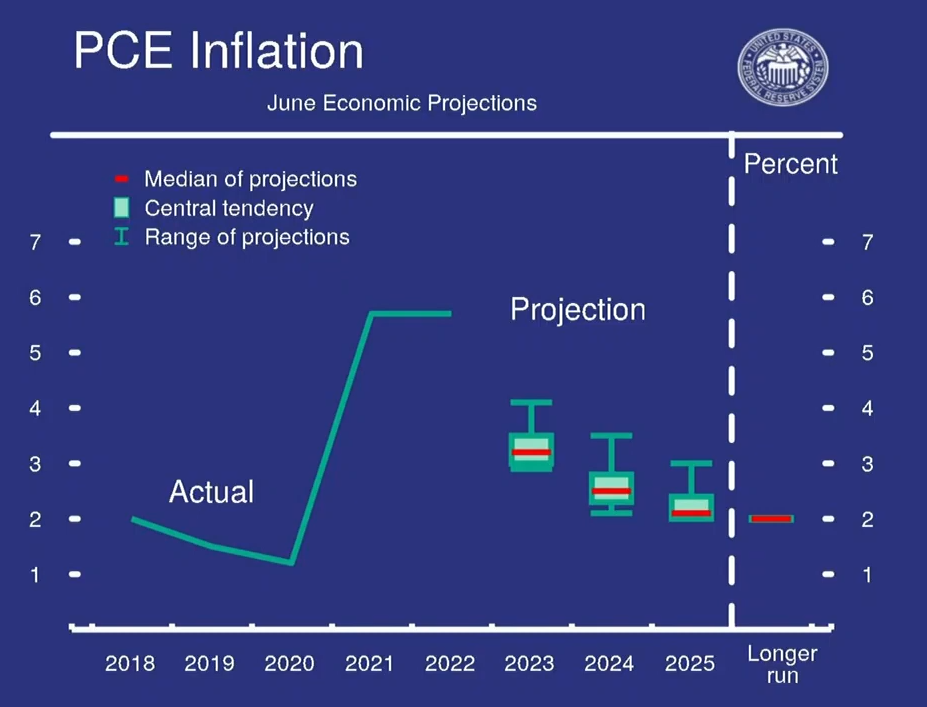

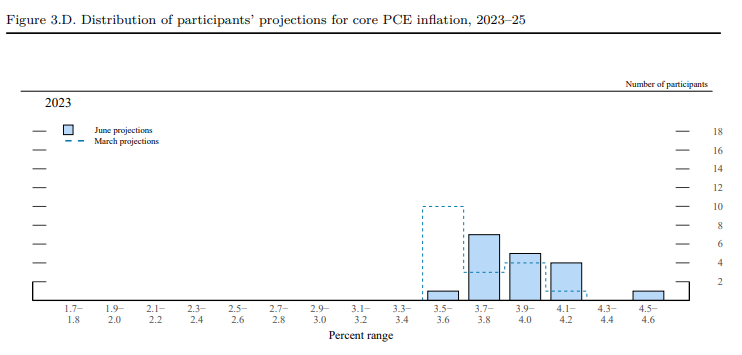

This is best seen in their revisions in PCE inflation...

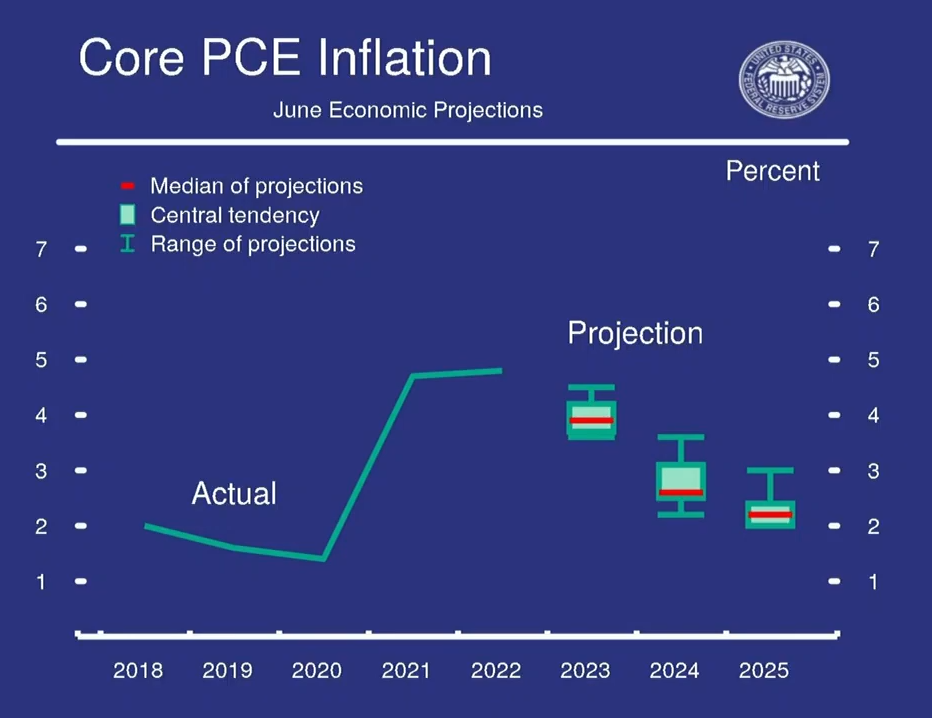

I would like to draw reader's attention to Core PCE in particular. Throughout Powell's presser he repeatedly discussed how sticky core PCE has been, and that it has been discouraging to see little give in the index despite higher rates.

The committee still expects 3.9% core PCE at the end of 2023, undermining their efforts to return inflation to 2%.

The biggest worry in this high core PCE revision is the fact that the stickiness within inflation is being caused by services inflation, a sector that the Fed has the least control over.

While components such as the housing market, raw materials and commodities are directly affected by the Fed's rate hikes (house and rent prices are still near all time highs), services are more complicated. As a result, Powell advised caution in expecting core inflation to drop, citing the fact that we are finally seeing some sort of slowdown in the rate of increases in services inflation, but "the fight still has a long way to go"

Finally, in regards to inflation, Powell said the conditions for inflation to come down are in place, and now it is just a matter of waiting for the full effects of the Fed's monetary policy to take effect in order to bring inflation down to the 2% target.

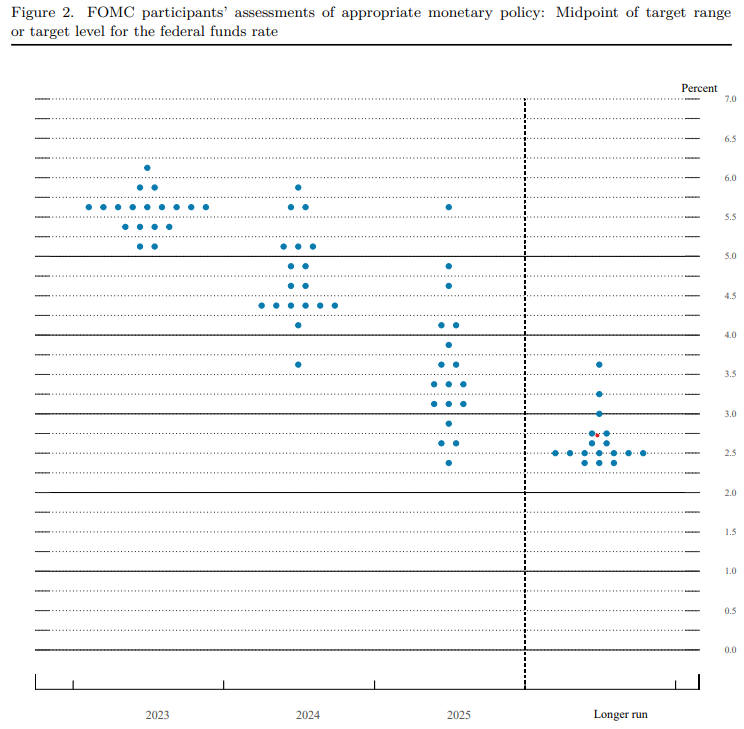

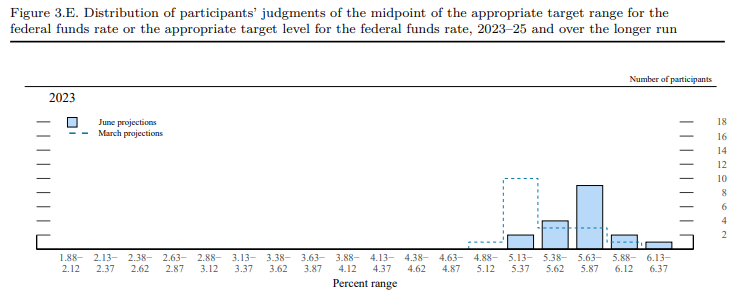

While all these points so far have been rather positive, the Fed's dot plot was not.

Markets came into this meeting with the assumption that there would be a skip in hikes, with 25bps in July likely, but even that was in question as many began to predict that this rate hike would be a pause in hikes, not just a skip.

Well this expectation was shattered by the FOMC, who revised rate expectations well higher in their SEP.

The new median for the 2023 Federal Funds rate is now seen at 5.6%, indicating another 50bps of hikes still expected by FOMC members.

This revision higher was undoubtedly driven by the expectations of stronger growth and stickier inflation and indicate that the FOMC is nowhere near done with hiking within this cycle.

On top of this, Powell said that rate cuts are not expected and could even be two or more years in the future as the Fed sticks to its "higher for longer" mantra, another key difference point between the FOMC and markets, which expect potential rate cuts to come as soon as the end of 2023.

With all this being said, how did the market react?

Oddly, and frankly, irrationally.

Andy's Angle

Today's market action after the FOMC decision was largely what we expected, especially considering the fact that the FOMC relayed 50bps of hikes yet to come as compared to an expectation of 25bps.

The initial selloff lasted only about 10 minutes, before the all too familiar V recoveries began.

The market once again shrugged the Fed off and called their bluff...

But why?