Value Stock Spotlight 5.0

As markets battle against shifting narratives this year over rate hikes and economic growth, it's important to see how rotation across sectors is playing out, and where value investors should be looking for their picks.

Andy's Angle's approach to value investing has always been through "sector discrimination",that is, picking out sectors within the market before searching for value stocks in said sector.

Instead of scouring the entire market for strong investments, it's more efficient and oftentimes more profitable to first discern which sectors will outperform in the future, and then search for value investments within those sectors.

But how does one even begin picking the right sector?

Well, the way I see it, it comes with experience, and really is more about feeling out the market than overwhelming yourself with data.

One thing I've learned in investing is that in order to be a better investor you have to truly feel the market, develop a sixth sense that allows you to understand shifts in market dynamics without having to do tireless amounts of research.

This comes with time.

But for our purposes I'll try to explain what I'm seeing as best as possible.

Sector Spotlight: Utilities

Utilities.

What I consider to be the most boring sector of them all.

Growth is low, but what isn't is their cashflows.

The utilities space is very top-heavy with just a handful of companies controlling a bulk of the space. To add on to that, these companies are also heavily regulated, with strong government ties.

These factors end up making them some of the most stable investment options on the market, and their strong dividends make them some of the most popular stocks for income and value investors.

That is, when the dividend yield is actually higher than the 10yr yield.

Over the last year utilities have been neglected as money flows out and into treasuries. Why would you hold a stock with inherent risk for a 5% yield when you could simply by T-bills for similar yields and drastically lower risk?

The utilities index is down nearly 30% from its all time highs in 2022 and is setting new post-covid lows almost everyday.

But is the selling justified?

In my opinion, no.

Utilities are one of the few sectors that can wither both high inflation as well as slowdowns in the economy as they are absolute necessities.

The same factors that inhibits their growth appeal is exactly what eliminates their risk, and as a result, sharp sell-offs like the one we have been seeing over the last two years is extremely rare... and an opportunity.

Utilities are dominated by a few large companies, so our latest value stock pick will be the highest valuation we have ever bought, but we believe there is strong upside in this name, despite a nearly 50% selloff from its highs.

Dominion Energy ($D)

Dominion Energy, Inc. engages in the production and distribution of energy. It operates through following business segments: Dominion Energy Virginia, Gas Distribution, Dominion Energy South Carolina, Contracted Assets, and Corporate and Other. The Corporate and Other segment focuses on corporate, service company, non-controlling interest in Dominion privatization, and non-regulated retail energy marketing operations. The company was founded by William W. Berry in 1983 and is headquartered in Richmond, VA.

Dominion's stock has been... thrashed.

Mercilessly.

The stock is trading at nearly 13-year lows and the fall just seems like it will never end.

And there are reasons for this.

First and foremost is Dominion's complete shift in business plans, moving away from traditional coal and natural gas powered electricity to cleaner energy sources as part of the energy transition.

They sold off numerous electrical transmission assets to Berkshire-Hathaway in the last few years, totaling nearly $10B.

The crown jewel of Dominion's energy transition goals is its 2.6-gigawatt project known as the Coastal Virginia Offshore Wind (CVOW) project.

There is no doubt that offshore wind is some of the cleanest forms of energy that is being researched, and Dominion is at the cutting edge of this innovation, with CVOW being the only active Offshore Wind project being devloped within the United States currently.

The issues arise with CVOW when we begin to look at its costs.

The company expects costs to mainly be comprised of fix costs staring in the first quarter of 2023, with the total installation cost being somewhere around $10B.

On top of installation costs, the costs of running and maintaining offshore wind is significantly higher than their legacy coal and NG power generations units.

According to the U.S. Energy Information Administration's (EIA) Annual Energy Outlook 2022, the cost of generating electricity from new solar, combined cycle natural gas, and onshore wind power plants in 2027 will be around $36.50, $39.90, and $40.20 per megawatt-hour (MWh), respectively, even without taking into account tax credits. Dominion Energy expects that the cost of generating electricity from the Coastal Virginia Offshore Wind (CVOW) project will be significantly higher, at $80-$90 per MWh. However, this is still lower than the EIA's average estimated cost of new offshore wind power plants in 2027, which is $136.50 per MWh. This suggests that the CVOW project is a relatively affordable offshore wind project.

Dominion is early to the offshore wind industry and in the long run this will pay them back significantly.

Finally, and I believe most importantly, Dominion has immense government backing.

Dominion is eligible for a federal 30% investment tax credit as well as support from the Virginian government which has ensured to back Dominion against the steep costs the project presents.

This greatly reduces the burden of the project on Dominion's balance sheet and enables them to smoothly transition to offshore wind.

Finally, the greatest advantage for Dominion and offshore wind comes at scale.

Right now costs are high for offshore wind and will likely be non-competitive in relation to oil and gas for the next few years, but this is set to drastically change. By 2030, wind energy is estimated to be nearly 28 percent cheaper to produce over a project lifetime than the current levelized cost of energy(LCOE) for gas, which is projected to increase over the next decade. Given new investments in offshore wind through executive action, in the Inflation Reduction Act, and prioritization from the U.S. Department of the Interior’s Bureau of Ocean Energy Management, the LCOE of offshore wind could be even lower by 2030.

Dominion is well positioned for growth, a rarity in the utilities space.

And...

Don't let all this Offshore Wind talk distract you from the fact that Dominion is still running its legacy coal and gas business and their beefy 6% dividend is not projected to be dropped at all.

Andy's Ratings

For a quick reminder...

We analyze companies on five different metrics to form the rating:

Growth: Is the company growing? What is their future like?

Health: How is the company doing financially? Is their business model sustainable? Will they survive?

Valuation: Is the current valuation fair? Is there enough value yet to be realized to make it a good investment?

Risk Profile: What are the risks of investing in this company? Are they worth the rewards? Are there any fatal risks to the business?

History: How has the company historically performed? What has management done in the past that may foreshadow the future?

With that being said, let's look at Dominion...

Growth:

Rating: 8.5/10

Reasoning: Dominion has the greatest growth profile you could want in utilities, and their investments into clean energy transition will prove to be an extremely profitable decision in the long run. Growth is here.

Health:

Rating: 9/10

Reasoning: The company has been able to manage its balance sheet well despite rising costs in relation to CVOW. They are still generating strong results to the tune of $2.3B in net income, enabling them to maintain their dividend, displaying company health.

Valuation:

Rating: 7/10

Reasoning: From a valuation standpoint Dominion is tricky, while it is trading around a relatively average 15x forward earnings, the growth prospects warrant a higher multiple despite its sector. However, another twist is the fact that these earnings are volatile and are largely unknown in their trie magnitude and sustainability. This makes valuing Dominion difficult, but the future prospects paired with the current drawdown in share price clearly makes it an appealing valuation, and we expect strong returns from this level.

Risk Profile:

Rating: 9/10

Reasoning: Again, risk, similar to health, is very positive for Dominion. With the share price depressed and fundamentals remaining stable, there is very little risk here for investors. The biggest risk would be if there are any setbacks in the CVOW project that could materially effect their earnings power. However, with our current outlooks for the economy, we expect Dominion to be in a healthy business environment, and in turn, there is minimal risk in an investment at these levels.

History:

Rating: 9/10

Reasoning: Dominion has a robust history, and recent history (2022) alone shows us just how amazing this business can perform in less than ideal economic conditions. With over 30 years of business under its belt and being an established major player in the electricity and energy space, the company's history is a strong sign for investors.

Andy's Rating: 8.6/10

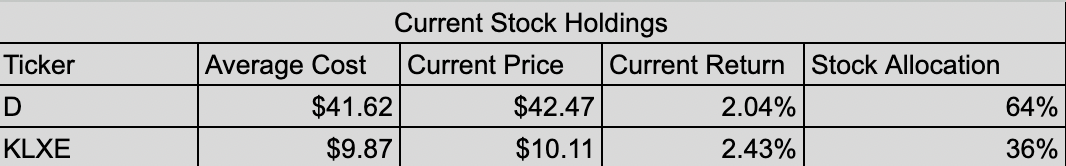

With that being said, we are listing Dominion as a Strong Buy at its current trading price of $41.62.

We see potential for Dominion to be a true rockstar in the utilities space over the next few years and as a result will be adding a large position to anchor our portfolio.

Andy's Angle Investing Portfolio Updates

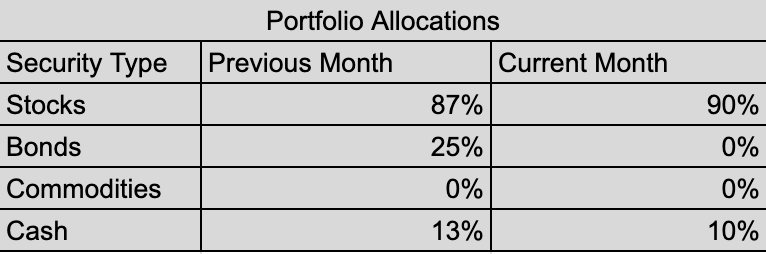

We have made major changes to our portfolio, they are as follows:

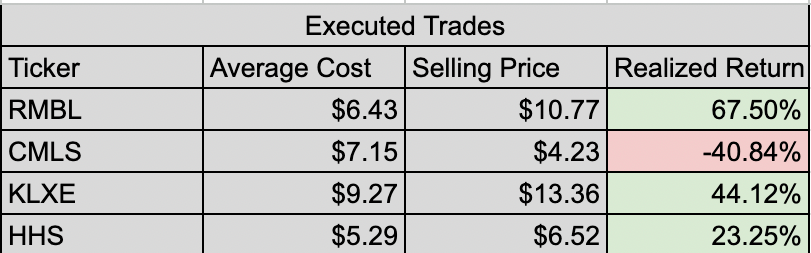

Our most notable move has been closing out both our positions in $HHS (23% realized return) as well as all of our bond exposure in favor of a large position in Dominion Energy.

We expect our portfolio to remain relatively stagnant for the rest of the year barring major gains in KLXE that would compel us to take profits.

We expect Dominion to be a stalwart of our portfolio for the foreseeable future.

-Andy

Comments ()