Insight: Where Do Markets Go From Here?

September has been rough.

The S&P500 is down over 5% for the month and bonds are down nearly 10%, reaching lows not seen since 2011, and for good reason.

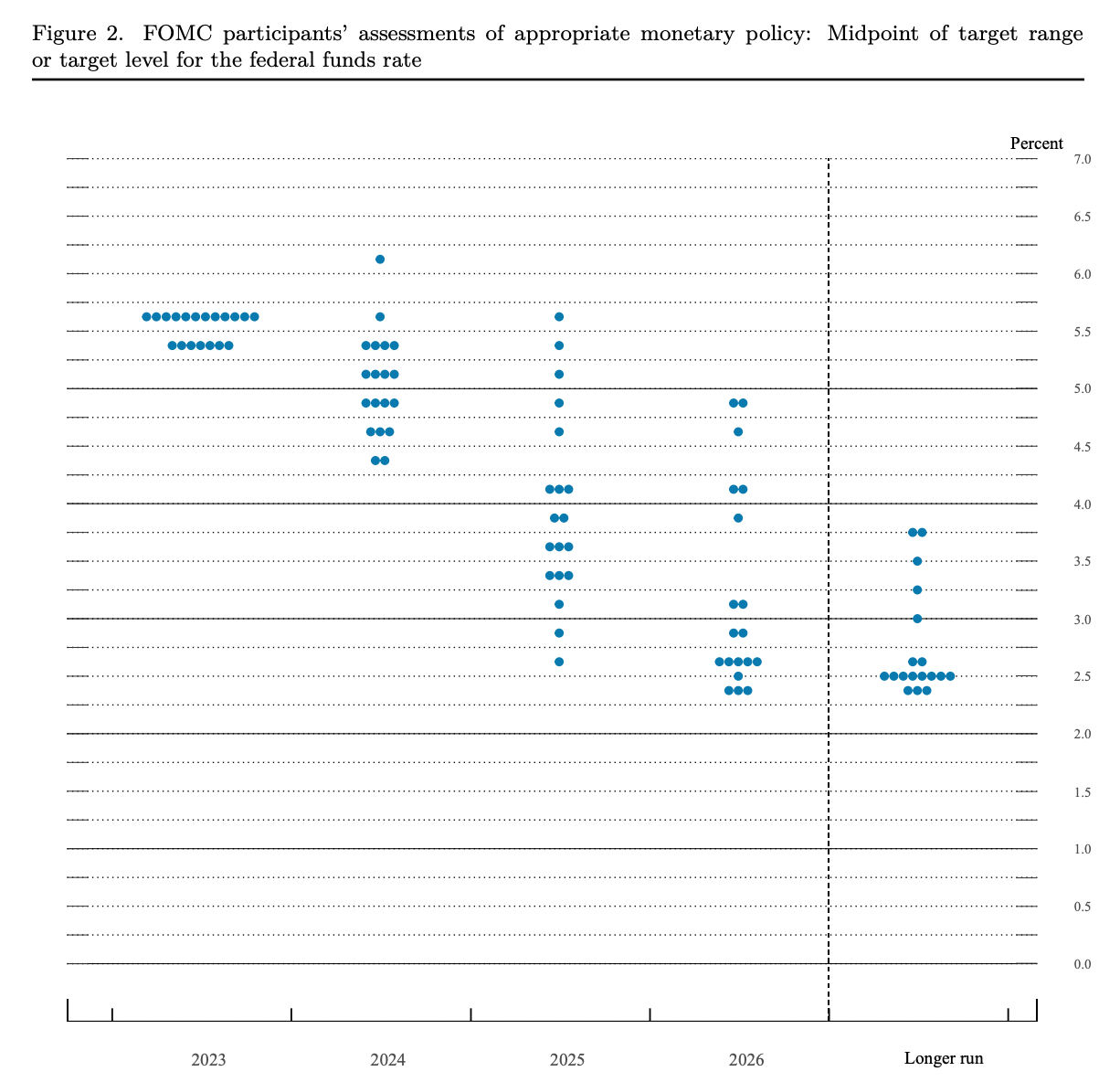

The Fed has gone full hawk, stating in their latest FOMC SEP that they expect there to be at least one more rate hike in this cycle and anticipate keeping rates at these levels through most of 2024.

This is a startling change from projections just a couple months ago that called for just a short pause and cuts beginning sometime in the first quarter of 2024.

On top of this, earnings came in soft last quarter, and as Q3 earnings approach it will be paramount for companies to deliver strong growth, defying dismal market conditions yet again.

While earnings compression has been anticipated by us for a long time, we believe that it will be important for companies to avoid this as interest rate expectations show that there will be little to no relief for companies any time soon in relation to tight economic conditions.

Rates are expected to stay at or above 5% through 2024, well into restrictive territory, and with inflation slowing down, the added earnings bump from inflation driven metrics will also slow, leading to slower earnings growth on Y/Y basis'.

So where do markets go?