PMI Rains on Bulls Parade

The Economy is Still Too Hot.

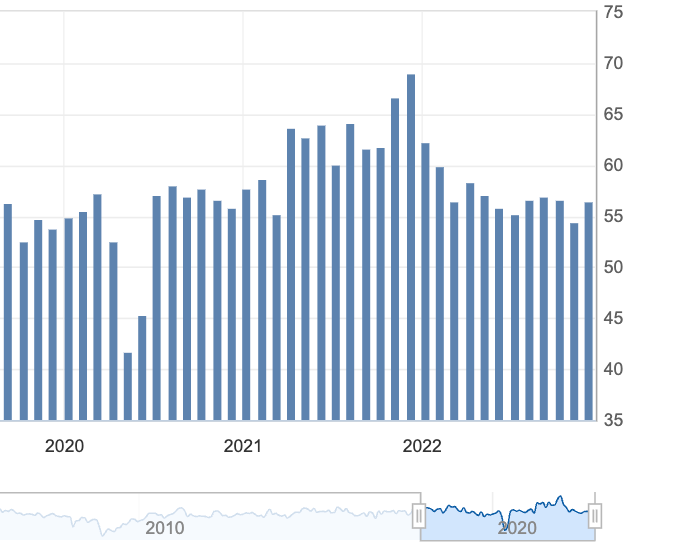

Markets opened the week lower with the S&P 500 down about half a percentage point at the open of Monday's session. All eyes were on ISM Non-Manufacturing PMI, set to be released at 10A.M.

As we highlighted in our weekly preview found here, the PMI, or Purchasing Managers Index, is a key measure of the economic conditions in the sector in focus, found via surveys sent to over 400 business managers, asking them various questions regarding their business actions in the last month. This week's sector in focus was the non-manufacturing sector which includes industries ranging from transportation to restaurants.

Markets were hoping for a cooler print with a consensus expectation of a 53.3 on the index vs. 54.4 from a month ago. Our predictions in the weekly preview expected a hotter print however, with our analysis calling for a 54.3 value for the index instead.

PMI came in much hotter than expected with a reading of 56.5 on the index, higher than the consensus 53.3, and in fact, considerably higher than September's print of 54.4.

Markets reacted negatively to the news as this extraordinary PMI print shows incredible resilience, and even re-acceleration of the U.S. economy, an economy that is supposed to be slowing. Investors sold off all major indexes as the belief that the Fed will easy rate hikes took a hit as a result of a stronger economy.

With employment and now both Manf. and Non-Manf. PMI still showing a chugging U.S. economy, there is little belief that inflation will unravel as fast as the Fed is projecting.

As of 1pm all three major U.S. indexes were trading lower, with the Nasdaq leading the drop at -1.5% on the day. The dollar also took a big jump, trading up 0.67%, further pressuring equities.

Our Interpretations and Positioning

We interpret this news as mildly bearish for the overall flow of equities and have shifted our overall positioning to neutral. As long as there are continued signs of a strong U.S. economy, it is advisable for investors to temper expectations regarding a dovish Fed and milder inflation. Heading into a blockbuster week with CPI and FOMC next week it is prudent to manage risk, as a result we are mainly positioning in risk-off positions.

Comments ()