The Powell Pivot

The same culprit for the last 5 recessions will strike again, and it isn't rate cuts.

Yesterday's Jackson Hole speech by Federal Reserve Chairman Jerome Powell made one thing clear.

Rate cuts are coming.

While this was already anticipated, it was important hearing it come from Powell's mouth, now the only question that remains is how big will the easing be.

We expect the Fed to take things slow, for better or worse (We would not have dealt with the entire 2022 inflation mess if the Fed had swallowed their pride and admitted they were wrong about inflation being transitory and hike faster), and begin with a 25bps cut at their September meeting, followed by an additional 50bps of easing before the year is done, bringing our 2024 terminal rate projection back below 5% and to the 4.50-4.75 range. We see an additional 150-200bps of easing in 2025 to bring our long run FFR projection to 2.50-3.00%.

While expected, the Fed has undoubtedly been forced to convey cuts earlier than they would have liked. Just last month we saw Powell take the stage for his July FOMC speech, and it was business as usual. Inflation was slowing, but was still sticky on the path to 2%, and while the job market had been easing, it was not reaching a level that would concern the latter of the Fed's dual mandate.

Fast forward less than a month and a lot has changed.

The BOJ hike and subsequent fall out with the Yen and Carry Trade sent shockwaves throughout markets, prompting calls for emergency cuts and a rescue line from the Fed. While this situation has eased, for now, the scare was enough to shake even the most hawkish members of the FOMC.

The nail in the coffin for the "longer for higher" mantra came earlier this week when the BLS revised jobs growth significantly lower... recordly lower:

800k lower than initially reported throughout the year.

This ultimately pushed the Fed over the edge, with Powell announcing "The time has come" to cut rates.

So now what?

Well, you've probably already seen the posts flying around about how each time the Fed cuts rates we see a recession within the next 12 months.

This time is no different, but not for the reasons you would have been led to believe.

We had never in history had the level of stimulus released during the pandemic, and this has fundamentally changed the way global economies function.

Using previous bouts of inflation and rate cuts is simply disingenuous and frankly misleading. This is a different beast.

We'll keep this short and to the point.

Anyone that tells you they know what will happen next and uses historical analogs to back their points is simply lying.

No one, not even Jerome Powell, knows what will happen next.

There is no textbook way to handle this, we have created a new problem that will require a new playbook to solve.

But here's our take:

We do expect a recession in the next 12-18 months, but it won't be because of the Fed cutting rates like most want you to think.

No no no.

It will be because of the same thing that has caused five out of the last five recessions (excluding covid) dating back to 1974.

Oil

An oil price shock.

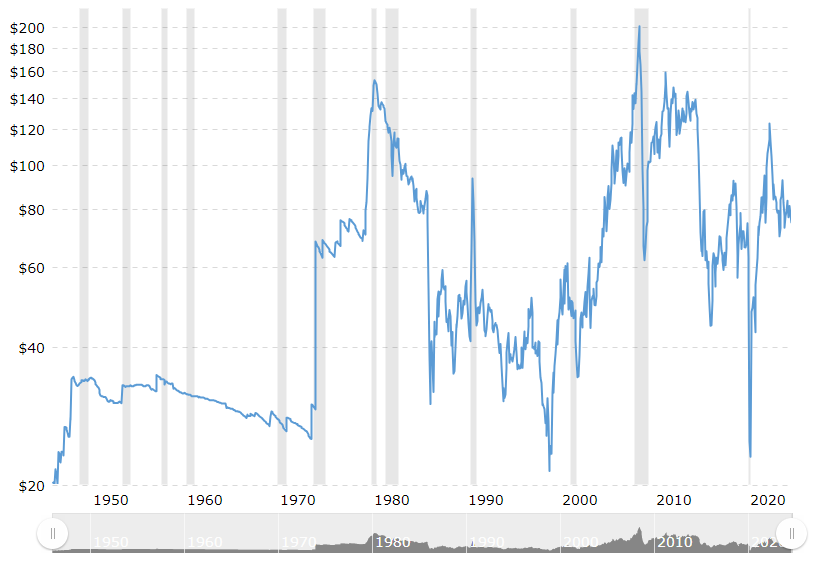

Take a look at 1974, 1979, 1990, 2000 and 2008.

Preceding each recession was an unsustainable rise in crude oil prices.

In 1974 OPEC+ placed an embargo on oil exports to the United States in response the the country re-supplying Israeli forces with weapons (sound familiar?) sending oil prices nearly 400% higher.

In 1979 the Iranian revolution and subsequent Iraq-Iran war sent production in both countries spiraling lower, creating supply constraints for nearly a decade and keeping prices almost 100% higher than pre-crisis levels, spurring two U.S. recessions in the span of a 5 years.

In 1990 the Iraqi invasion of Kuwait and subsequent Gulf Wars with global participation saw another unsustainable spike in oil prices, triggering another crisis and recession.

In 1998 oil prices dropped to their lowest levels ever on an inflation-adjusted basis, prompting all countries to globally cut production. However, as the dotcom bubble accelerated the demand for oil quickly outpaced production and oil prices saw a meteoric 150%+ rise, triggering another recession.

Finally, 2008. A mix of lower oil production, rising demand and inflation saw oil reach its highest ever level on an inflation adjusted basis, over $200/barrel in today's dollars. While this wasn't the key component to the eventual economic collapse in 2008, it was a significant player and one that is often overlooked.

So now 2024.

The ingredients for an unsustainable oil price shocks are there, and most are not prepared.

Conflicts are brewing across the Middle East, and while large scale war has been avoided for now, it's clearly on the table.

More importantly however, is the way OPEC+ has been behaving.

The oil cartel has seemingly turned a corner on how well they enact their quotas, as exports have been going lower and lower throughout the year. This type of coordination is something we have not seen from the cartel... ever. Usually there are always miscreants who try to cheat their quotas and produce in excess to realize profits, but this time around it doesn't seem to be the case.

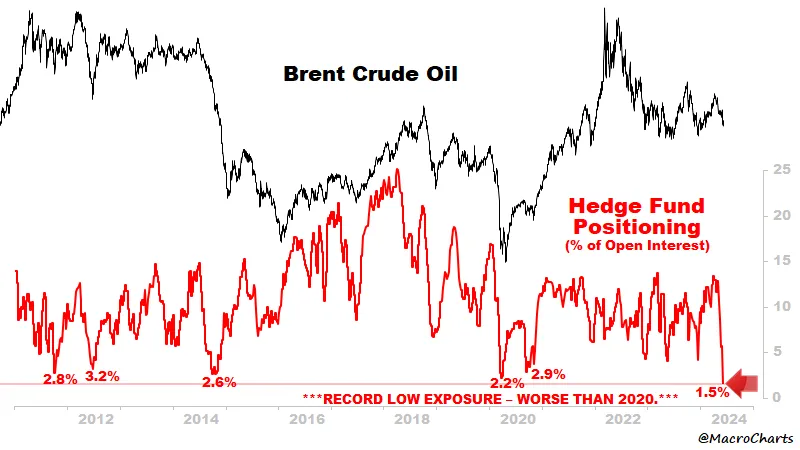

Pair this with the fact that crude oil has now become a financial asset before its title as a commodity and we see that the current crude oil price in the mid $70s is not reflective of supply and demand fundamentals.

Yeah.

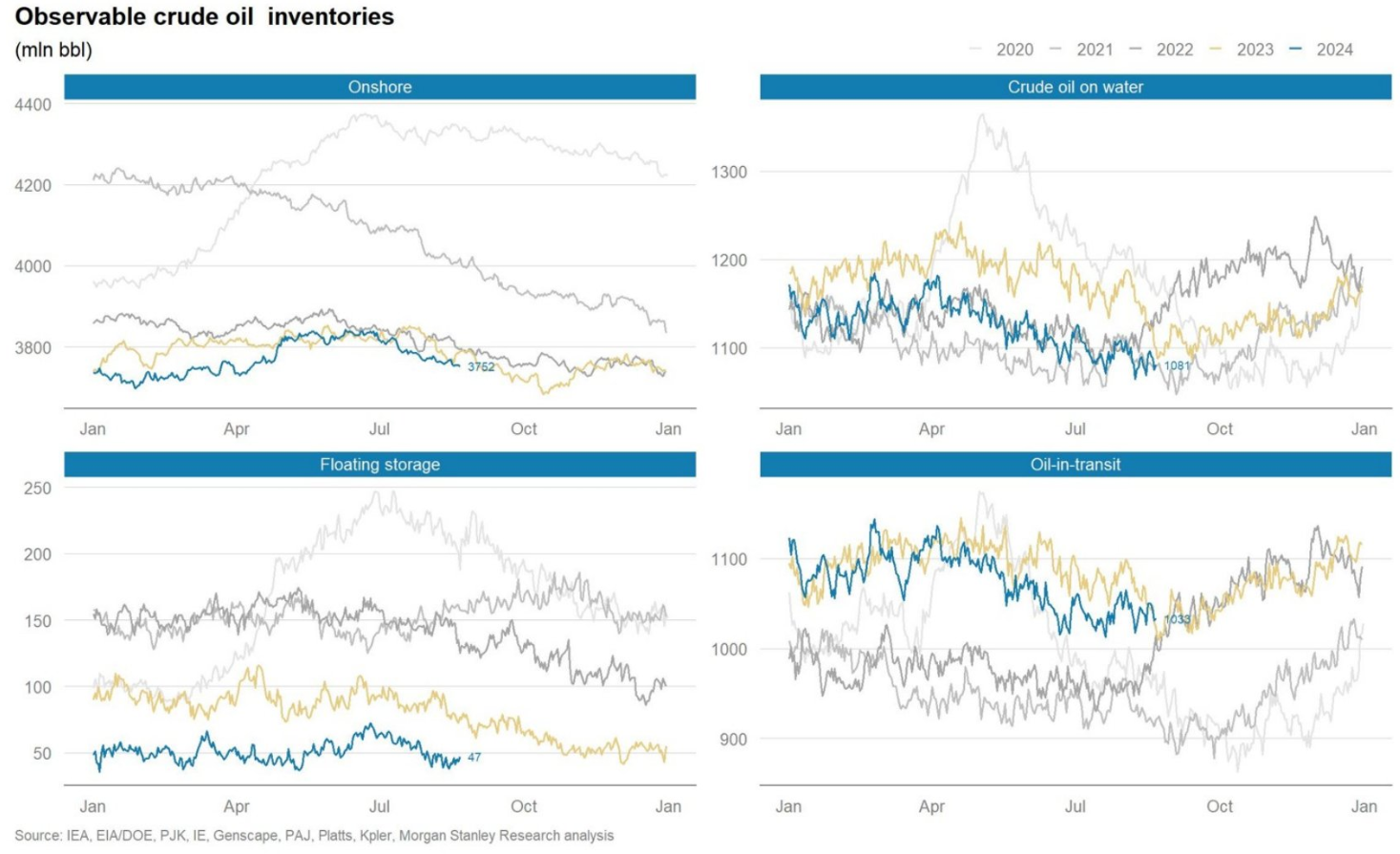

Global inventories are at multi-year lows.

The price of oil would not tell you that, but that's why you cannot let price set your narrative.

Funds have no exposure and are net short, no wonder they would drive out forecasts that call for lower oil:

Funds, almost all of which are heavily short oil, assume that U.S. shale production can simply exceed global consumption as U.S. growth never stops. Again, not true.

New Permian laterals are more expensive, gassier, and overall just not economical to be drilled... so why are we assuming these companies will just drill more and more at disgustingly low strip prices?

They won't.

Eventually these fundamentals will come to a head, just as the Fed begins easing and declaring victory against inflation.

How high can this price spike in oil go? Again, unpredictable.

But if one thing is clear, unless prices begin slowly rerating towards reasonable, fundamentally supported levels around $85/barrel on WTI, we are in for a price shock back over $100/barrel, which will inevitably lead to higher inflation and leaves the Fed, again, behind.

Last thing, if Chinese demand begins surprising to the upside... there's no telling what happens next.

Long oil equities while they are cheap is the way to go, until recession strikes.

-Andy

Comments ()