Trade Spotlight: 7/10

This battered behemoth presents a unique long opportunity....

At Andy's Angle we aim to provide our readers the best opportunities to succeed via our inputs on markets.

While our main goal as a publication is to promote value investing and guide our readers through the gauntlet of value investing, we understand that there are many more opportunities available on the market.

With that being said, we are proud to announce the launch of our newest segment "Trade Spotlight".

This new segment will be more frequently published than our investing education and value stock spotlight segments and will likely feature multiple short posts per week.

This segment will highlight one trade per post that we are liking in the current market, and will be more technical based than our current fundamentals-oriented investing.

These trade spotlights will feature larger companies, often blue chips, that we like from a technical standpoint for either long or short trades. We will include our analysis, various trading strategies, and our thesis for each potential trade that we highlight.

We hope this new segment will not only broaden Andy's Angle's appeal to a larger group of investors, but also hope that it provides a nice supplement to our existing value based investing strategy.

With that being said, let's take a look at our first trade spotlight!

Disney ($DIS)

Our first trade spotlight and our featured trade for 7/10 is Disney.

Disney has been battered this year after a stellar January which saw the stock rally over 30% from its bear market lows. Fast forward seven months and Disney stock trades once again near its lows of both the pandemic and 2022 bear market.

This downwards pressure has been fueled by negativity surrounding park attendance, Disney+ slowdowns and a heated legal battle between the company and Florida governor Ron DeSantis.

We believe this immense pressure represents a nice long opportunity for investors, especially given Disney's rich history.

Here is our analysis in a few charts:

To start, the stock is trading at a significant support level that dates back almost a decade.

This area in the mid-$80s has seen numerous reversals and is a clear accumulation zone for investors.

Zooming in a little, we can identify a few key support and resistance lines.

At this level, Disney has 3 key support lines, all of which have seen immense buying spurts off of them, giving us key buy zones at $87.50, $84 and $80.

In terms of resistance, there are many levels that have been created by the recent sell-offs, giving us key distribution zones at $95, $104, $118 and $125.

Finally, in terms of technical setup, it's a pretty clear wedge here, and while this is usually a bearish trend, we believe that given the already depressed share price, there is a strong possibility that the price action holds the support line and breaks out of the downtrend.

Potential Trades

We see two distinct trades that can be taken here, both long.

Long Shares

This is the more obvious strategy given Disney's history, to simply long shares at these levels.

Given the immense rally in stocks this year, its been hard for investors who invest in individual stocks to find good deals on large cap names, but Disney presents itself as a premier opportunity for those long term investors.

A long position in the $85-87 range is likely to yield over 100% returns in the next 2-3 years as Disney stock inevitably rebounds given its immense moat in the entertainment industry and robust history.

We see this to be a multi-year trade, but even in the shorter term a move to $100+ yields a strong return for investors and we believe this can be expected within 3-6 months under the current market outlook.

This is our lower risk option, and while we could see some more downside on Disney stock, the risk/reward is extremely skewed in favor of longs.

Long Options

Our second trade strategy operates under a slightly shorter timeframe and involves the much more volatile options class of equities.

In this case, we believe buying longer dated call options on Disney stock will yield strong returns.

In particular, we are looking at call options for the October and January expirations, giving us enough time for the stock to appreciate in value without having to worry too much about time decay within our options pricing.

We are going to look at two different contracts and their potential returns under the following trade strategy:

The two contract we are focusing on are:

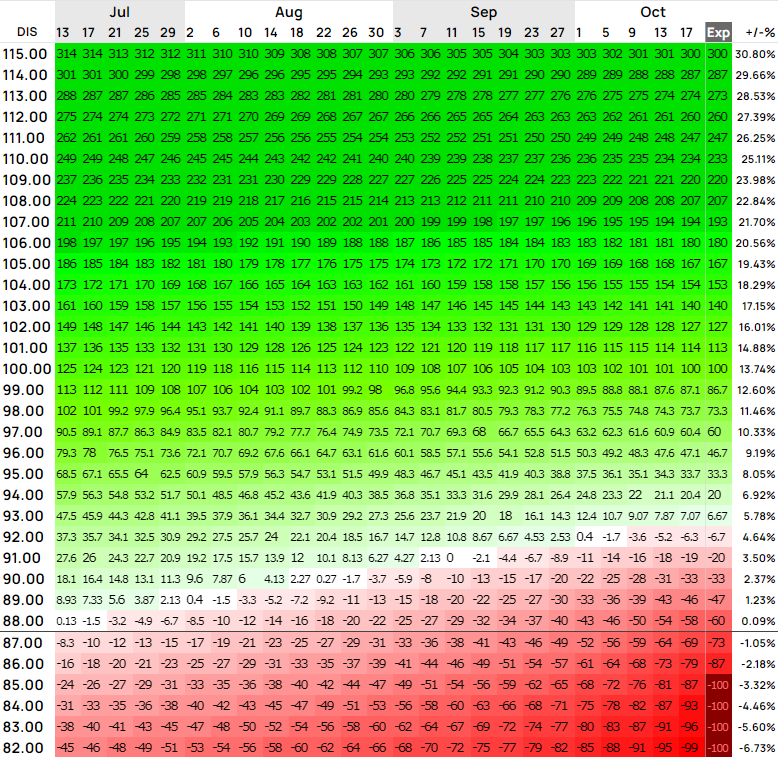

October 20th $85 call ($7.50/contract)

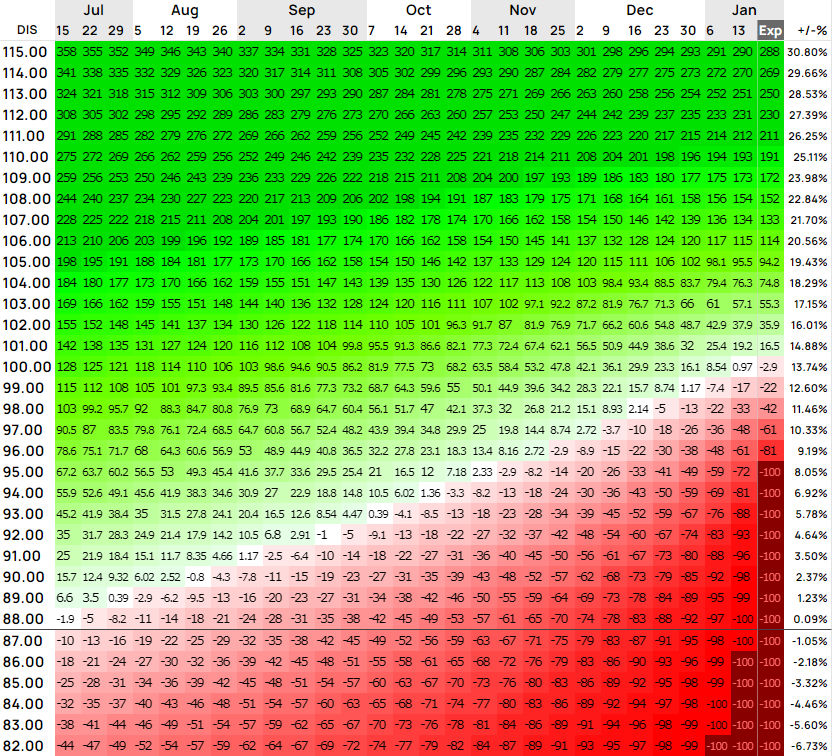

January 19th $95 call ($5.15/ contract)

We chose these two as we believe the best pair risk and reward.

The lower, in the money, strike for the October call shields investors from further downside and time decay, while the higher January call gives the contract more time but also allows for higher returns given the out of money strike.

Here are the two profit matrices for both contracts:

The October expiration gives a larger breadth of profitable values, with the breakeven price at $92.50 at expiration.

Note that at our $84.00 stop loss level there is the potential for about 40% losses, while at our T1, T2 and T3 targets there is upside of 50%, 170% and 300% respectively.

The January options returns are less appealing, especially given the higher breakeven price at $100.15, but it also offers the investor a longer time horizon to be profitable.

Options are inherently risky, and we do not suggest investing large amounts of capital in these given the opportunity to incur large losses.

With that being said, we do like the setup, and using this as a supplement to larger investments in our value picks could be a great way to round out a portfolio.

Disney represents a strong opportunity for both the long term and short term investor and as a result it is out Trade Spotlight for today.

We hope our readers like this new segment and would love to hear new feedback on what we could do better to provide the most value for you!

Thank you,

-Andy's Angle Writing Team-

Comments ()