Trump 2.0

And a recap of the busiest week of the year...

The weekend has finally arrived after the most frenetic week of the year, now it's time to sit back and unpack what took place, and our analysis on what's going to happen moving forward in equities, commodities, yields and beyond.

Trump is back, the Fed is cruising and stocks couldn't be happier...

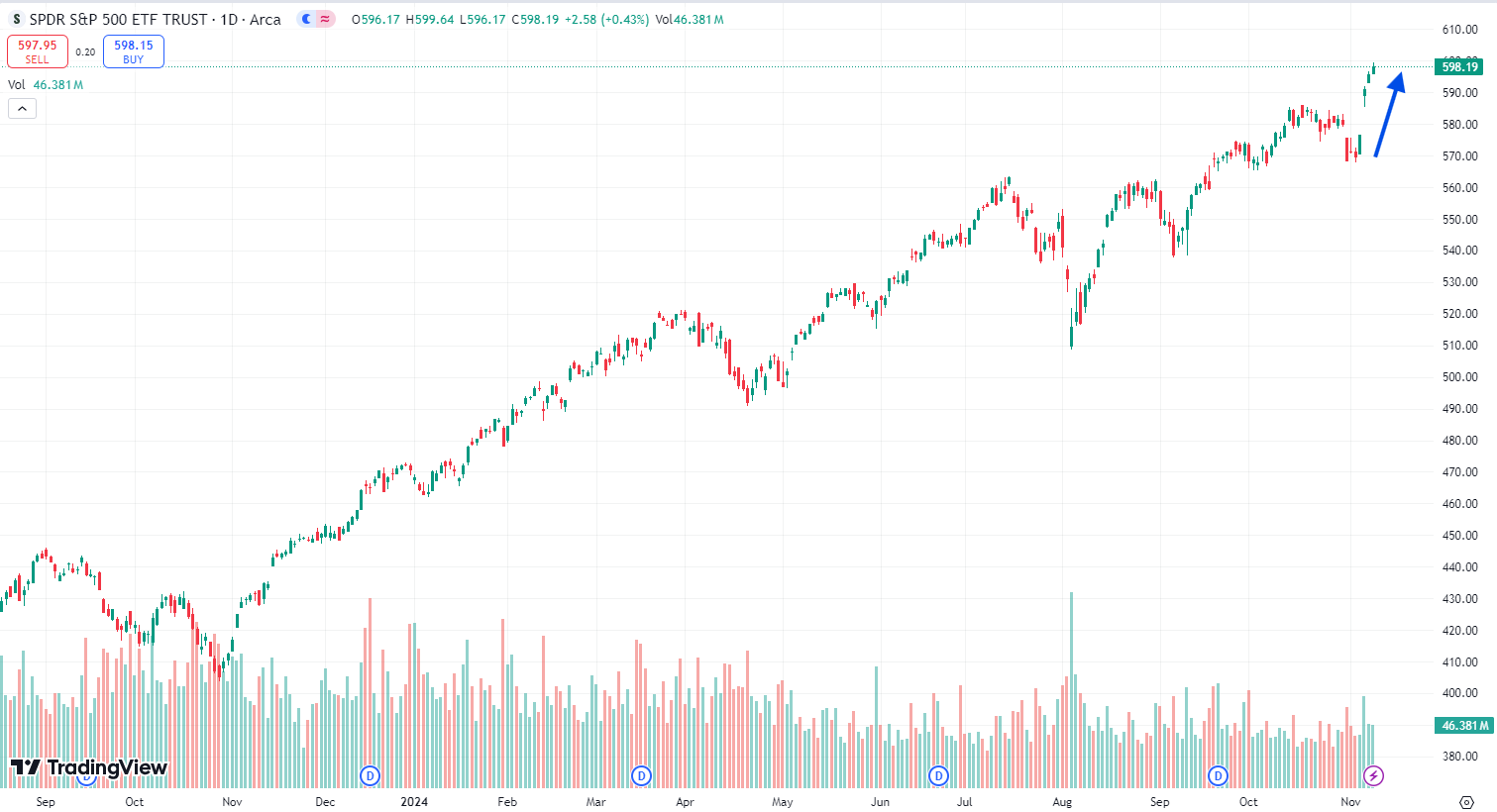

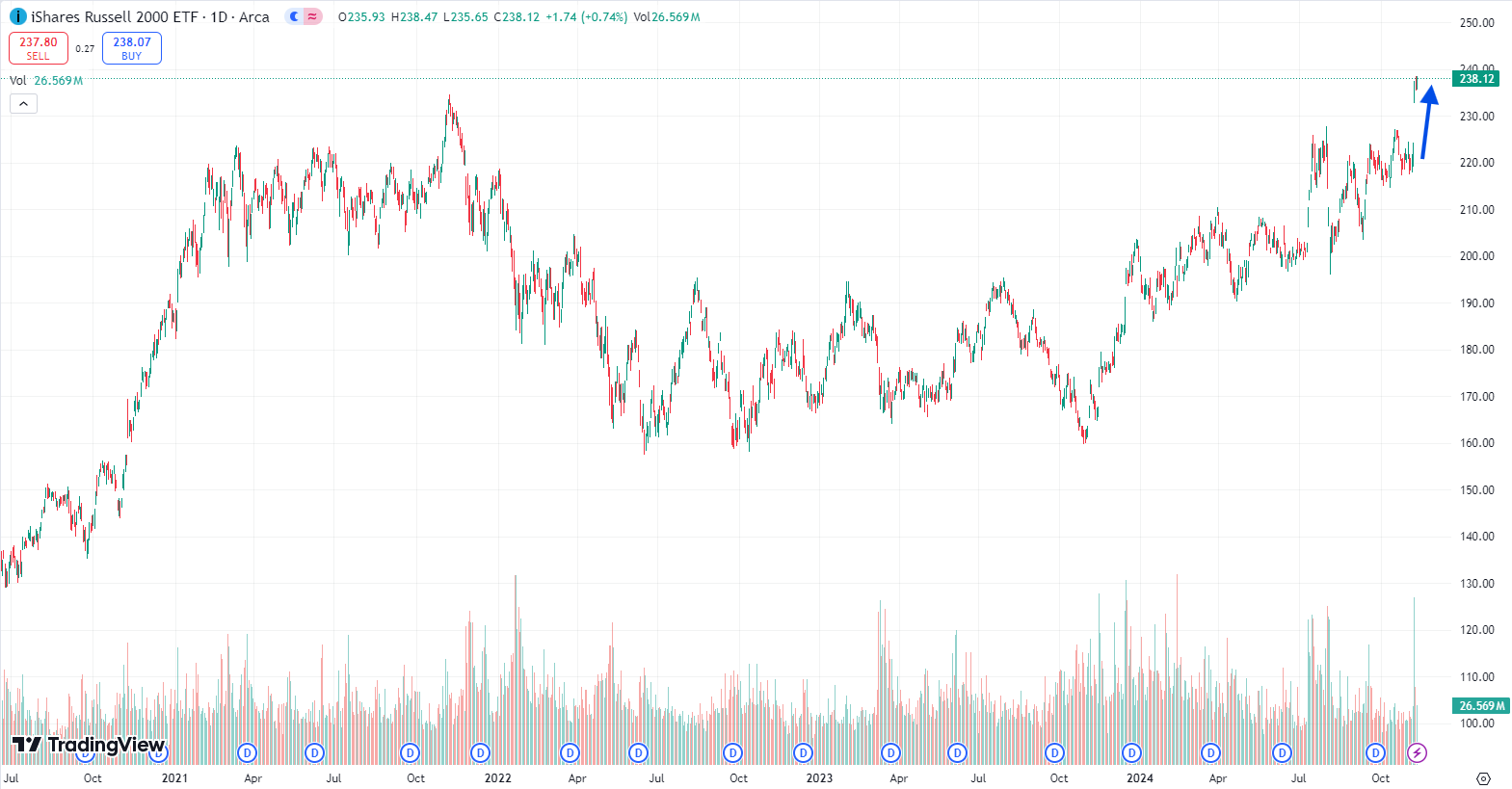

All three major indexes set all time highs, posting their best one week gains of the entire year. More impressive than that, though, was the Russell 2000 small cap index, breaking out of its nearly three year slump to finally set a new record, ending the week a staggering 9% higher.

Stocks were ignited by not only a Trump victory, promising easing of corporate regulations and more tax breaks, but also over the savory proposition of a red sweep as the GOP takes control of both the senate and house.

In addition to equities, we also saw crypto rise as the GOP has notoriously been pro-crypto and the blockchain ecosystem. Bitcoin hit a new all time high over $70k.

On the other hand...

Commodities took a beating.

Both gold and oil pushed lower following the election results, the latter falling victim to Trump's foreign policy revolving around easing tensions in the Middle East as well as reaching a resolution in the Russo-Ukrainian war. While the narrative of "Drill Baby Drill" is being pushed we believe that producers are in clear control of production rather than the Federal Government, and while Trump's policies may help easy regulations on exploration and production names, we expect these benefits to be seen further down the income statement rather than in production given where U.S. production is right now... at record highs.

Gold on the other hand was hit by the strengthening dollar, a similar reaction to Trump's victory back in 2016...

The Dollar climbed higher to end the week, extending its brilliant rally since late September... right when the Fed cut rates for the first time during this cycle, all thanks to the long-end of the yield curve, for example

It's pretty funny really. Both mortgage rates and the 10yr hit two year lows the same week the Fed cut the Federal Funds Rate by fifty basis points. Since then, the 10yr rose a staggering 90bps. Jobs data came in hotter than expected, and despite inflation looking mostly under control, the economy was humming along at an unprecedented clip...

However.

As the chart above shows, the 10yr seems to have created a blowoff top following Trump's election. On election night, yields jumped higher, pricing in the inflationary pulse of the Trump administration as potential tariffs and larger budget deficits loomed. Despite this, yields reversed course as the Fed cut the FFR by a further 25bps later in the week, with Powell hammering home the idea that the Fed has inflation under control.

Powell refrained from commenting on any consequences of the election on monetary policy, giving us little room to understand if the Fed expects a change of course as Trump gets ready to take office once again.

With all this laid out, we can move on to actually analyzing what comes next and updating our outlooks and our positioning going forward to continue realizing stellar returns...