Investing: Keep It Simple.

95% of active investors fail, the other 5% have a plan

Money managers and financial "gurus" around the world tell people to invest their savings in index funds and collect the 8% annual return they offer and eventually "compound" enough to retire at 65.

Stupid.

While it is an option for sure, it is more of a tool to keep investors confined to the sidelines and for large index managers to collect fees.

Even worse than this are the mutual funds and "actively" managed funds that promise slightly higher returns of 10-12% annually, all the while collecting commissions and fees netting them hundreds of millions.

The moment an investor takes control of their own investments is when they can truly make strides towards financial freedom.

This addition of Andy's Angle is the pilot of a 10 part series that will help our readers understand how to invest independently, create their own portfolios, and smash the puny market returns of 8-10%.

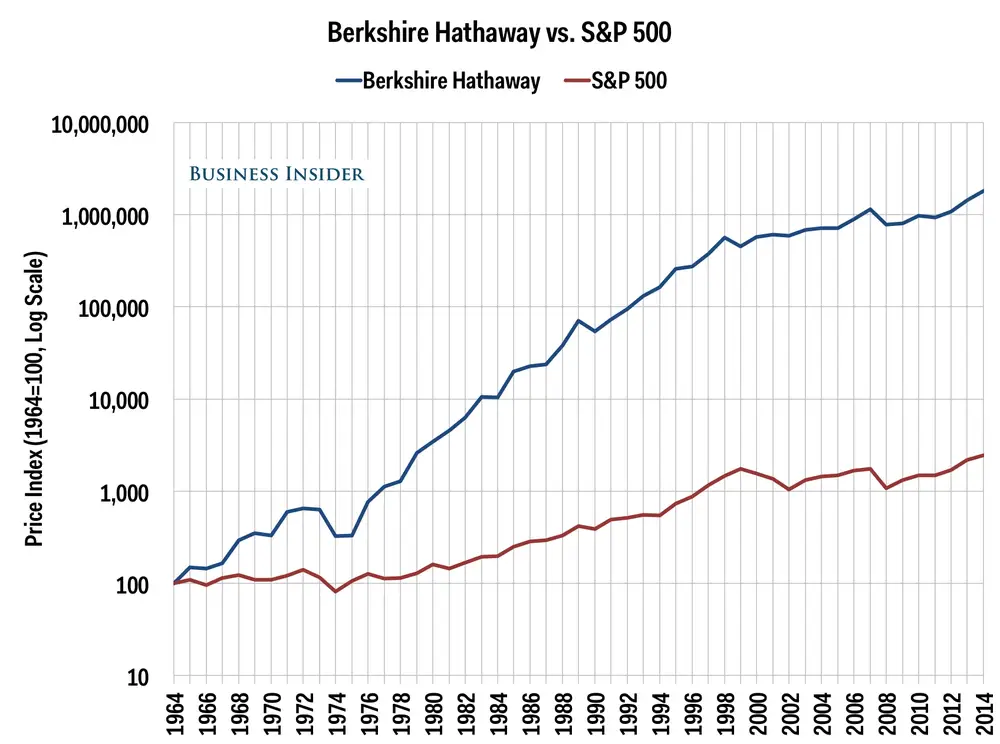

The success of picking good stocks can be found everywhere, most notably seen in the investing success of Warren Buffett.

His outperformance of the S&P 500 is staggering, and is a testament to the power of investing in good companies rather than just exposing yourself to the entire market through an index fund.

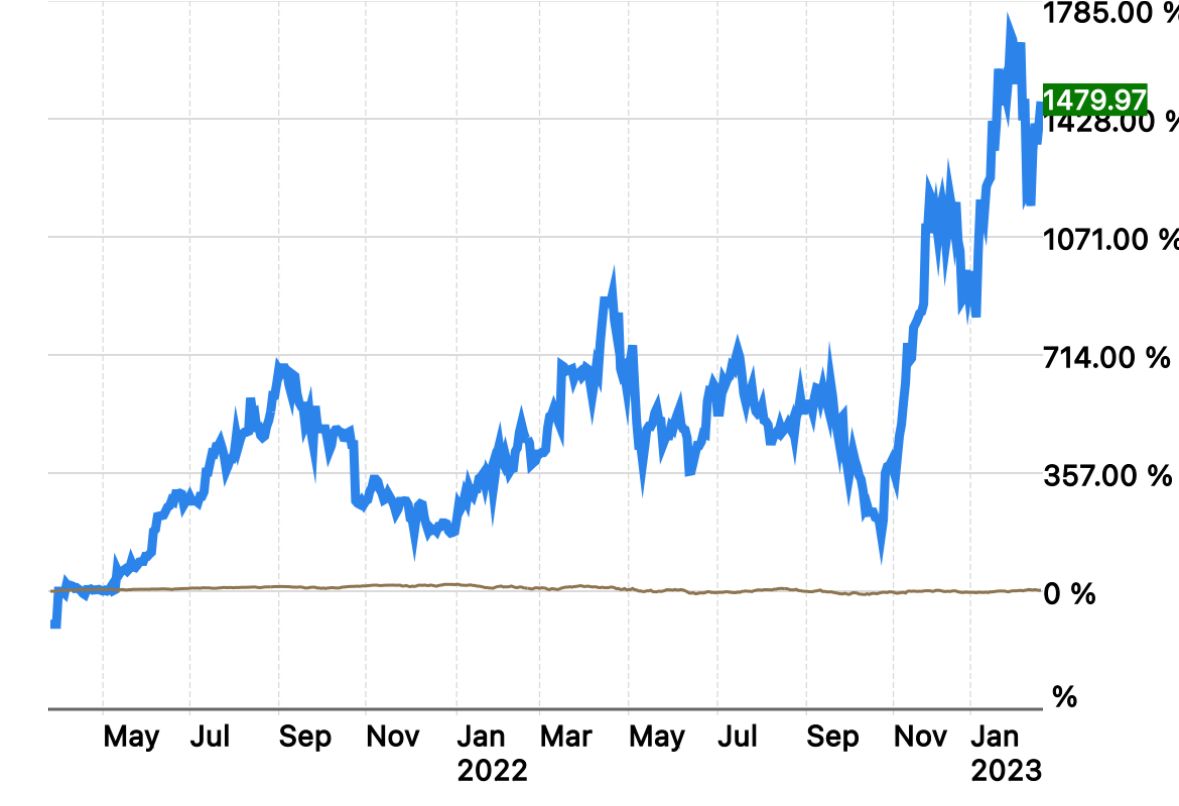

The same effect can be seen with Andy's portfolio over the last two and a half years:

Over the last 20 months Andy's portfolio has grown 1,429%, at a pace of roughly 150% annually. Over the same period, the S&P 500 is up just 1.3%.

1.3%...

Imagine putting your money to work for 20 months just to lose over 5% in real terms as a result of inflation. Stupid.

The formula to outsized returns are simple, invest in sound value stocks, and let your math and analysis do the work for you.

While retail traders have diverted their attention from index funds at a record pace over the last 5 years, they have instead gone to an even bigger money sucker in the form of options.

Trillions of options are bought weekly now, with short term expirations that almost always end up going to 0. Even if a trader makes a few 30-50%+ trades, one trades wipes them out back to square one.

This is not investing, this is gambling, go to Vegas if you want to play with your money like that.

Another bad habit retail traders have picked up is mob mentality and chasing hot stocks just to get smoked almost instantly. This really picked up in 2021 after everyone witnessed a once in a lifetime squeeze of GameStop stock.

Ever since then, every ticker that up more than 20% intraday suddenly has a chance to replicate GME's 2,500% run, and sheep by the dozen pour in, hoping for this quick money overnight.

Stupid.

This series will educate our readers on how to really pick sound stocks that can easily net you 100% upside throughout a year, without putting your money at tremendous risk in options or pump and dumps.

Anyone that says anualizing more than a 10% return is not possible is simply wrong.

I'm looking at the same 4,500 tickers as everyone else is, and Buffett was looking at just a couple hundred tickers in the late 70s, but the key is in picking the right companies that are both healthy and offer upside from their current valuations.

Lets get into it.