Value Stock Spotlight 3.0

Despite a strong rally off what is increasingly looking like a bear market bottom in October of 2022, a lot of the stock market is still bleeding and value names are more abundant than they have ever been over the last two years.

However, given the current macroeconomic backdrop, and one that is looking uncertain at best for the rest of the year and heading into 2024, many of these "value" names may just be a trap.

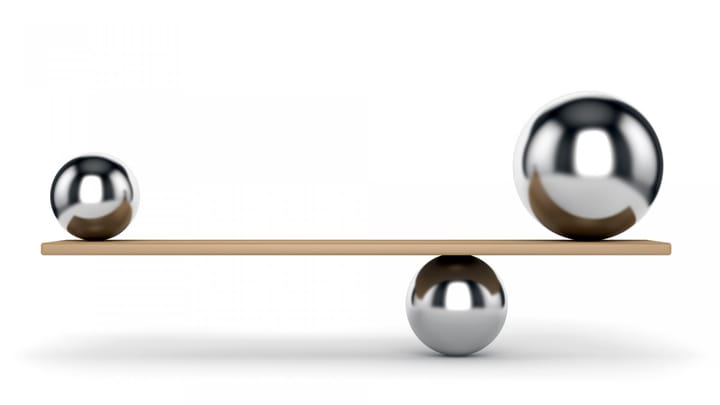

Companies carrying large debt loads tend to be the ones trading at cheapest valuations relative to market norms in metrics such as P/E, EV/EBITDA and P/FCF. In low interest rate environments this tends to be a good thing, debt helps facilitate growth and offer leverage for both the company to use as well as for investors as it gives far greater upside than names without debt. However, higher interest rates, like we have now, make large debt loads burdens for companies as interest payments swell.

This leads to more junk than ever before when trying to look for value stocks.

Most names trading at crazy PE multiples, sometimes even below 1x, carry loads of toxic debt that may simply take the company out of business if rates don't come down soon enough.

This is where an even more important aspect of value investing comes into play,