Value Stock Spotlight 6.0

Time to find another great investment.

And we're back.

Few important notes to begin:

Member subscriptions were paused for a brief period from January through March as we anticipated a slowdown in pieces and felt it was not fair to charge despite this.

Moving forward we will be releasing one market commentary per month, maybe two depending on how fast market conditions change, and on top of this, we are looking to present about one value stock per month, however if we feel strongly about a certain pick we may extend coverage on the singular name and post new suggestions at a more spaced out time.

Our recent picks have done exceedingly well, with both $GCI and $D returning over 25% from our original recommendations.

Moving forward we will be suspending full trade coverage through our portfolio, opting to just give full length reports on stocks we are sure will be profitable and provide supplementary updates as needed.

With all five of our previous picks returning 30%+ at some point in their lifetime since our call, and two of them exceeding 50%+ in just three months, we feel that this is the right move going forward.

Expect pieces to be cleaner, shorter and more data driven, enhancing reader experience.

With that being said, lets dive back into the process of finding our next value stock winner.

As I have said for years now, energy remains my favorite sector.

The cashflows and valuations simply are too good to ignore, and for all value investors, these names have been safe and strong.

Late last year I took a contrarian position in Ring Energy ($REI) as it languished with all energy names as crude oil prices threatened to break the key $70/bbl mark.

What drove this decision?

First off, I was extremely skeptical with the lavish bearishness on oil, headlines like "demand fears" and "Chinese slowdown" flooded the market nonstop almost everyday.

But they, at least in my research, were baseless.

Chinese production was slightly down in 2023, sure.

But travel was way high, consumer spending was resilient and stimulus was right around the corner.

And boy did it come.

The PBOC not only cut rates but hit Chinese markets with record stimulus to begin 2024, spurring demand.

Fast forward to today and we see just last night that Chinese industrial production and spending both grew at much stronger than anticipated paces, leading oil prices higher once again.

But let's go back to late 2023.

Everything was demand focused, the only issue was...

There was never going to be a drop in demand.

A first year economics student could tell you that oil demand would once again smash records in 2024, yet it took the EIA almost five separate revisions to finally show this.

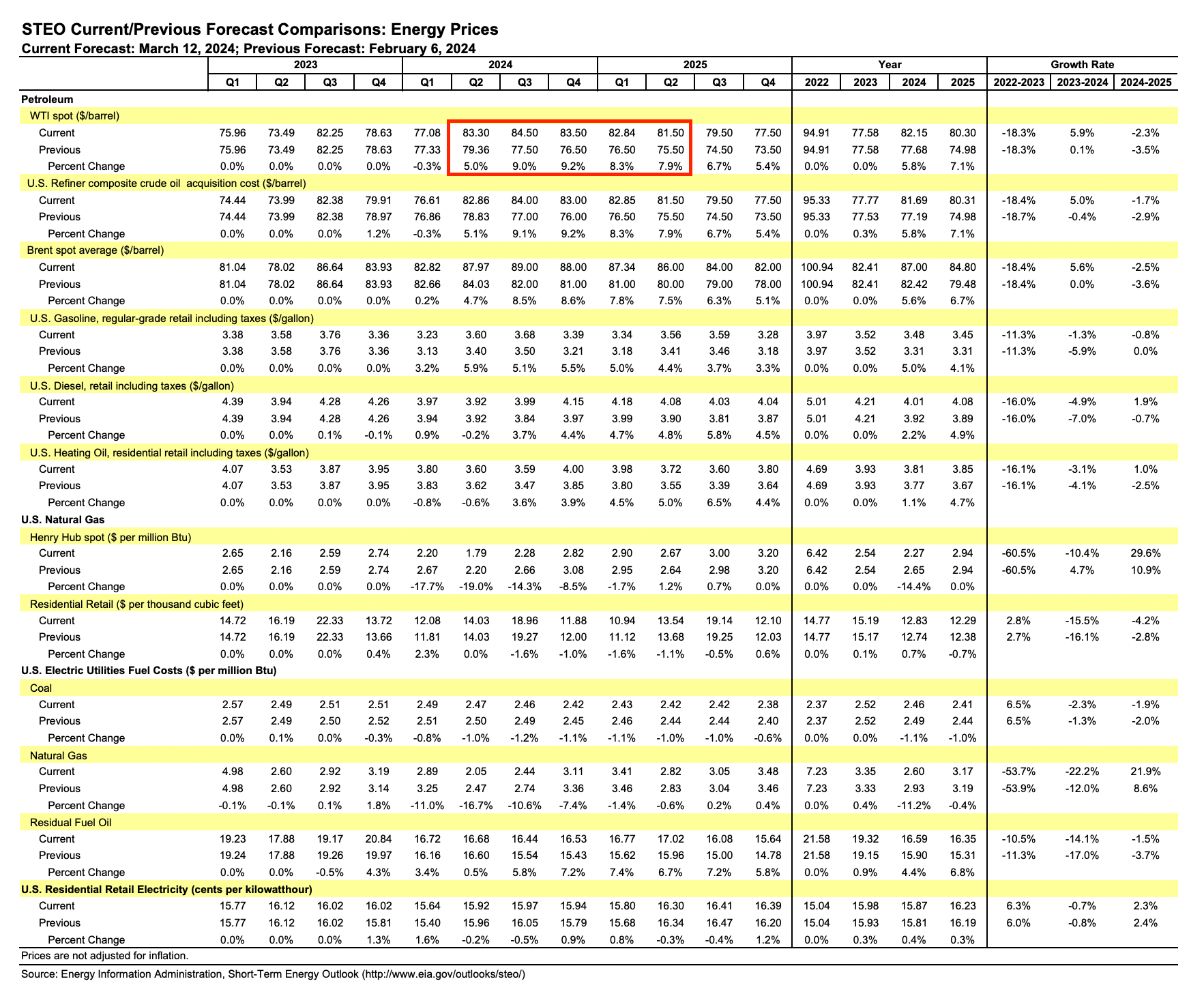

Hell even in their last STEO:

Energy price forecasts showed that WTI spot prices had been revised higher by 8% on average for the next five quarters... and this is only a month on month change.

How bad are these guys?

The issue was never demand.

A major supply crunch in the physical oil market, something I pointed out back in January, will absolutely crush all previous predictions of lower oil prices.

OPEC+ production cuts will extend through Q2 and overall the amount of oil available in markets will simply not be enough to support lower prices.

As global governments look to refill their reserves, adding artificial demand into the mix, oil prices will remain relatively stable in the $80-$90/bbl range, with risks mostly weighted to the upside given the current geopolitical landscape.

My contrarian $REI investment yielded 35%, a simple 35% that with just a basic understanding of oil markets and energy investing was a no brainer.

We like no brainers.

Let's look at my next one: