Value Stock Spotlight 7.0

A small cap darling.

Markets have begun the month of June extremely sluggish, with incoming economic data suggesting that the economy and the jobs market may not be as strong as initially thought.

Just today we saw JOLTs job openings fall to three year lows, indicating the jobs market has reached contraction levels sufficient enough to support the Fed's outlook on cutting interest rates.

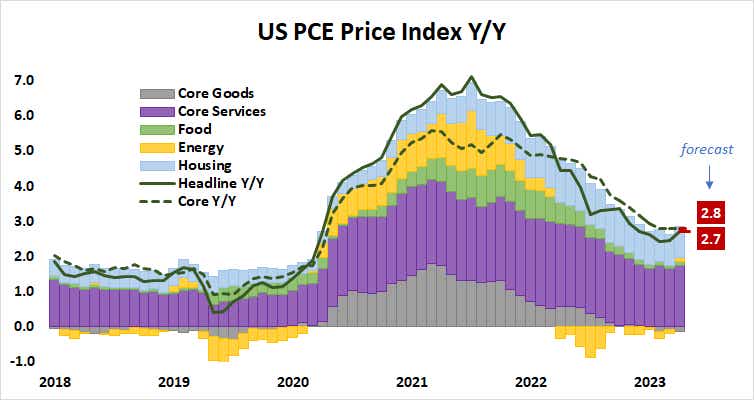

The issues comes when you look at incoming inflation data:

While inflation has significantly dropped down from its 2022 peak, it has slowed in its progress towards the Fed's 2% target.

This proposition, that is, lower economic activity paired with stubborn inflation, has led many investors to begin muttering the "s" word, stagflation.

While this type of data structure is the hallmark of a stagflationary economy, we are not in the camp of stagflation bears, and believe there are bigger market factors that must be analyzed when looking at the inflation story in relation to the economy.

First, it's important to understand what factors within the basket of both PCE and CPI are keeping the headline figures sticky, and a common theme can be found:

Services and Housing.

They are the key components that have been keeping inflation steady.

Services have been contributing to inflation at a significant rate for years now, dating back before the pandemic, and is slowly reaching its normalized rate of 1%.

Housing is expected to slow as data on both new and pending homes sales has come in much softer than expected for two months in a row now.

Lastly, one thing to note is the volatility of energy contributions to PCE, and with the current pullback in Crude Oil prices, albeit short term within our forecast as the market diverges from true supply/demand dynamics and is influenced by increased paper trading on U.S. cash futures (that's a story for another time), we can expect inflation to gradually cave towards the Fed's goal by the end of this year.

So no stagflation, the fears are decently well rooted, but there seems to be too much positive momentum on the inflation front to be worried in that regards.

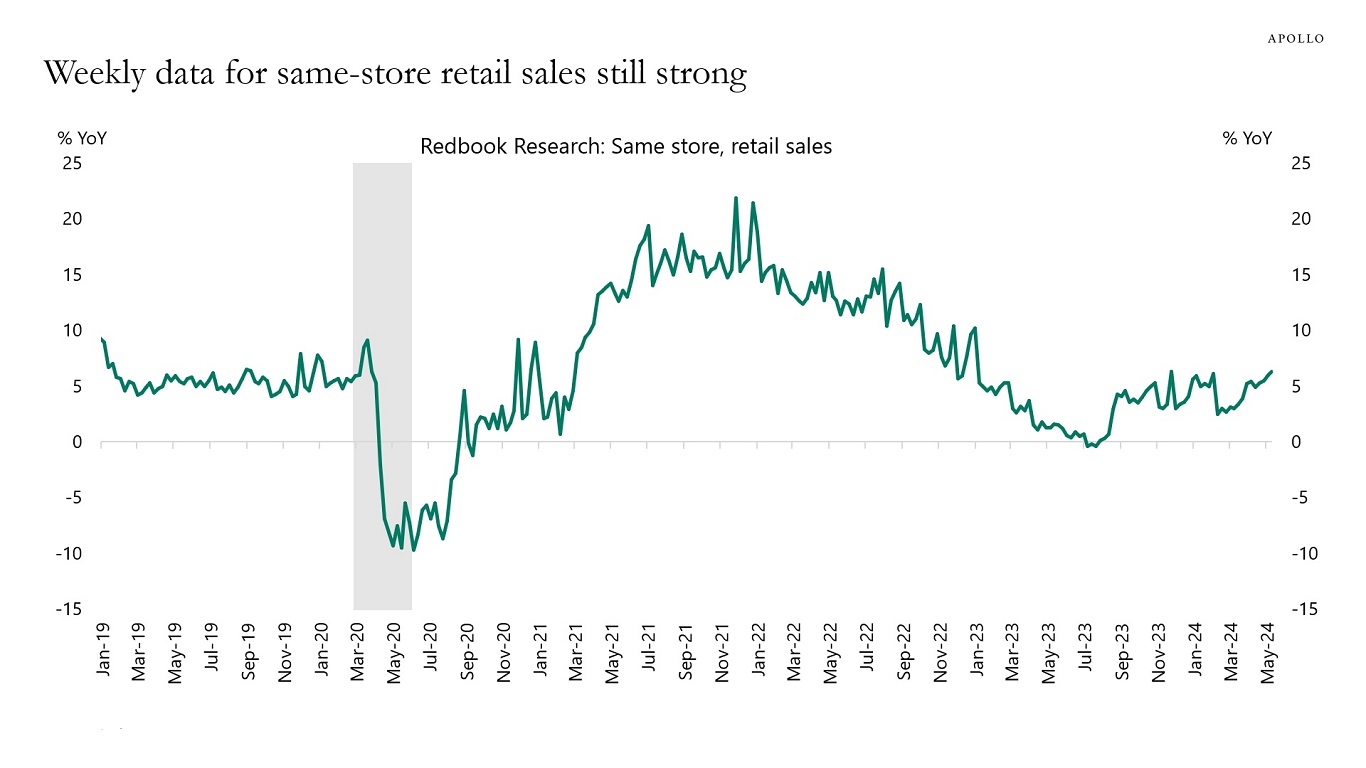

And a quick note on demand:

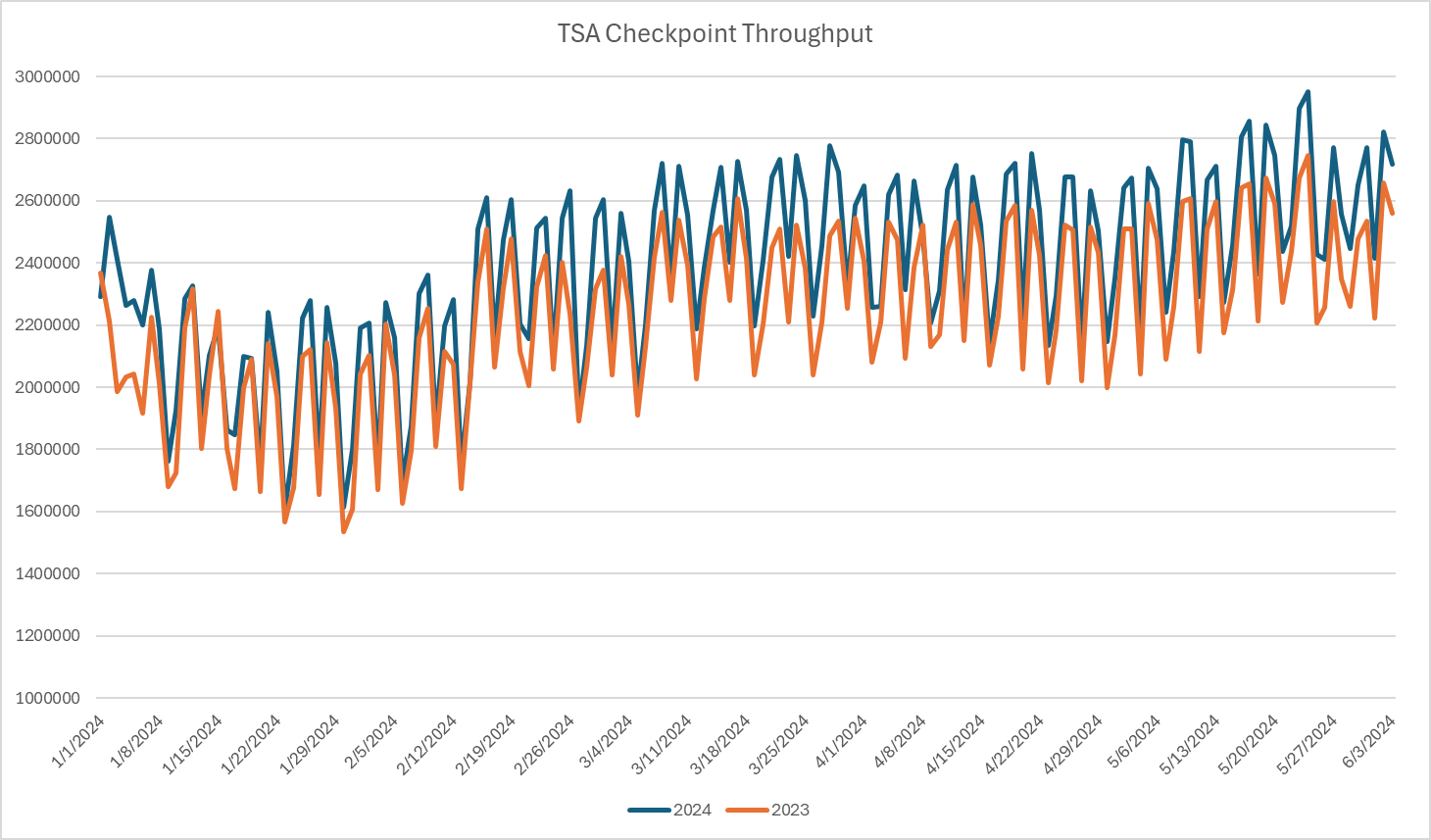

Travel and retail demand are still extremely strong, with the former setting records and being up nearly 7% YTD as compared to last year in terms of TSA checkpoint data, indicating that there seems to be no issue with consumers and spending.

With that all laid out, we believe a dovish cave is coming from the Fed, and while that is expected by markets to widely culminate in the first rate cut coming in September, we would not be surprised at all, given the recent data and market movements in commodities, to see a surprise cut come earlier than that in July.

What does this mean?

Well, we are growing bullish on sectors of the market that are especially sensitive to interest rates, namely consumer discretionary and energy, but at an even broader scale, small caps as a whole.

The Russell 2000 has been... trash.

Languishing far below its 2021 highs while all other major indexes stand near all time highs that are, in the case of the Nasdaq, 12% higher than its corresponding 2021 peak.

This has led to small caps reaching their lowest relative valuation to the S&P500 of all time:

And this trend is about to change in a big way.

As the outlook for interest rates drops and the underlying pressure on smaller companies is alleviated, small caps, as we've seen them do so often in the past, are due for a massive rip higher, that could send the Russell 2000 index up 20-30% in just a six month timeframe.

So what does this all lead us to?

Our 7.0 value pick, joining an elite group of stock picks in the Andy's Angle portfolio:

Darling Ingredients ($DAR)

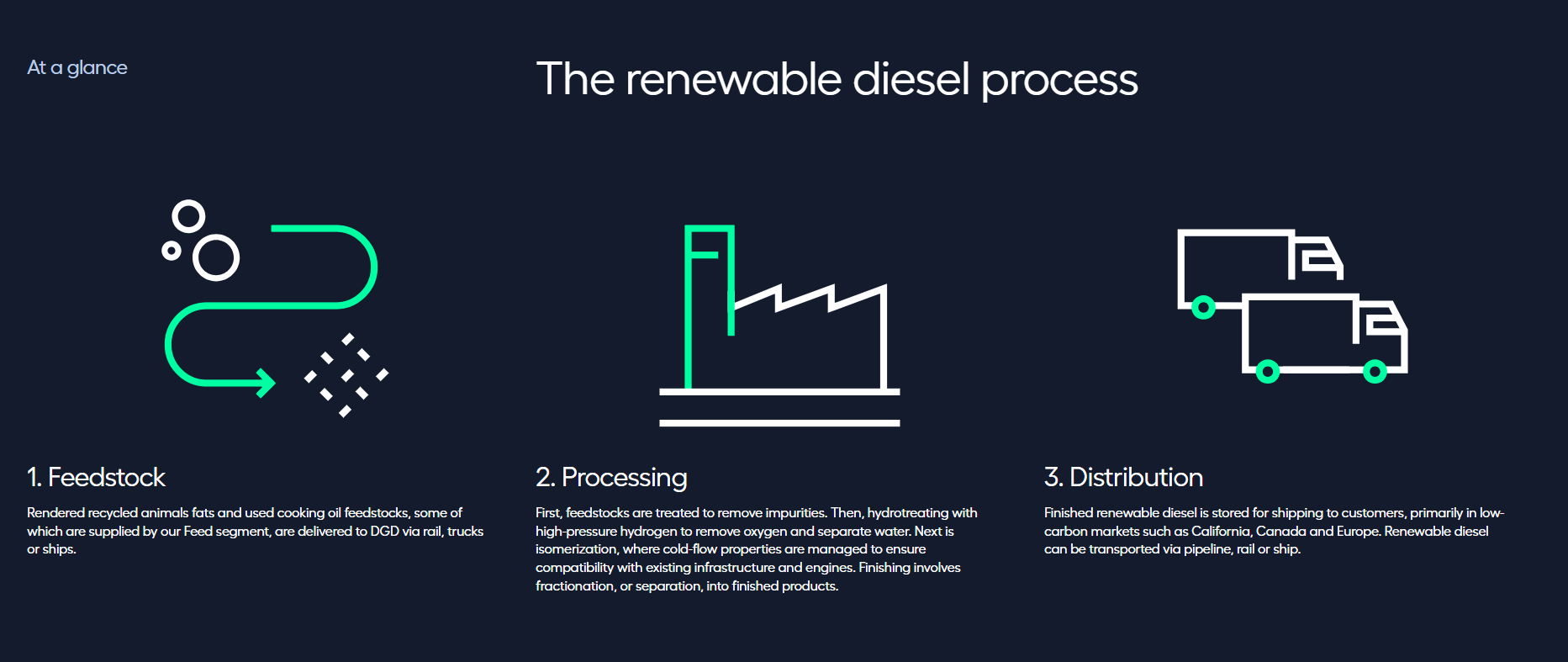

Darling Ingredients, Inc. engages in the development and production of natural ingredients from edible and inedible bio-nutrients. It operates through the following segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients. The Feed Ingredients segment includes ingredients business such as fats and proteins used cooking oil, trap grease and food residuals collection, the Rothsay ingredients, and the ingredients and specialty products. The Food Ingredients segment comprises gelatin, natural casings and meat by-products, and specialty products activities. The Fuel Ingredients segment consists of biofuel and bioenergy services. The company was founded in 1882 and is headquartered in Irving, TX.

At a $6B market cap, Darling comes in right about dead center in the group of small caps stocks, generally defined to be under $10B.

We've had this name on our radar for months now, but we are seeing a good entry point here as it breaks below a support level and attracts notably higher volume, indicating a capitulation event is taking place following its 50%+ dive from all time highs.

The company serves as both a value play, trading below 10x forward P/E, as well as a strong growth name as it is a big player in both the renewable fuels industry as well as an overall important player in specialty foods.

The exposure to the food industry allows the company to be in a rather defensive position, regardless of potential economic slowdowns.

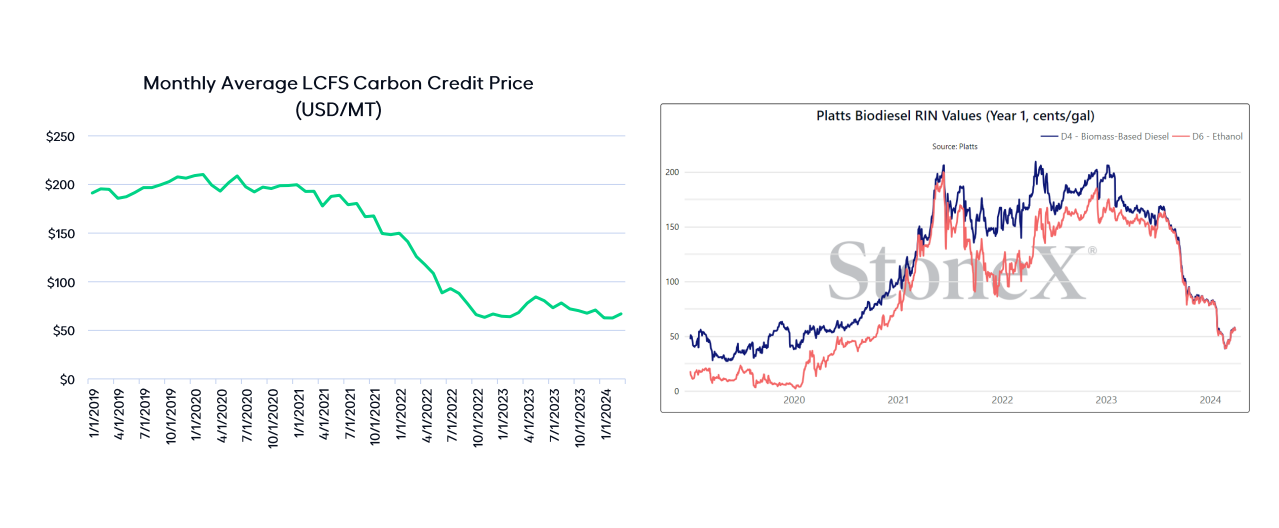

On the other hand, their rapidly growing renewable fuels segment has shown immense potential and has been consistently growing over the last few years, offering growth potential as the world shifts towards lowering emissions.

Their far reaching solutions, using waste products to create things such as fertilizers, animal products, fuels, foods, and even collagen and gelatin used in medical applications gives Darling Ingredients broad exposure across many categories, both for growth and stability.

Moving onto their financials:

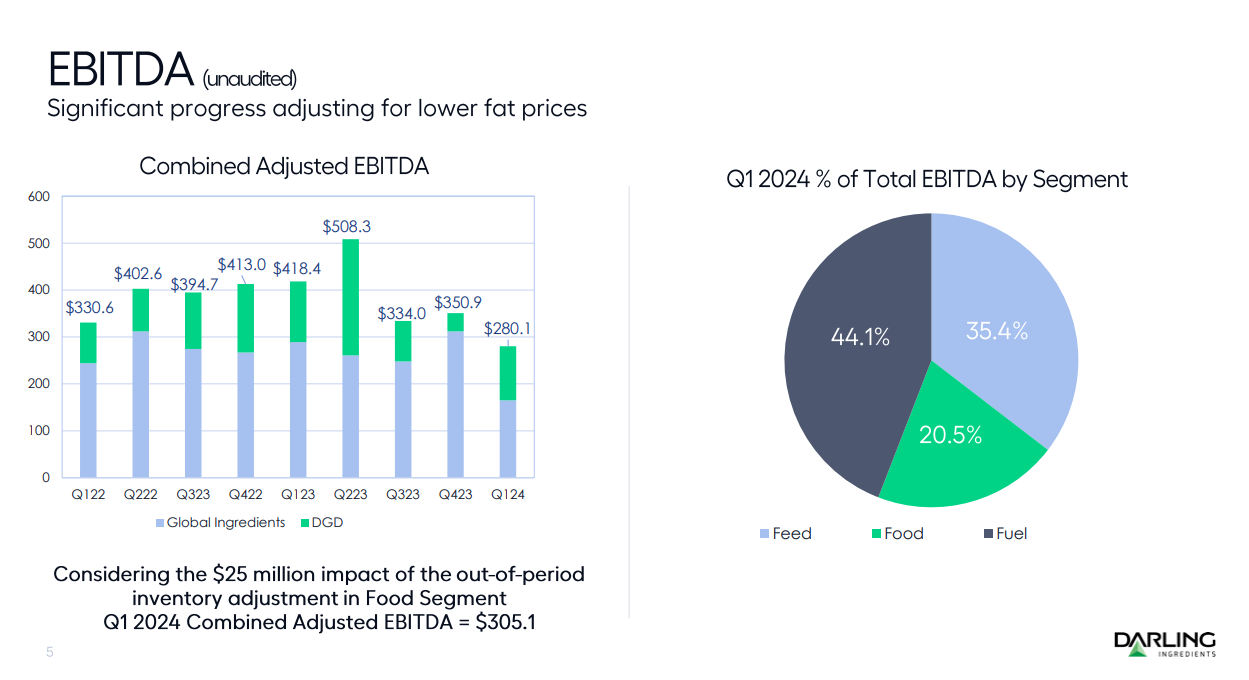

Their overall earnings power has been hit over the last few quarters, namely due to a reduction in pricing across their three main segments.

With lower demand, in line with the softer economy commentary noted above, their pricing power has diminished, and this has evidently taken a hit on the stock.

Regardless, the company still generates roughly $1.2B in normalized annual EBITDA and even more impressive than that, a $450m annual Free Cash Flow figure.

That puts the current market cap at just about a 7% FCF yield... dirt cheap considering the baseline market rate is generally around 12-15%, implying immense upside, especially as FCF is only expected to grow from here as pricing inevitably improves.

On the balance sheet front, the company does carry a load of debt, over $4B, but given their strong free cash flow as highlighted above, this debt is a relative non-factor when it comes to valuing the name.

It all comes down to pricing.

As interest rate related pressures ease and economic conditions normalize, pricing will once again revert to its mean, leading to much higher realized revenues across Darling's segments, giving them boosts that will trickle all the way down to their bottom line.

We particularly love names with high Free Cash Flow generation as it ensures the company is in a stable position to both enhance shareholder value, through share buybacks as Darling has done through the past, or in the form of future dividends.

Finally, as the market for small caps as a whole appreciates, we expect Darling to reaffirm itself as a leader in the renewables space.

Closing Remarks

We have initiated a sizeable position in Darling Ingredients, with an average price of $38.50/share.

This pricing has been something I've been waiting for and it feels that now is the time to accumulate into a nice position.

We expect Darling to anchor our value portfolio for an extended time as we see upside to $50-60+ over the coming months and year.

For now we have an even 50/50 split between Darling and our 6.0 Value Pick, with no cash remaining within the value portfolio, we think the time is right to deploy into value and small cap names now.

In the event Darling goes much lower than this, maybe towards $32-35/share we will re-allocate some capital off of our extremely successful speculative portfolio in order to average the position.

-Andy

Comments ()